Investment thesis

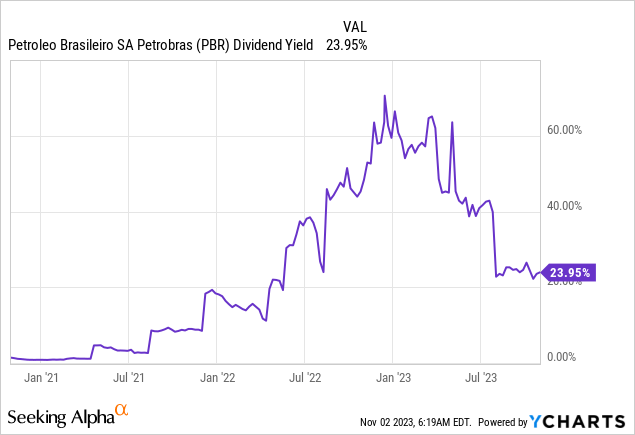

Petrobras (NYSE:PBR) is a very generous company when we speak from the dividend policy perspective. The dividend yield has been massive since the 2022 oil prices spike. According to my analysis, oil prices are very likely to stay higher for longer and PBR’s ability to generate a substantial free cash flow margin gives me the high conviction that dividend is safe. Moreover, according to my valuation analysis, the stock is attractively valued even under conservative dividend growth assumptions. The risks of investing in oil and gas companies are substantial, but I think that the potential benefits outweigh all the risks and uncertainties. With that being said, I assign PBR a “Buy” rating.

Company information

Petrobras is a Brazilian oil and gas behemoth employing over 45 thousand employees, including subsidiaries across the world.

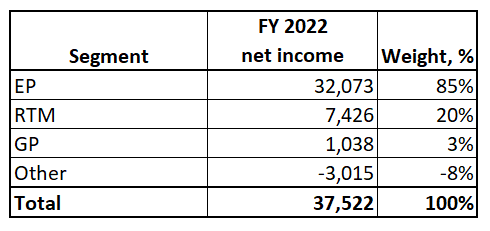

The company’s fiscal year ends on December 31. The business is operated through three main segments: Exploration and Production [EP], Refining, Transportation and Marketing [RTM], and Gas and Power [GP]. According to the latest annual SEC filing, the EP segment contributed 85% to the total FY 2022 net income.

Compiled by the author based on the latest annual SEC filing

Financials

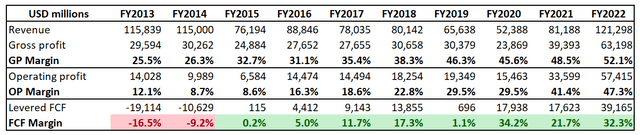

As an oil and gas company, Petrobras significantly depends on trends in energy commodity prices. That said, its financial performance has been very volatile over the past decade with annual revenue bottoming at $52 billion in FY 2020 and achieving the decade’s high of $121 billion in FY 2022. I would like to highlight that PBR’s profitability has improved massively over the decade, as its operating margin during the deep crisis of FY 2020 was higher than in the last year of the previous oil and gas supercycle, FY 2013. Last year’s spike in crude oil prices due to sanctions against Russian oil after its invasion of Ukraine was a massive positive tailwind for Petrobras. The company generated a staggering 32.3% levered free cash flow [FCF] margin in FY 2022.

Author’s calculations

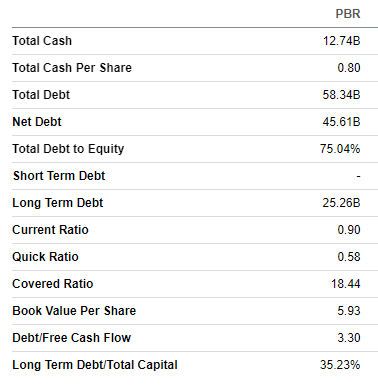

Despite having a staggering over 20% levered FCF margin over the last three years, I cannot say that the company’s balance sheet is a fortress. Despite the fact that the leverage ratio might look somewhat moderate at below 1, the net indebtedness of $46 billion is massive, and the notable part of the debt is short-term. The major reason why the balance sheet strength does not align with wide FCF margins is the company’s very generous dividend policy. After a recent revision, the payout ratio was trimmed to 45% of the FCF, compared to 60% in the previous policy. Such an aggressive dividend policy is because the company is controlled by the Brazilian Federal Government, and profit from the country’s major oil company is vital to finance governmental projects and initiatives. With that being said, I do not expect a rapid improvement of the company’s balance sheet, even in the current environment of high energy commodity prices. But, at the same time, this also indicates that PBR’s generous dividend payout is safe.

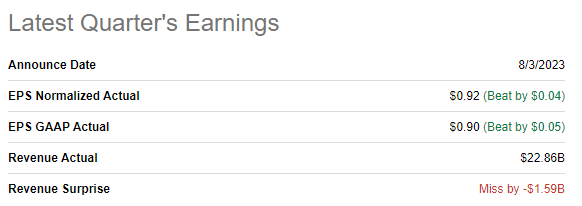

Seeking Alpha

The latest quarterly earnings were released on August 3, when the company missed revenue consensus estimated by a notable margin but successfully outperformed expectations around the bottom line. Unsurprisingly, revenue dipped YoY by almost 35% as last year’s biggest spike in oil price occurred exactly in Q2 and prices started moderating in the second half of FY 2022. The adjusted EPS followed the top line and shrank YoY from $1.33 to $0.92.

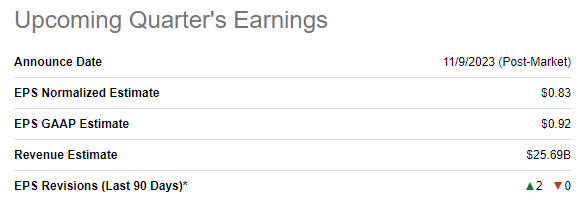

Seeking Alpha

The upcoming quarter’s earnings release is scheduled for November 9. The revenue decline is expected by consensus to decelerate as the quarterly expectation of $25.7 billion indicates an 8% YoY decline. This is a significant improvement compared to Q2.

Seeking Alpha

Now, let me switch to the longer-term prospects of PBR. There are multiple reasons why I think that we are amid the new oil supercycle now. The major positive catalyst to keep oil prices elevated for multiple years is substantial underinvestment in capex due to the era of low commodity prices between 2014 and 2021, multiplied by a massive COVID-19-related crisis for the industry. The accumulated global volume of investments in oil and gas exploration and production is the primary driver for the supply side. The oil output can only occur if new wells are drilled, or existing ones are intensified, but it also requires substantial capex.

The ongoing biggest war in Europe since WWII where Russia, one of the world’s largest oil producers is involved, and its economy is now isolated with the help of sanctions. According to WSJ, this war can run for years. If that is the case, around 10% of the world’s total oil output will stay under sanctions for longer, significantly weighing on the supply side of the macroeconomic equation. The recent military escalation between Israel and Hamas also brings vast geopolitical uncertainty to the Middle East, where some other major oil producers are located.

Last but not least, the U.S. Strategic Petroleum Reserve [SPR] has also been one of the strong factors affecting crude oil prices as the country is by far the largest oil consumer. Joe Biden’s administration was aggressive in using the Reserve last year to fight inflation, but now the SPR is running very low. It seems that the world’s largest economy will start refilling its SPR soon and that is also likely to be a solid positive catalyst for oil prices.

Overall, I think that Petrobras is a strong global oil and gas player given its strong profitability improvement. This makes the company well-positioned to absorb multiple industry tailwinds, which I have described above. PBR’s substantial indebtedness might have been a significant risk if energy commodity prices were flying low, but I am comfortable with the current balance sheet in the current environment of high crude oil prices.

Valuation

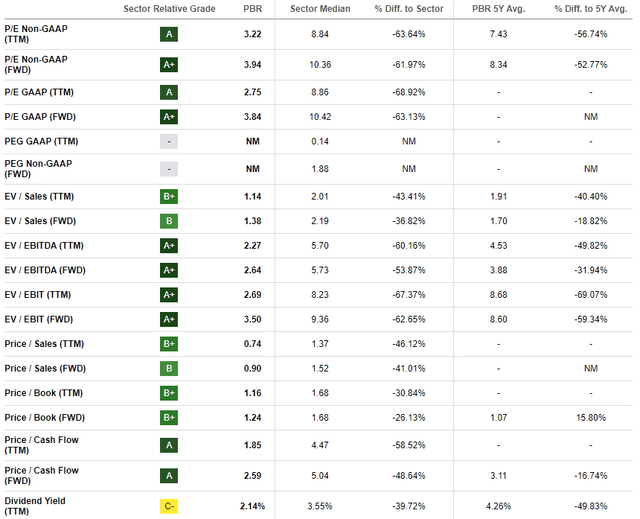

The stock demonstrated a massive rally with a 66% year-to-date price increase this year, significantly outperforming the broader U.S. stock market and the iShares MSCI Brazil ETF (EWZ). It is also important to highlight that PBR also outperformed the U.S. Energy sector (XLE) by a very wide margin this year. Seeking Alpha Quant assigns the stock a high “A” valuation grade because current ratios are substantially lower than the sector median and historical averages.

Seeking Alpha

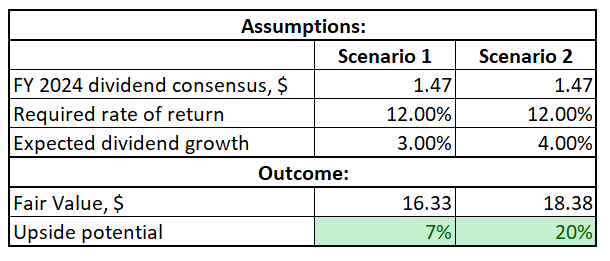

Now, let me proceed with the dividend discount model [DDM] simulation. I use an elevated 12% WACC, considering country risks and inherent volatility in energy commodity prices. Consensus dividend estimates forecast an FY 2024 payout of $1.47, which I will incorporate into my DDM calculations. Dividend growth is always tricky to project due to the substantial volatility in oil companies’ profits so that I will simulate two different scenarios. I consider both of them fairly conservative to implement for my analysis.

Author’s calculations

According to my DDM calculations, the stock is attractively valued, with the upside potential varying from 7% to 20%, depending on the dividend growth assumptions. My fair price estimation is at the midpoint between the two ends of the range, i.e., $17.4 per share, meaning approximately 13% upside potential.

Risks to consider

Operating within the oil and gas industry exposes Petrobras to a high degree of vulnerability to swings in energy commodity prices. Potential investors should be aware that oil pricing is influenced not only by the immediate supply and demand dynamics but also by the impact of breaking news, rumors, and decisions made by a very limited group of key individuals in oil-exporting countries. While it is evident that, over the long term, prices eventually align with fundamental market factors, short-term fluctuations in the oil market can be drastic. Consequently, the stock prices of oil and gas companies, including Petrobras, tend to exhibit considerable volatility and are heavily affected by prevailing sentiments regarding energy commodity markets.

Petrobras also faces substantial operational risks as it conducts complex and high-risk operations, especially related to its offshore activities. The company is extensively involved in offshore drilling and exploration, which presents unique risks and challenges. Deepwater drilling means the company must handle high pressure, extreme depths, and harsh sea conditions. Equipment failures or a well blowout might lead to substantial downtime and safety hazards. In case of pollution due to the company’s fault, Petrobras might face substantial costs and significant reputational damage. For example, as a result of the Deepwater Horizon oil spill in the Mexican Gulf in 2010, BP, the project operator, paid more than $65 billion in cleanup costs, charges, and penalties.

Bottom line

To conclude, PBR is a “Buy”. The company demonstrates substantial profitability improvement and is now well prepared to absorb positive industry trends, which I expect to sustain over multiple years. The valuation is attractive and the company pays almost half of its FCF in dividends, which I consider a gift amid the beginning of a new oil and gas supercycle.

Read the full article here