The Japanese say, If the flower is to be beautiful, it must be cultivated. – Lester Cole.

I like international investing despite it being a brutal few years trying to diversify outside the U.S. I also like currency-hedged funds when it comes to developed markets, as often a weak currency benefits that currency’s domestic stock market. If one want to invest in Japan, I think currency hedging is critical against the Yen, which makes the iShares Currency Hedged MSCI Japan ETF (NYSEARCA:HEWJ) a good exchange-traded fund (“ETF”) for what it does. That doesn’t mean, though, that now is the time to own it.

What is HEWJ?

HEWJ is a type of exchange-traded fund designed to track the performance of large and mid-sized Japanese companies. While doing so, it also mitigates exposure to fluctuations between the value of the Japanese yen and the U.S. dollar (USD:JPY). This unique feature makes HEWJ an attractive option for investors seeking to invest in the Japanese market without being vulnerable to currency volatility.

HEWJ comes with a set of distinct features that make it appealing to investors.

1. Reduction of Currency Impact

Investing in foreign equities can often expose investors to currency risk. However, HEWJ seeks to reduce the impact of the yen-dollars exchange rate fluctuations on its Japanese equities allocation.

2. Broad Exposure

HEWJ offers broad exposure to a wide range of Japanese companies. This provides an opportunity for investors to potentially benefit from Japan’s stimulus policies.

3. Customizable Currency Risk Management

HEWJ can be easily combined with an unhedged Japan fund like the iShares MSCI Japan ETF (EWJ) to tailor currency risk while maintaining consistent equity exposure.

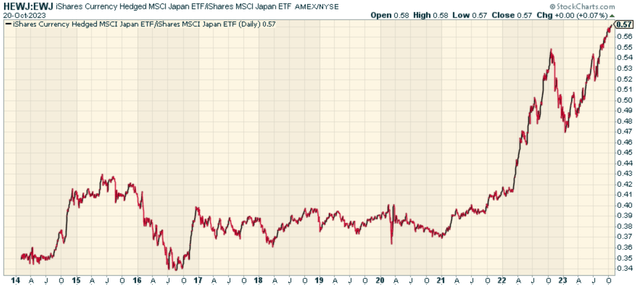

The extend to which currency hedging has outperformed non-currency hedging is incredible. The price ratio of HEWJ to EWJ is at all-time relative highs.

stockcharts.com

The Fund’s Expense and Management Fees

HEWJ has a net expense ratio of 0.50%. However, it is important to note that the regular expense ratio is reported as being 1.02% at present. This includes management fees and acquired fund fees and expenses.

Notably, BlackRock Fund Advisors, the investment advisor to the fund, has contractually agreed to waive a portion of its management fees through December 31, 2025. This agreement has been made to maintain the attractiveness of the fund to investors in the current competitive market.

Understanding HEWJ’s Holdings

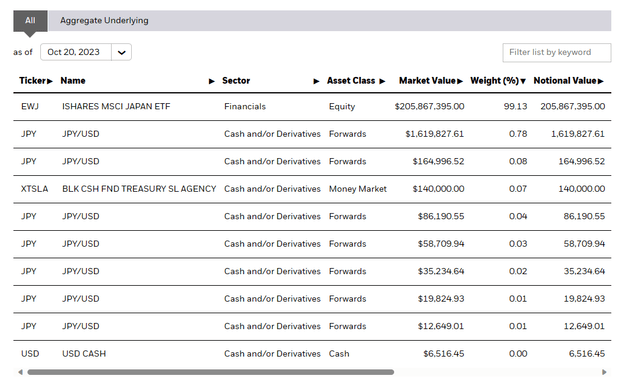

The HEWJ fund’s primary holding is EWJ, along with offsetting JPY/USD forwards. The aggregate underlying portfolio consists of 237 stocks, skewed towards export-oriented sectors like Industrials and Information Technology. The fund’s top holdings include leading Japanese companies like Toyota Motor Corp (TM) and Sony Group Corporation (OTCPK:SNEJF). The extensive diversification of the fund, demonstrated by the absence of any position exceeding a 5% threshold, is a testament to its stability.

ishares.com

However, investors should note that the fund’s ~15x earnings and 1.4x book multiples mean HEWJ is priced at a premium to historical levels. Japan has done well, but the valuation and risk of a blow-up in their own bond markets make it challenging to get too comfortable in my view.

Wrapping Up

The iShares Currency Hedged MSCI Japan ETF offers a unique opportunity to invest in the Japanese market while mitigating currency risk. Its broad exposure to a variety of Japanese companies and its unique currency hedging strategy make it an attractive choice for investors. But given the risk more broadly of a global risk-off sequence likely being here, I wouldn’t allocate to the iShares Currency Hedged MSCI Japan ETF at this very moment.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here