Introduction

You’ve probably seen a bunch of articles on Seeking Alpha talking about what the S&P 500 Index (NYSEARCA:SPY) (SPX) (SP500) might do this year. I’ve been mulling over whether to spill the beans on my take and forecast for the index until the end of 2024. Honestly, 2023 didn’t go as I thought for the overall market, despite being ranked among the top 5% of financial bloggers on the internet for my buy/sell recommendations, a status I maintained from the previous year.

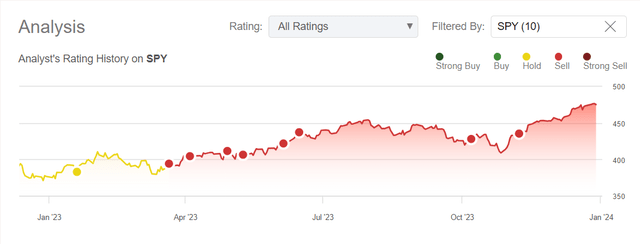

Seeking Alpha, my coverage history of SPY

This discrepancy between the relative success of individual ratings and the failure to assess general market conditions creates a dissonance that I have to deal with. In today’s article, I will attempt to do some sort of error work that should make it clear what to expect in the new year of 2024. I hope that my macro findings will be more successful this time than in the past.

What Went ‘Wrong’ Last Year? And What Now?

I put the word ‘wrong’ in quotes because the broad index contradicted my thesis; for most people, on the contrary, 2023 turned out to be one of the best because we did see one of the fastest recoveries. The SPY closed near its all-time high towards the end of 2023 and painted a robust bullish picture:

TrendSpider Software, author’s notes

The S&P 500 demonstrated a 26% total return with only 13% realized volatility, fully recovering from the previous year’s losses. This performance ranks in the 79th percentile of all annual returns since 1962, according to Goldman Sachs [proprietary source]. The Federal Reserve successfully pursued disinflation goals while maintaining robust US growth, with GDP growth estimated at +2.4% in FY2023, defying earlier recession predictions.

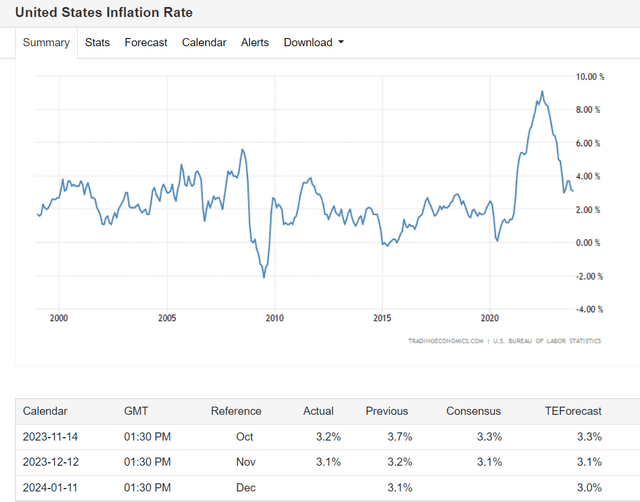

TradingEconomics

Many agree that the disinflationary process in the economy will continue. If so, lower prices should logically lead to lower GDP growth (higher base effect). The market is assuming exactly that and expects GDP growth of just +1.7% in FY2024, 70 basis points less than in FY2023. So there is no pronounced inconsistency here where I could say that the market is frankly mistaken.

If inflation has already been defeated, then the market expects Mr. Powell to start lowering interest rates very soon. After all, what is the point of keeping it so high if prices are no longer rising significantly and the unemployment rate is still not responding in any way to the tightening of monetary policy?

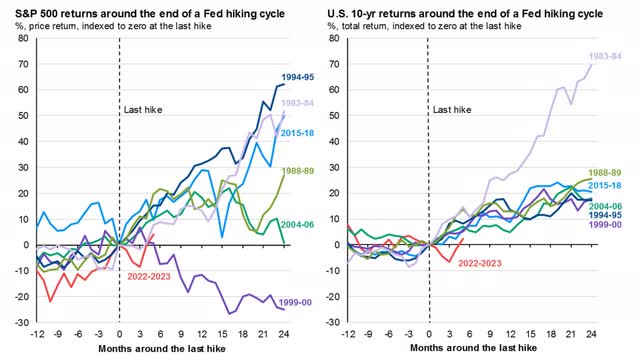

History is on the side of the bulls when it comes to the assumption that the Fed will soon cut interest rates: the only exception was after the end of the bull cycle at the beginning of this millennium.

Data shared on X by Mike Zaccardi, CFA, CMT

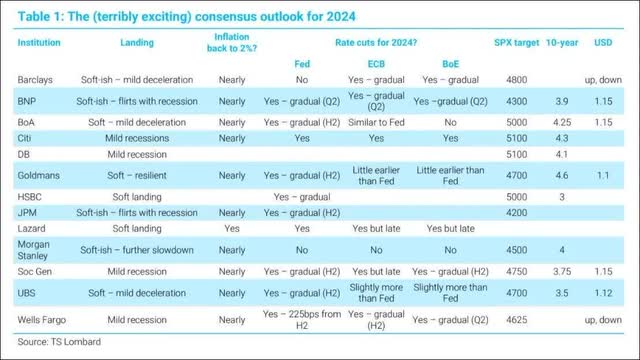

And since the risk of multiple contraction coming back from 2022 looks a little less clear today, it’s not at all surprising that the consensus for 2024 is largely optimistic. Most banks see no hard landing, generally expecting the first Fed’s cut to start in the 2nd half of the year.

TS Lombard data, shared by Tilo Marotz on LinkedIn

But this whole coherent bullish story has its inconsistencies.

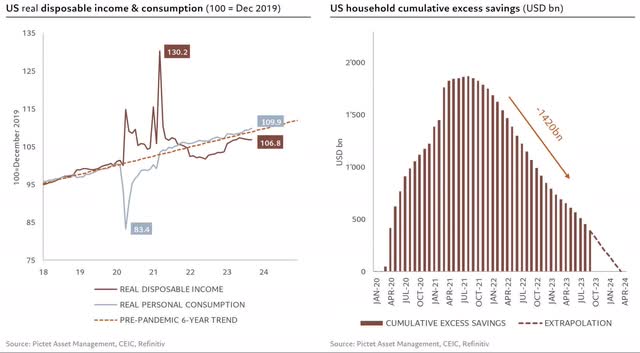

The main point I got wrong last time was the US consumer, which was not weakened as much and to the extent I thought it would be. If you have read my previous macro articles, you may recall that I expected a sharp drop in consumption in the second half of 2023, which obviously did not materialize. I was premature with my conclusion, but it seems to me that the issue is precisely the timing error and not the root of my thesis itself, because consumer consumption, for all its resilience during the last year, should start to cope without the post-COVID excess savings on hands somewhere between Q1 and Q2 FY2024:

Shared by Michael A. Arouet on X

Also, according to the Kobeissi newsletter, we have already begun to see the impact of the renewal of student loan repayments since October 2023: In my opinion, there is more to come.

![The Kobeissi Newsletter [December 2023]](https://incapitalpros.com/wp-content/uploads/2024/01/49513514-17041239286657004.jpg)

The Kobeissi Newsletter [December 2023]

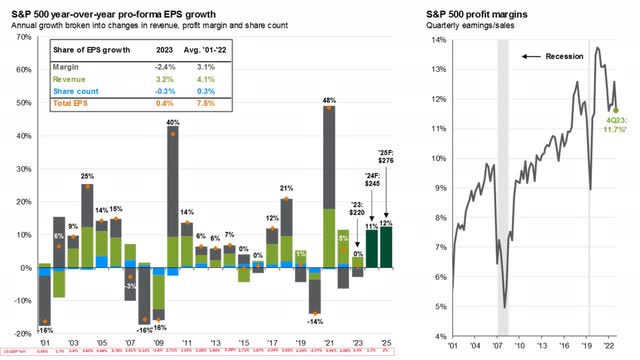

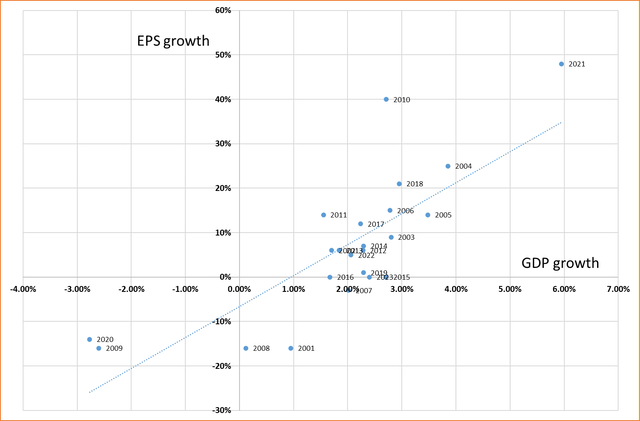

At the same time, the market expects GDP growth of 1.7% in FY2024 and around 2% in FY2025, in line pricing the S&P 500’s EPS growth rates of 11% and 12% respectively, after almost no growth in 2023. I decided to supplement the earnings per share and net profit margin data recently published on X by Mike Zaccardi with the US GDP growth data from Macrotrends to understand whether today’s consensus forecast is justified.

Data shared on X by Mike Zaccardi, CFA, CMT

Author’s work

What the market expects from SPY’s EPS in FY2024 and FY2025 with stagnant GDP growth looks completely illogical not only from the perspective of regression analysis but also from the perspective of history. We can clearly see that since 2001, declines in earnings per share during recessions have been followed by sharp increases which were followed by smoother growth rates in the next few years; that’s not what’s priced in today. This means that even if we start from the expectation that there will be no recession in 2024, the expected EPS growth of 11% year-on-year appears to be an overly optimistic assumption. Given the stagnating economic growth (from +2.4% to +1.7%) and the still quite high corporate net profit margins (that may get lower from here), it sounds illogical, to say the least, to expect such strong historical growth against a backdrop of declining excess savings and falling corporate sales prices.

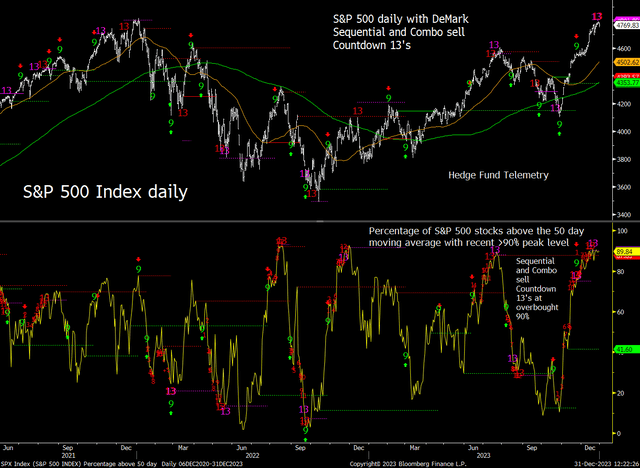

In addition to this fundamental discrepancy, there are also technical set-ups – of which quite a few have accumulated today – which show that the market is heavily overbought. The SPX is overbought and exhausted, as Thomas Thornton wrote just recently, and I can’t argue with that as ~90% of the stocks in the SPX are trading above the 50-day moving average.

Shared by Thomas Thornton on X

On the other hand, the technical setup mentioned above can only be a temporary phenomenon. Despite the fundamental factors I described above, I don’t see a clear trigger for a sharp sell-off today. If profit margins in the corporate sector recover from their recent decline, the EPS could indeed rise to growth rates in the low teens over the next 2 years.

Furthermore, if we continue to draw historical parallels, the data shows that after a +20% rally from a 52-week low in the S&P 500, the average 1-year return was +16%, with a positive return over 80% of the time. Even more remarkably, the 3-year returns following such a rally were positive 100% of the time. Based on this historical pattern, the outlook for 2024, 2025, and 2026 suggests that these years could be very attractive for the equity market.

Based on a combination of market factors, which I try to look at as less biased as possible, they lead me to the conclusion that it is necessary to upgrade my ‘Sell’ rating on SPY to ‘Hold’.

Concluding Thoughts

At the moment we see a macro picture in which too many conflicting factors are interwoven. I still don’t see the SPY continuing its rapid growth in 2024, similar to 2023: The volatility of the index is likely to remain, but not the angle of its growth. Considering the stagnant economic growth and the high risk that companies’ margins will continue to decline due to the deterioration in consumer demand, I expect approximately flat dynamics of the market in 2024.

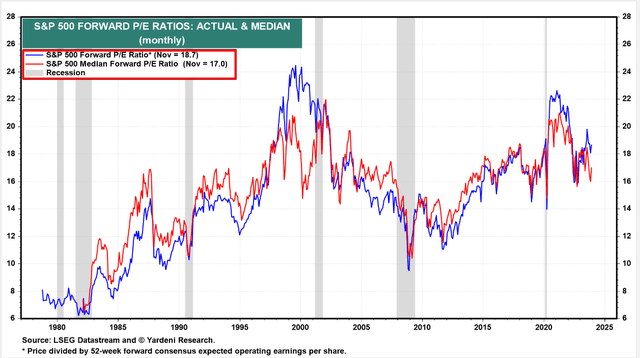

As for the market valuation, it seems overheated to me personally after the recent multiple expansion that was responsible for the 2023 rally. However, according to Yardeni Research, if EPS growth in 2024 is even close to current consensus forecasts, SPY’s P/E ratio will fall to 18.7x, which would be only slightly above the median. So this slight excess over the median may predict a flat dynamic for the index in 2024.

Yardeni Research, author’s notes

I am therefore neutral on the SPY and do not expect growth to be as fast as last year, but I am not shouting “recession is coming” this time either.

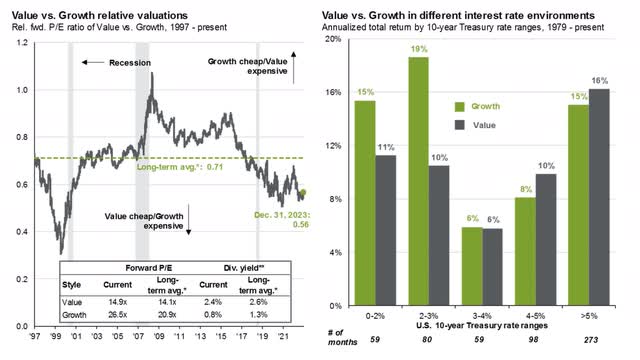

What is relatively clear to me today is the high probability that value factors will dominate until 2024: Value stocks have also had more chances to outperform in similar macro modes in the past.

Data shared on X by Mike Zaccardi, CFA, CMT

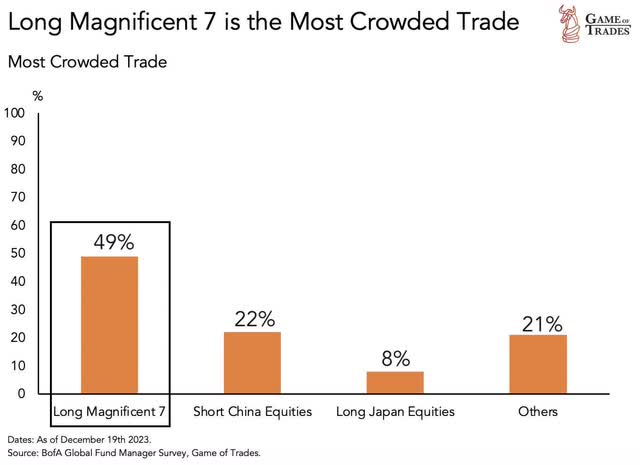

Income investing should have quite a few advantages in 2024. I also agree with the conclusions of Mike Wilson of Morgan Stanley, who says that small caps should have more impressive momentum compared to mega caps – this is due to the normalization of inflation and valuation multiples. Therefore, investors need to be very selective and constructive this year and avoid an overweight allocation to ‘magnificent 7’ stocks like everyone else is doing.

Game of Trades on X

Thanks for reading!

Read the full article here