Wide-moat systems software company ServiceNow, Inc. (NYSE:NOW) stock has significantly outperformed the S&P 500 (SPX) (SPY) since my last update in October 2022. I urged investors to capitalize on its steep selloff last year as NOW dip buyers tried to form a long-term bottom. That thesis panned out, although robust buying momentum didn’t return until the start of 2023. However, SaaS companies like ServiceNow have ridden the surge in interest in generative AI in 2023 through its highs in mid-July 2023.

The company reported its third-quarter or FQ3 earnings release yesterday (October 25). Unsurprisingly, the company delivered a robust performance underpinned by solid growth in enterprise customers and with the US government.

Accordingly, ServiceNow outperformed analysts’ estimates as it posted subscription revenue of $2.22B in Q3. In addition, it also delivered a better-than-expected adjusted EPS of $2.92, well above the consensus estimates of $2.56.

Furthermore, the company delivered an upgraded Q4 outlook for its subscription revenue to about $2.32B, accompanied by an adjusted operating margin of 27.5%. Despite that, the company pointed out its near-term cRPO growth could be impacted, given the mix of 12-month contractual renewal terms. As such, while renewal rates are 99%, management estimates a “one-point headwind to Q4 cRPO growth.”

Despite that, I didn’t glean any yellow flags from ServiceNow’s growth cadence as it looks to expand its TAM, cross-selling with Microsoft (MSFT). Management highlighted the benefits of its partnership with the King of SaaS, as it collaborates with “Microsoft’s enterprise sales teams.” As such, the partnership has proffered greater exposure for ServiceNow’s offerings “while exposing ServiceNow to a broader customer base.”

Notably, the company stressed the positive externalities with Microsoft Azure globally, telegraphing that the “Microsoft partnership influenced deals globally, including government wins in the Americas and APAC.”

Microsoft investors should have observed the solid performance of Azure in its recent earnings scorecard, demonstrating its cloud computing leadership. Therefore, ServiceNow’s ability to target IT service and operations management across the on-prem and hybrid cloud space is foundational to its success. Coupled with the need of its customers looking to consolidate their IT budgets even as they invest in generative AI products, ServiceNow remains well-positioned for long-term secular growth.

Management also reminded investors that ServiceNow’s generative AI strategy is “centered around execution rather than exuberance.” The company stressed that it has a “substantial pipeline of over 300 customers from various industries and stages of testing, demonstrating the demand for AI solutions.”

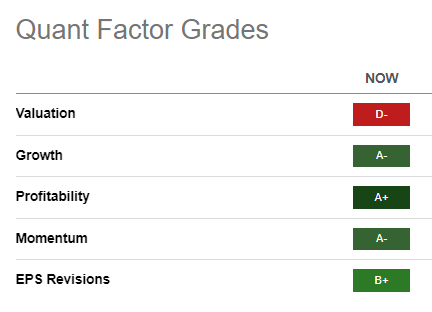

NOW Quant Grades (Seeking Alpha)

Given its solid growth potential (“A-” growth grade), NOW is a high-quality stock underpinned by a best-in-class “A+” profitability grade. In addition, its rock-solid execution, as demonstrated by its recent earnings release, likely justifies its growth premium, as Bulls would argue.

While I firmly believe in the company’s long-term growth drivers in the IT service and operations management space, its growth premium must also be assessed carefully.

NOW last traded at a forward EBITDA multiple of 31.1x, well above MSFT’s 20x. As such, investors need to ascertain whether it’s sufficient to justify buying at the current levels or wait for a steeper pullback?

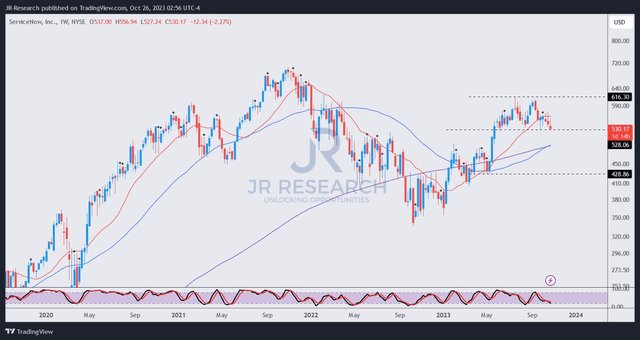

NOW price chart (weekly) (TradingView)

As seen above, NOW’s upward momentum was rejected at its July 2023 highs at the $615 level. Buyers have struggled to lift its momentum higher since. While the stock was up by nearly 5% in the post-market session after its earnings release, the risk/reward at the current levels doesn’t seem attractive enough to me.

I encourage investors to watch the $530 support zone closely, as a decisive breakdown below that level could open up further downside toward the gap supported by the $430 level.

It might be more appropriate to wait patiently for a further pullback before committing more funds.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here