Introduction

I like overlooked stocks with excellent risk rewards and generous dividends. When I pick ideas, I strive for all three to be presented. However, occasionally, I make an exception with the third rule. If I spot an explicitly growing deficit in a particular market, I am happy to sacrifice the regular cashflows for superior risk-reward. Today, I will present you with such a company. The enterprise in question is Tidewater (TDW), a leading offshore services company.

Why offshore?

The shipping industry is not homogenous. Even between major types, vessel types are sub-categories, having their specifics. Tankers are a great example. We have products and crude oil tankers considering the type of oil. For example, we have Suezmax, VLCC, and Handy, given the ship’s size. Offshore vessels vary, too. We have anchor handlers (AHTS), platform supply vessels (PSV), and offshore construction vessels (OCV).

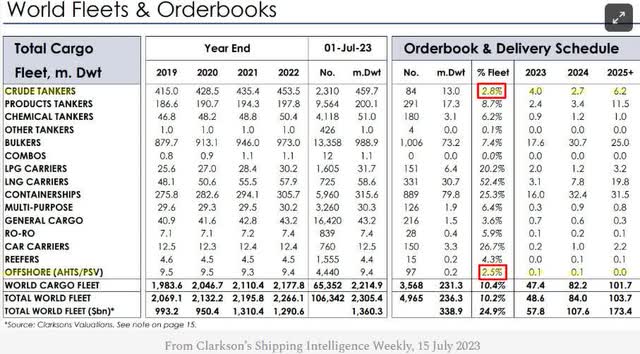

Tanker and offshore vessels have more in common than we think. Apart from being an essential part of the oil and gas industry, they are on the verge of a supply shortage. Let`s look at the chart below from Clarkson’s shipping Intelligence:

Clarkson`s shipping intelligence

Product tankers and offshore vessels have a record low order book as a percentage of the fleet, 2.8% and 2.5%, respectively. On top of that, the deliveries of new vessels are almost non-existent. The graphs below from TDW’s last presentation reveal how tight is the future supply of newly built vessels.

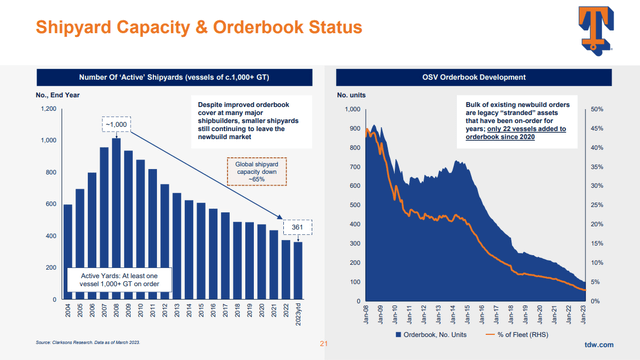

Tidewater presentation

The left image shows the decline of active shipyards, and the right one illustrates the steep orderbook contraction. In total, 65% of global shipyard capacity is down, while the order book is at a mere 2.5%. Only 22 vessels have been added to the order book since 2020.

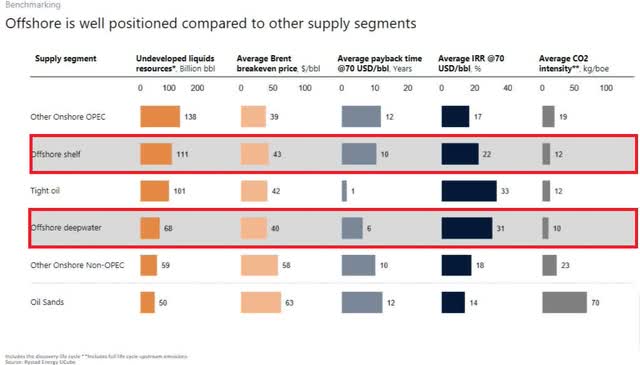

What drives the demand for offshore vessels? Deepwater oil fields are very competitive, as shown in the chart by Rystad Energy.

Rystad Energy

The deep-water projects have a $40/barrel breakeven cost, 31% IRR at $70/barrel, and an Average CO2 intensity of 12 kg/boe. The following best are the offshore shelf projects. Those figures make deep water fields very appealing for development.

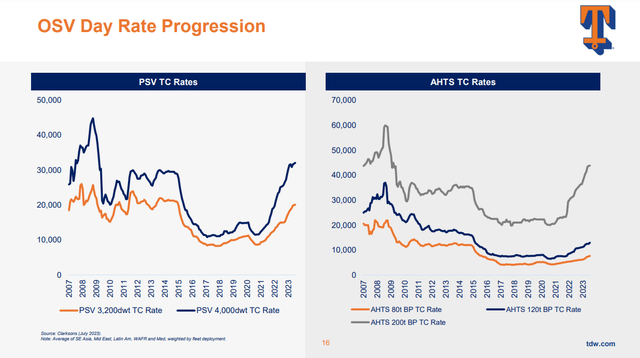

Supply is short, and demand is strong, the mandatory ingredients for long-term rising day rates. As seen below, the day rates have been rising for the last three years.

Tidewater presentation

AHTS 200t BP and PSV 4000 dwt had grown significantly for that period. With the deep-water oil projects revival and declining vessel supply, I expect those to rise much higher. TDW is among the best companies there to play offshore vessels deficit.

What does the company do?

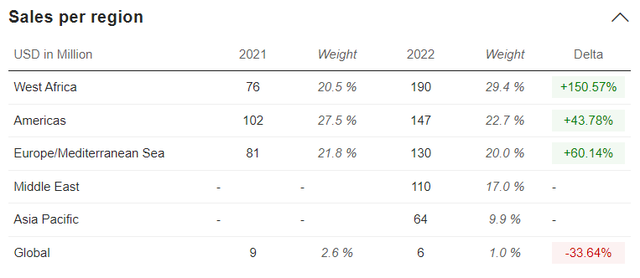

Tidewater operates a diverse fleet of offshore vessels providing support and transportation services to the energy industry. The company’s geographic segments include the Americas, which consists of the United States Gulf of Mexico, Trinidad, Mexico, and Brazil; the Asia Pacific, which includes Southeast Asia and Australia; the Middle East, which includes Saudi Arabia, United Arab Emirates, India, and East Africa; the Europe/Mediterranean, which consists of the United Kingdom, Norway, and Egypt; and the West Africa, which includes Angola and other coastal regions of West Africa. The chart below from Market Screener shows Sales per region are as follows:

Market Screener

TDW provides services for all stages of offshore oil and gas exploration, field development and production, and wind farm development and maintenance are supported by its vessels and related vessel services.

Company Fleet

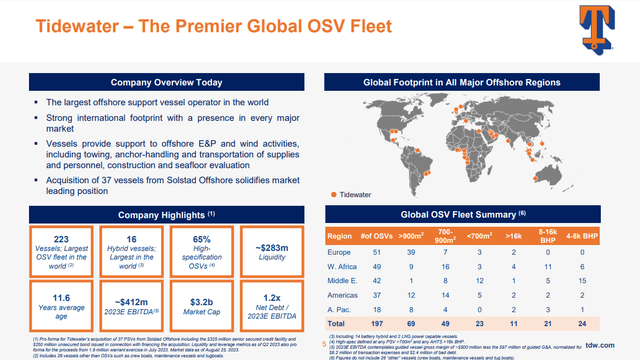

TDW is the largest offshore support vessel (OSV) operator globally. It has 223 vessels total with 65% high specification OSVs. TDW successfully expanded its fleet through acquisitions. The last one is the deal with Solstad, adding 37 vessels to its fleet. The chart below gives a glimpse of TDW’s standing.

Tidewater presentation

The company operates globally. Its Middle East operations engage less than 20% of its fleet. The most significant part of the fleet operates in West Africa and Europe. Less exposure to the Middle East reduces the company`s political and operation risk, given the Israel-Hamas war. TDW fleet age is 11.6 years, below the industry average figure.

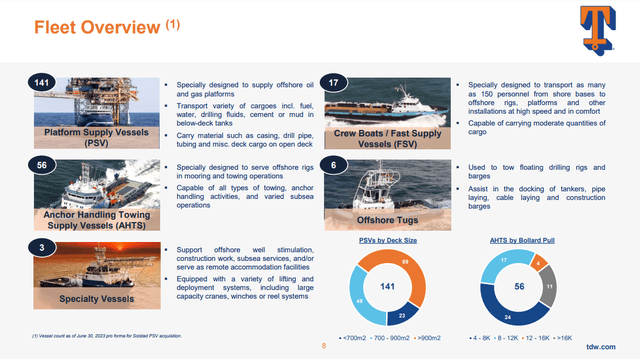

TDW fleet is diverse, as shown in the last presentation’s image below.

Tidewater presentation

The company has 141 Platform supply vessels (PSV), 56 AHTS, and 17 FSVs. 69 of the company`s PSVs are the most desired size >900m2. Globally, there are 398 such vessels, and 95.7% are active. In other words, we have the two ingredients for rising day rates: limited supply and growing demand.

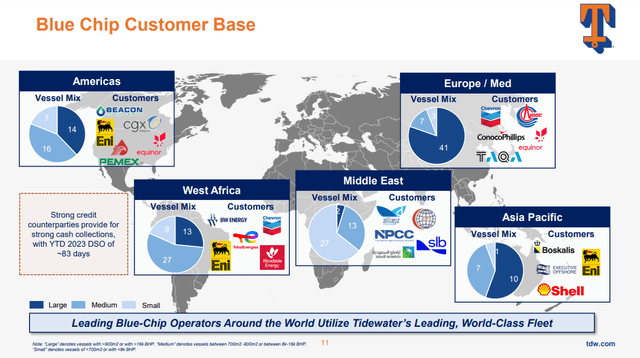

TDW customers and E&P majors such as Eni, Shell, Chevron, and Saudi Aramco. A detailed chart with TDW customers is presented below.

Tidewater presentation

As pointed out earlier, the deep-water projects attract more investments due to their superior economies. The major oil producers know about those developments. They have started investing in deep water fields for the last twelve months. Equinor is one of the multiple examples of investing $4.62 billion in developing the Rosebank project.

Shareholders

The offshore industry is too niche and small for Fidelity, Blackrock, and Vanguard. However, its size and obscurity work perfectly for specialized funds and adventurous investors.

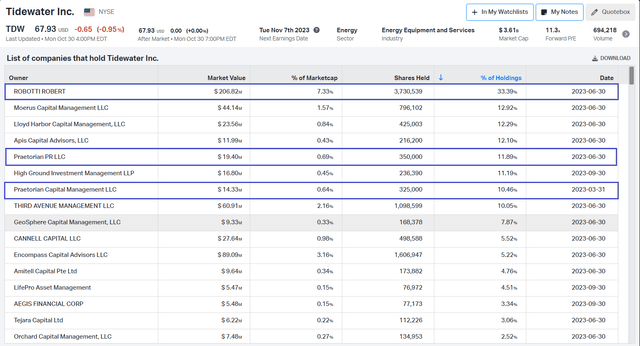

The table below shows TDW’s largest shareholders.

Koyfin

Robert Robotti owns 7.33% of the company’s shares. He is a legendary value investor. Harris Kupperman, a follower of inflection investing, manages Praetorian Capital. Moreus Capital is a boutique fund with a concentrated portfolio. They all share one thing: investing early in overlooked industries and companies. Their funds’ performance is proof of strategy viability.

When I research stocks, I am hardly impressed by significant funds on the shareholder’s list. I look for people like Kupperman and Robotti, the true smart money. Their presence is not enough to buy but is a reason to dig deeper into the company.

TDW solvency, liquidity, and profitability

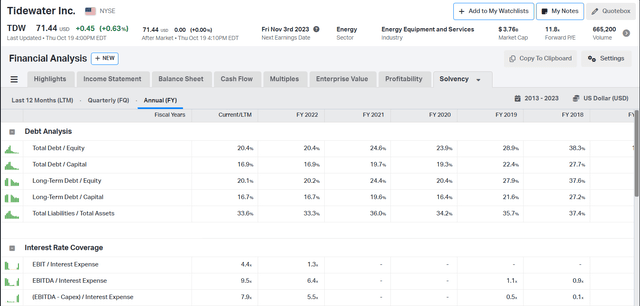

TDW maintains a healthy balance sheet without excessive leverage. Let’s look at TDW’s capital structure and interest rate coverage.

Koyfin

Total debt to capital is 16.9%, or for every $1 capital, the company borrowed $0.17. Total liabilities to total assets are very conservative, too, at 33.6%. The company`s liquidity, measured with interest expense ratios, is improving. The EBITDA-CAPEX/Interest expenses ratio is 7.9, compared to 5.5 in 2022.

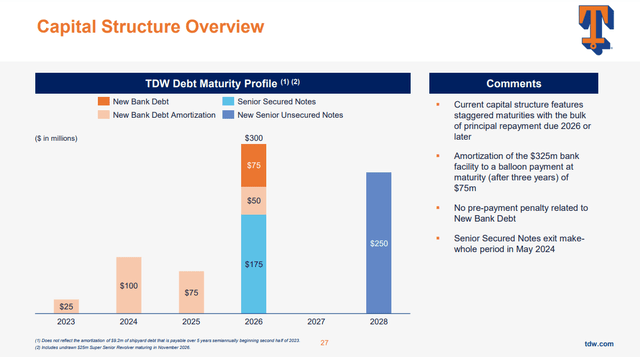

TDW has reduced its debts for the last five years despite the turbulent 2019 and 2020. Before July 5, it had a total debt of $182 million and cash of $171 million. However, Solstad vessel’s acquisition changed the company’s capital structure. The quote for the press release explains how TDW will finance the deal.

Tidewater Inc. (NYSE: TDW) (the “Company”) today announced the closing of its acquisition of 37 platform supply vessels and related assets from Solstad Offshore ASA. In connection with the Company’s financing of the Solstad acquisition, the Company completed its previously announced bond offering in the Nordic bond market on July 3, 2023. The purchase price of approximately $580.0 million consists of the previously announced $577.0 million base purchase price and an initial $3.0 million purchase price adjustment, which will be adjusted for bunkers and other consumables within the next fourteen days. The purchase price was funded through a combination of cash on hand, net proceeds from the $250.0 million Nordic bond issuance, and net proceeds from the $325.0 million senior secured term loan made pursuant to a Credit Agreement dated June 30, 2023, with DNB Bank ASA, New York Branch, as facility agent, and other lenders.

The cost of the acquisition is $580 million. The funding will come from TDW cash reserves, net proceeds from Nordic bond issuance ($250 million), and senior secured term loans ($325 million). If the deal is complete, TDW’s capital structure will look as follows.

Tidewater presentation

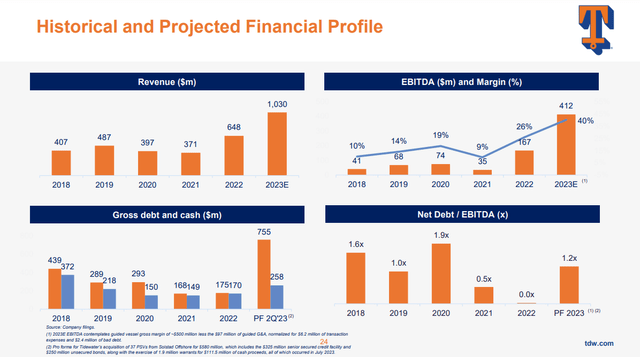

TDW profitability is on the rise. EBITDA margin moved from 2021’s bottom to 40%. Company revenues grew QoQ from $191 million to $210 million. TDW’s net income QoQ changed from $10.7 million to $22.6 million. Those figures reflect on the company`s efficiency metrics.

Tidewater presentation

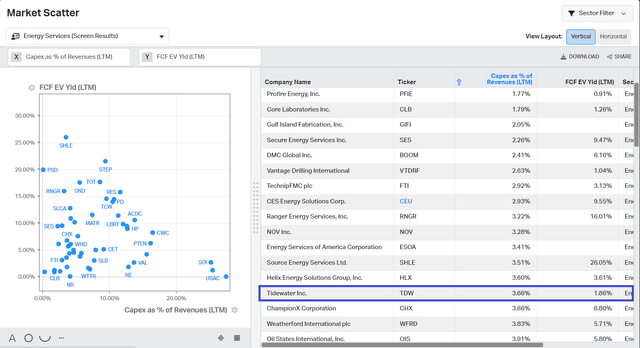

Looking at ROIC or profit margins is insufficient to measure a company`s efficiency. I use Capex as % of Revenue vs FCF yield to estimate how profitability affects capital investments.

Koyfin

TDW is not the best among its group. Its CAPEX/Revenue ratio is 3.66%, while its FCF yield is 1.88%. With rising day rates, FCF will improve. On the other hand, the company will be motivated to spend more capital investments.

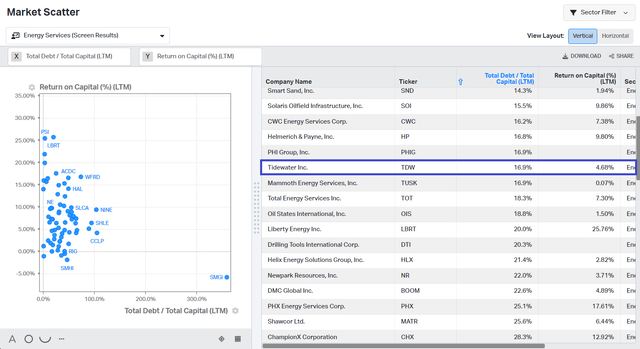

To estimate TDW`s capital allocation efficiency, I use Return on Capital versus Total Debt/Total Capital.

Koyfin

TDW is among the best capital allocators. Regardless of the industry, this is the most essential skill for any management team. I seek low leverage and rising ROIC as an investor and analyst.

Valuation

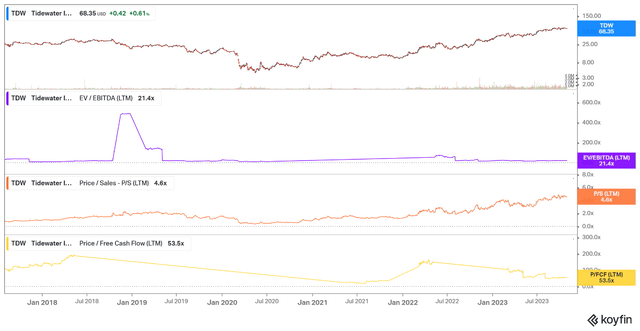

TDW has made impressive gains in the last two years. However, I believe we are in the middle of the offshore bull cycle.

The chart below shows TDW price, EV/EBITDA, Price/Sales, and Price/FCF. Looking at Price/Sales, TDW is expensive. Now, P/FCF is at 53.5, though in 2019, it reached 196. EV/EBITDA is at 21.4, lower than the 2022 and 2021 levels.

Koyfin

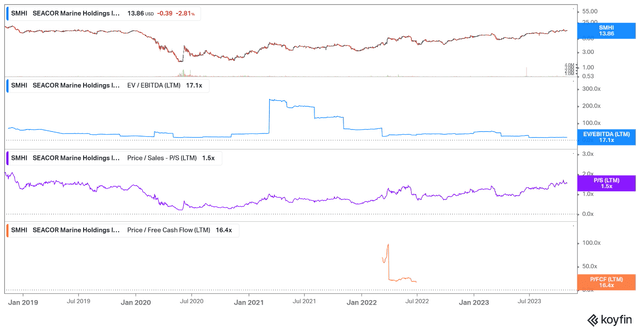

However, to estimate a company`s value is not enough to look at its past. The next step is to compare TDW with its peers. The other major US-based OSV operator is Seacor Marine (SMHI). Let’s see its performance.

Koyfin

Seacor has 17.1 EV/EBITDA, 1.5 Price/sales, and 16.6 Price/FCF. It is cheaper than TDW. I believe the reason for that is the smaller Secor fleet (59 vessels) and its lower utilization (77%) compared to TDW. Looking at TDW’s past performance, I expect EV/EBITDA to reach at least 40 due to improved profitability caused by rising day rates and constrained supply.

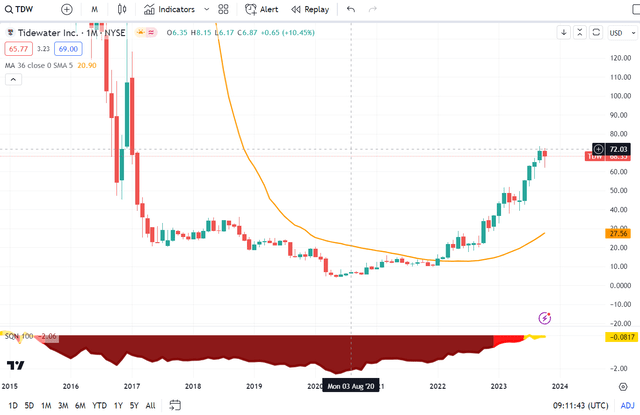

Price Action

TDW had a solid last 12 months. However, it is far away from its previous highs. The graph below is monthly and shows Van Tharp SQN and 36 periods simple moving average (MMA).

Trading View

The SQN indicates the price enters a neutral regime (yellow). A neutral or bull quiet is the best for taking long positions from all SQN regimes. The price is extended above 36MMA, and I expect a healthy correction. The dip is an excellent opportunity to add or make an initial entry.

Zooming out is a valuable exercise to see where we are. The chart below is the monthly TDW.

Trading View

The price is still at the bottom compared to the previous top. I do not suggest we see a $1,500 share price. However, looking at the big picture, we realize the bull trend might have just started. How long it will last and how far it will reach depends on many knowns and unknowns.

Risks

The offshore industry is highly cyclical. Exuberant bull trends and windowmaking bear declines are standard, not an exception. Cyclicality depends on the oil-gas capital investment cycle. We are at the bottom of CAPEX in oil and gas. Investments in new projects started creeping up. This is the primary driver for OSV demand. Oil rigs follow a similar pattern; their stocks have advanced significantly for the last twelve months. Simply put, being at the bottom of the CAPEX cycle significantly de-risks offshore investments.

Geopolitical uncertainties are another risk factor. However, they could be a blessing for some. Companies with less exposure to the Middle East will benefit. In my article on Ecopetrol (EC), I argued why I consider regions such as South America will become more attractive for investors. The reason is a lack of interstate conflict and abundant resources. The largest portion of TDW’s fleet is dispatched to the Americas, West Africa, and Europe. Less than 20% of the fleet operates in Middles East.

Investors takeaway

We are in the middle of another offshore bull cycle, and TDW is one of the best companies to bet on that theme. The company owns quality vessels and operates across the globe. TDW owns 69 PSV >900m2 or 17% of the global fleet. After acquiring Solstad vessels, the company will cement its leading position as the top OSV operator globally. The price is overextended, and I expect a correction. The potential dip will give a better price for entry. I give a buy rating considering TDW’s quality fleet and healthy financial and growth potential.

Read the full article here