PIMCO Access Income Fund (NYSE:PAXS) is a relatively fresh CEF that was established back in early 2022 (January 31, 2022).

Similar to more mature PIMCO CEFs such as PIMCO Corporate and Income Opportunity Fund (PTY) and PIMCO Dynamic Income Fund (PDI), PAXS focuses primarily on generating high and predictable streams of current income with capital appreciation being the secondary objective for management to deliver on. Moreover, just as in the case of PTY and PDI, management can be rather flexible when it comes to the capital allocation in the fixed income space (i.e., there are no strict limitations on the sector, duration or security-type level).

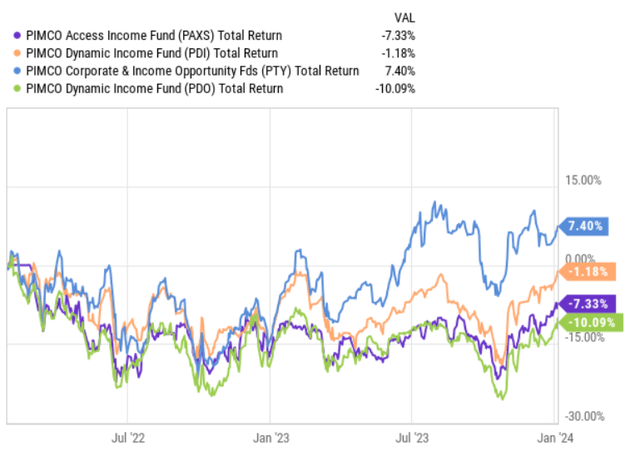

What is also quite similar among these PIMCO (including PAXS) names is that almost all of them have experienced subpar results in the past couple of years, which mostly stem from the combination of higher SOFR and external leverage that create a natural drag on fixed income instruments. The external leverage component specifically becomes more expensive thereby reducing the spread between portfolio yield and cost of capital, thereby hurting the dividend coverage metrics.

YCharts

With that being said, in my opinion, PAXS embodies a couple of interesting elements, which could help the stock price recover and at the same time derisk the dividend coverage.

Thesis

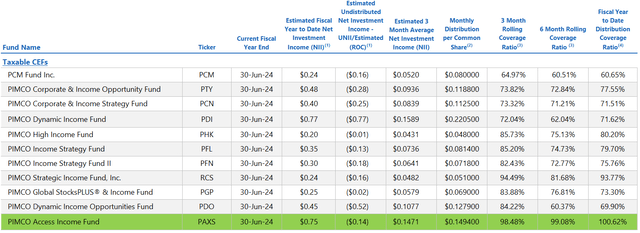

First, we have to appreciate the fact that PAXS carries the healthiest dividend coverage levels across the entire PIMCO taxable CEF space.

PIMCO Investments LLC

If we look at the statistics above, on a 6-month rolling basis, PAXS has managed to accommodate the dividend (almost) without having to rely on trimming the NAV base. Compared to other CEFs in this list, it could be deemed as a solid performance (note that the net interest income is in the numerator and the dividend in the denominator).

I think that this is important to establish and keep in mind as it indicates that PAXS is not that reliant on realizing some of the portfolio holdings to sponsor the distributions in a time when the overall fixed income markets are relatively depressed but poised to rebound as the SOFR reverts back to more accommodative levels.

However, it is true that the risk is still there because the margin of safety in the context of prevailing dividend coverage is almost non-existent.

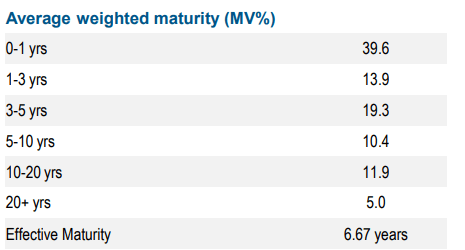

Another nuance, which distinguishes PAXS is the duration profile that is clearly tilted towards the front-end of the curve.

PIMCO Investments LLC

Currently, around 40% of the market value lies in the 0-1 year range of fixed income securities with the bulk of the remaining share mostly distributed across 1-5 year maturity segments.

All in all, this is one of the key reasons why PAXS has managed to achieve relatively acceptable net investment income levels as it has protected the fund from locking in low fixed rate instruments for a long period of time before the Fed started to aggressively hike the interest rates. Namely, since the refinancing process is much faster in the short duration segments of fixed income securities, the interest rate risk is greatly minimized.

On the flip side though, a heavy concentration in the 1-3 year maturity profiles imply that PAXS will not be able to benefit from the falling SOFR as much as other PIMCO CEFs that have introduced a more pronounced bias towards the mid or long-end of the curve.

Yet, on a net-net basis, PAXS should be still a beneficiary of lower SOFR because of two reasons:

- All of the remaining allocations that are currently in the 5+ year bracket will still be subject to a favorable repricing as the rates decrease.

- Most importantly, PAXS’s external leverage profile will significantly improve (let me elaborate on this below).

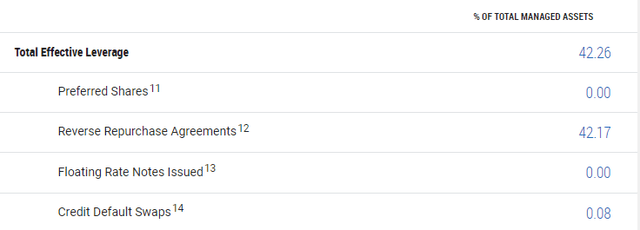

As of now, PAXS has applied an external leverage load of ~42%, which is definitely on the high end of the typical PIMCO CEF structures.

PIMCO Investments LLC

Almost all of these proceeds are sourced via REPO markets, which are heavily correlated and to a large extent linked to the SOFR dynamics. In other words, in times of elevated SOFR, servicing REPOs gets expensive, and in times of falling interest rates, REPOs adjust immediately to the level that is in the very short-end of the curve.

So, for PAXS, the assumption that the interest rates have peaked and market consensus indicating first cuts already this year bring positive news in terms of the fund’s ability to cover the dividend in a sustainable fashion.

The last thing that I would like to emphasize is PAXS’s exposure to rather risky segments of fixed income.

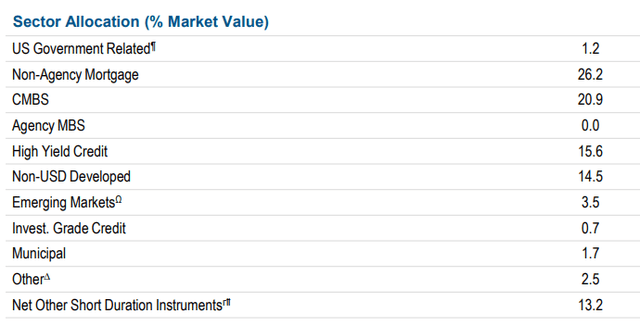

PIMCO Investments LLC

Just as for a typical PIMCO CEF, we can see a considerable skew towards inherently more volatile and business risk sensitive fixed income instruments. In this case, roughly 45% of the AUM are located in the “speculative” segments of fixed income universe – i.e., non-agency backed mortgages, high yield credit and emerging markets.

This means that while the dividend (or distribution) coverage is relatively healthy and subject to positive dynamics from interest rate normalization, there is still a notable presence of credit risk, which could potentially offset all of the positives we currently see and force PAXS to revise the amount of distributable cash flows (especially against the backdrop of almost no buffer in the current dividend coverage).

The bottom line

PAXS is one of my favorite PIMCO picks as it provides a very attractive dividend of 12% with the healthiest dividend coverage profiles across the PIMCO CEF space. It also carries favorable prospects in terms of the capital appreciation that could stem from decreasing SOFR.

The key risk in this context is really the credit quality aspect in the underlying portfolio as ~45% of the investments are made in rather speculative pockets of fixed income segments. Any potential defaults could render the current dividend (or distribution) coverage unsustainable since the NII just barely covers the current distributions (on a YTD basis). While having lower SOFR will definitely come in extremely handy, the most critical aspect for PAXS’s ability to accommodate the existing distributions is that it does not tick up higher, which seems as a very unlikely event.

In a nutshell, PAXS is an attractive fixed income vehicle that fits nicely in yield-seeking investor portfolios, where the investors are willing to assume additional credit risk (in a balanced manner) to get compensated via attractive double-digit yield.

Read the full article here