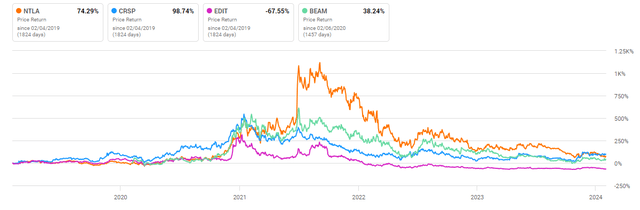

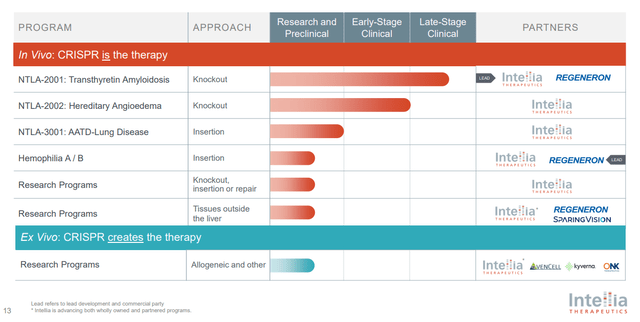

In our analysis of the CRISPR technology sector, particular attention has been paid to companies such as CRISPR AG (CRSP) and, more recently, Editas (EDIT). A critical aspect for these entities is the development of in-vivo programs. Success in this area not only promises enhanced scalability but also the potential for profitability. Historically, firms within this sector have opted for ex-vivo methodologies due to their simpler development processes, despite the challenges posed by scaling these operations.

In contrast, Intellia (NASDAQ:NTLA) has adopted a distinct strategy by prioritizing in-vivo approaches from the outset. While this decision introduces greater risk, market responses have been notably unfazed. This observation suggests a market perception that aligns the potential rewards of successful in-vivo applications with, or even above, the inherent risks involved. Such a strategy, if it proves successful, could redefine industry standards and expectations, placing Intellia at a competitive advantage in the long term.

Seeking Alpha

2001 Candidate

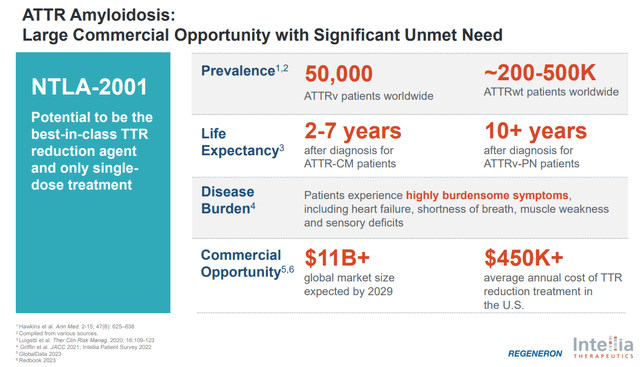

The investigational therapy “2001” represents a significant advancement in the realm of in vivo gene-editing, targeting the genetic root of ATTR amyloidosis—a condition characterized by the accumulation of misfolded transthyretin (TTR) proteins in various organs. Unlike traditional approaches that mainly manage symptoms or slow the progression of the disease by reducing TTR production, “2001” aims at a more fundamental correction by directly altering the patient’s DNA.

Intellia

Interim results from a Phase 1 study of “2001” were shared by the company. The findings so far suggest that “2001” is generally well-tolerated across a range of dosages, with most adverse events being mild to moderate, related to the infusion process, transient, and resolving spontaneously. This points to a promising safety profile.

A critical efficacy metric for ATTR amyloidosis treatments is the reduction in serum TTR levels. “2001” demonstrated a pronounced decrease, with both mean and median levels dropping by approximately 90% at 28 days post-infusion in patients administered higher doses. Importantly, this reduction appears to be sustained, with low TTR levels persisting for at least 12 months post-treatment, indicating both the effectiveness and durability of the gene editing.

The protocol for the ongoing phase involves administering a single 55-milligram dose of “2001,” based on the promising interim data. This one-time infusion method underscores “2001”‘s potential to revolutionize treatment paradigms by offering a more convenient and possibly definitive therapeutic option for ATTR amyloidosis patients, compared to the current standard of continuous therapy.

Advancements in Gene Editing and Delivery Solutions

The company is poised to embark on a transformative journey in the gene editing field, with a strategic pivot towards leveraging its gene insertion technology within extracellular vesicles (EV) environments. This pivot aims to transcend the current liver-centric applications of gene editing, thereby broadening the therapeutic reach and refining the tools available for genetic intervention.

Intellia

A pivotal step in this direction is the planned submission of a Clinical Trial Application (CTA) for NTLA 3001 in the first quarter of the upcoming year. NTLA 3001 is designed to tackle Alpha-1 antitrypsin deficiency—a genetic condition that predisposes individuals to lung and liver diseases. The advancement of NTLA 3001 into clinical trials denotes a significant leap forward, potentially offering a new therapeutic avenue for patients afflicted by this disorder.Additionally, there is NTLA-2002. Intellia Therapeutics’ NTLA-2002 represents a strategic foray into the application of CRISPR/Cas9 gene-editing technology for the treatment of Hereditary Angioedema (HAE). The therapeutic approach of NTLA-2002, aiming to permanently alter the KLKB1 gene within liver cells, intends to mitigate the overproduction of kallikrein—a critical factor in the exacerbation of HAE symptoms through increased bradykinin levels, leading to swelling and inflammation. Early clinical trial results for NTLA-2002 are promising, showcasing a substantial decrease in the frequency of HAE attacks. A notable up to 91% reduction in attack rates post a single treatment administration underscores the potential efficacy of this intervention. Furthermore, the durability of these outcomes, with some patients reporting extended periods without attacks, signifies a breakthrough in HAE management.

Furthermore, the company is enhancing its collaborative efforts with Regeneron, focusing on a gene insertion initiative for Hemophilia B, a blood clotting disorder resulting from Factor IX deficiency. This collaboration is set to materialize into a clinical study slated for commencement next year. The progression of such a program into the clinical stage underscores the ongoing expansion and sophistication of gene editing applications, promising new hope for Hemophilia B patients through potentially groundbreaking treatments.

Refocusing and New Collaborations

The firm has made a strategic decision to discontinue the development of NTLA 2003, which was aimed at addressing liver disease in patients with Alpha-1 antitrypsin deficiency. Instead, the focus will shift towards the application of DNA writing technology in treating this condition. This pivot reflects an evolving approach to genetic therapies, prioritizing innovative methodologies that may offer improved outcomes or greater efficiency.

In a significant expansion of their partnership, the company and Regeneron are intensifying their collaborative efforts to pioneer in vivo programs targeting neurological and muscular diseases. This initiative will harness the synergy between proprietary CRISPR/Cas9 technologies and Regeneron’s advanced delivery mechanisms. A noteworthy aspect of this collaboration is the adoption of a compact CRISPR enzyme, NMA 2 Cas9, which is particularly compatible with AAV (Adeno-Associated Virus) delivery systems. This strategic choice underscores a concerted effort to refine and extend the scope of gene editing technologies to affect tissues beyond the liver, potentially overcoming one of the major hurdles in the field of genetic medicine.

Moreover, Regeneron has reaffirmed its commitment to this collaborative venture by extending the technology partnership with Intellia for an additional two years, until April 2026. This extended partnership is poised to catalyze the development of genomic medicines specifically for ocular diseases, marking a significant step forward in the quest to address these conditions.

Financial and Strategic Outlook

As of the close of the third quarter of 2023, Intellia Therapeutics reported its financial reserves at approximately $993 million, encompassing cash, cash equivalents, and marketable securities. This figure marks a reduction from the $1.3 billion reported at the end of 2022, reflecting a substantial cash expenditure over the nine-month period. The estimated cash burn for the year 2023 stands at around $320 million. Despite this outflow, the company’s robust financial position is deemed sufficient to support its ongoing and planned research and development activities.

A notable upcoming financial boost for Intellia includes an expected $30 million payment from Regeneron, pertaining to the extension of their technological collaboration, anticipated in the first half of 2024. This inflow will further bolster Intellia’s financial resources.

During its third-quarter earnings call, Intellia highlighted the cost-effectiveness of its scientific methodology. The company is on the verge of launching two Phase 3 trials but predicts no substantial escalation in operational expenditures. This efficiency is credited to its versatile lipid nanoparticle (LNP)-based delivery platform, which facilitates streamlined manufacturing processes across various projects. The non-reliance on viral vectors for gene delivery and the use of synthetic components, alongside established production protocols, are expected to maintain manufacturing expenses at a manageable level. This strategy represents a competitive edge in the gene therapy domain, where manufacturing costs often present significant hurdles.

Specifically, for NTLA 2001, scale-up efforts for manufacturing have been finalized, ensuring ample drug product availability for forthcoming pivotal trials. This advance planning underscores Intellia’s preparedness for the next phases of clinical development and the transition toward commercial availability.

Moreover, the financial dynamics of the collaboration with Regeneron for NTLA 2001 are structured such that 25% of the associated costs are borne by Regeneron.

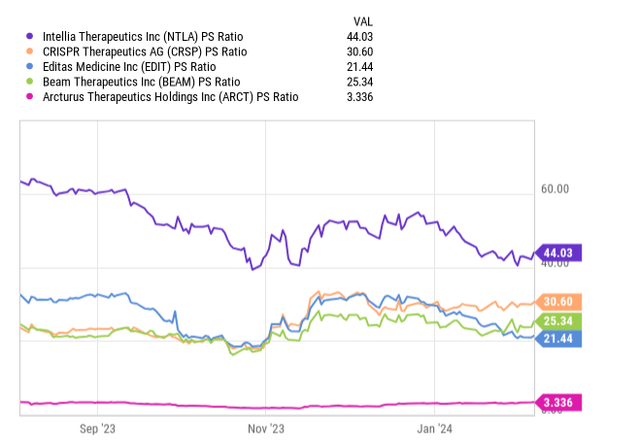

Valuation and Risks

Regarding the closest-to-completion program of the company in question, the projected total addressable market (TAM) is estimated at around $11 billion (as is visible in the ATTR commercial opportunity image). However, drawing from Casgevy’s experience in the gene therapy space—specifically for sickle cell disease—there’s a significant gap between the initial TAM projections and the realistic market size achievable post-launch. Challenges such as regulatory hurdles, scalability constraints, and pricing strategies often curtail the expected market penetration. For instance, Casgevy, despite its high TAM potential, is realistically targeting around 385 annual patients, leading to a best-case scenario revenue of approximately $777 million, which is to be shared with Bluebird. This scenario underscores the complexities involved in converting theoretical TAM figures into actual revenues.

It’s crucial to note, however, that the technology being developed by Intellia promises enhanced scalability compared to currently approved sickle cell therapies, suggesting a potentially higher intrinsic value based on its delivery mechanisms. Positive developments in the commercial adoption of Casgevy could serve as a positive indicator for Intellia’s future prospects, given the market’s likely perception of Intellia’s offerings as a next-generation scalable therapy.

Despite these positive aspects, the company’s financial burn rate of about $320 million per year, against a backdrop of approximately $900 million in current assets (estimation for the year-end) and minimal debt, indicates a runway extending into 2026. Nonetheless, the case of Invitae (OTC:NVTA) highlights the precarious nature of financing in this sector, where companies frequently require market-based capital injections, sometimes under less-than-ideal conditions.

YCharts

Given these factors, alongside the company’s current market valuation and the distance from launching any therapy, a cautious stance seems prudent. My existing investments in Intellia already provide sufficient exposure to this sector. Thus, I will refrain from increasing my holdings in companies with significant negative cash flows, despite acknowledging the potential value within Intellia’s pipeline.

Read the full article here