Billionaire investor Bill Ackman just announced that he has closed his short position on bonds (BND)(TLT)(HYG), citing the abundance of macro risks as his reason for closing out his position. In our view, this is a bullish indicator for “sleep well at night” high yield stocks. As a result, we are increasing the tempo at which we are investing in our top defensive high yield picks. In this article, we will look more closely at Mr. Ackman’s bond short, his reasoning for closing it out, and then share some of our top high yielding Dividend Aristocrat (NOBL) picks.

Why Bill Ackman Shorted Bonds

Just a few short months ago back in August, Bill Ackman, head of Pershing Square Holdings (OTCPK:PSHZF), turned heads in the financial press by shorting 30-year U.S. Treasury bonds. His reasoning for doing so was largely a product of his outlook on inflation, U.S. budget deficits, view on current bond valuations, and a desire to hedge the rest of his portfolio.

Mr. Ackman anticipated that long-term inflation would likely settle closer to 3% rather than the Federal Reserve’s stated target of 2%. He then reasoned that a 3% long-term inflation outlook would warrant a 30-year treasury yield of around 5.5% rather than its then current level of 4.16%.

Another likely tailwind for long-term bond rates rising that Mr. Ackman cited as part of his reason for the short position is the ongoing and accelerating budget deficits for the U.S. government. In addition to driving inflation higher by increasing the demand for goods and services from the economy, the enormous number of treasuries being dumped on the bond market skews the supply-demand equilibrium – especially at a time when major past treasury buyers like China are significantly reducing their holdings – in a manner that favors bond buyers, thereby pushing interest rates higher.

Another major incentive for shorting long-term bonds was simply the fact that Mr. Ackman has a lot of money invested into stocks whose valuations would be harmed by meaningful increases in long-term interest rates. As a result, such a short position would serve as a good hedge for his portfolio against such a scenario playing out.

Last, but not least, he felt that the valuation on 30-year treasury bonds was too rich at the moment, offering an asymmetrically attractive risk-reward for bond shorts at the time that he placed the bet.

Why Bill Ackman Closed His Bond Short Position

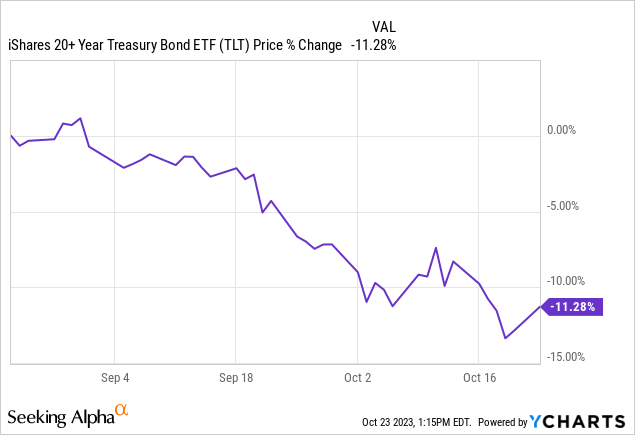

Ackman’s bet was quite successful, with interest rates moving materially higher and long-term bond prices moving materially lower over the past two months:

However, he recently announced that he decided to close his bond short position due to increased geopolitical risks and a changing economic landscape.

In particular, Bill Ackman expressed that it had become too risky to maintain a short position against bonds, stating:

There is too much risk in the world to remain short bonds at current long-term rates. We covered our bond short.

He went on to point out that the economy is slowing faster than recent data suggests. As a result, he thinks that bond yields could very possibly decline moving forward as soaring geopolitical risks could lead to a flight to safety in U.S. treasuries (thereby increasing demand for bonds and pushing down interest rates as a result) and a sudden drop-off in economic activity showing up in the data in upcoming months could also cause the Federal Reserve to pivot away from monetary tightening and raising interest rates to easing and cutting interest rates. This would also cause bond yields to fall. When combined with the strong rise in interest rates over the past few months, the risk-reward was no longer attractive enough for him to maintain his short position. Instead, he decided to lock in his profits and close the short position.

Top High Yield Dividend Aristocrat Picks

What does this mean for investors? First and foremost, it is a very bullish signal for high yielding defensive stocks, which had gotten whacked in the face of rapidly rising long-term interest rates. Sectors like utilities (XLU), REITs (VNQ), and even some of the more utility-like midstream (AMLP) names had gotten hit quite hard in recent months as investors braced themselves for a higher for longer interest rate environment and leading business figures such as JPMorgan Chase (JPM) CEO Jamie Dimon warned of potential 7% interest rates in the near future. Moreover, Bill Ackman’s short position stoked further concern on Wall Street about where interest rates were headed. Major utilities investors like NextEra Energy (NEE) sounded a cautious tone on how much they could invest in growth projects and even slashed their growth guidance at NextEra Energy Partners (NEP) in response to the rapidly rising interest rates.

However, with Ackman pivoting and the rapidly rising risk of a broader global hot war breaking out via the Israel-Hamas and/or Russia-Ukraine conflicts, the outlook for interest rates may not be quite as gloomy as it was previously. As long as inflation does not spike suddenly, it appears highly likely that the Federal Reserve is done with hiking interest rates and – should Ackman’s thesis about the economy slowing much more than the recent data suggests it is proven correct – it is probable that the Federal Reserve may not be that far away from pivoting towards interest rate cuts.

With that in mind, and given that the valuations on SWAN high yield stocks are still heavily discounted, we think that now is a great time to buy them hand-over-fist. Here are two exceptionally defensive businesses that are trading at compelling valuations right now:

High Yield Dividend Aristocrat #1

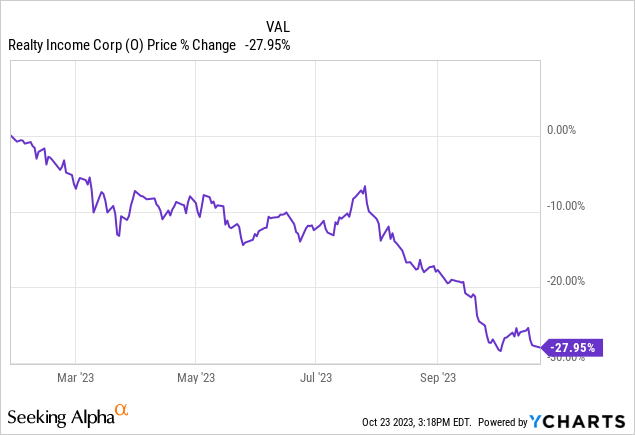

Realty Income Stock (O) – nicknamed “The Monthly Dividend Company” – is a bond-like triple net lease REIT that offers investors a great buying opportunity after its stock sold off aggressively this year:

O offers investors a very high quality and well-diversified portfolio of triple net lease properties capable of weathering economic challenges and e-commerce disruption. 92% of its rent is sourced from tenants deemed resistant to both recessions and e-commerce headwinds, leading us to believe that it will hold up very well during an economic downturn just as it did during the 2008-2010 Great Recession and the COVID-19 lockdowns.

Its A- credit rating, reasonable leverage ratio, significant liquidity, and well-laddered debt maturity ladder further reduce risk even if interest rates were to truly remain higher for longer.

With a dividend yield of 6.2% that is very well covered by AFFO and protected by O’s defensive and bond-like cash flow stream, and an approximate 15% discount to its underlying private market NAV, O offers investors a compelling combination of safety, yield, and value. As a result, it is one of

High Yield Dividend Aristocrat #2

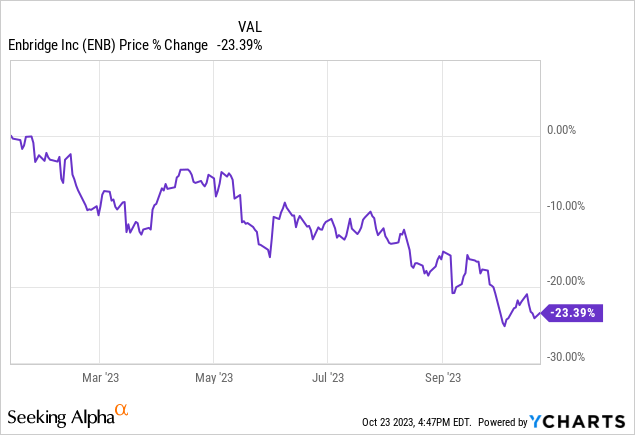

Enbridge (ENB) is another very defensive business model that is well-positioned to weather a major economic downturn. With a well-balanced portfolio between oil and natural gas exposure along with a small but growing renewable power production portfolio with a staggering 80% of its EBITDA safeguarded against inflation, 98% of its cash flow coming from either contracted or regulated assets, and an impressive 95% of its counterparties being investment grade, ENB generates utility-like cash flows for its shareholders. Furthermore, it owns such large and strategically located assets that it plays in indispensable role in the North American energy infrastructure value chain and will also own the largest natural gas utility in the United States once it completes its acquisition of assets from Dominion Energy (D).

This makes it a very defensive, bond-like investment. Moreover, ENB’s BBB+ credit rating and very well-laddered debt maturity schedule make it fairly resistant to a higher for longer interest rate environment should that scenario manifest itself. Given that its stock price been beaten down pretty severely this year, ENB looks very opportunistically priced right now:

Between its 8.2% NTM dividend yield, discounted EV/EBITDA multiple relative to its five-year history, and low business model risk, ENB makes for a great high yield, sleep well at night, Dividend Aristocrat investment for investors looking to benefit from the potential for declining interest rates while guarding against a likely economic downturn.

Investor Takeaway

The sudden change in position by one of the biggest and loudest bond market bears is a bullish signal for defensive high yield stocks that generate bond-like cash flows. O and ENB are among the strongest and highest yielding stocks in the market today with Dividend Aristocrat-like 25+ year dividend growth streaks. Moreover, they have also seen their stock prices tank in the wake of rising interest rates. With the economy appearing to be headed for a slowdown and interest rates likely nearing their peak, now may be a great time to load up on these and similar stocks.

Read the full article here