Blade Air Mobility (NASDAQ:BLDE) provides an Urban Air Mobility (UAM) platform that aims to lower the cost of air transportation alternatives on congested routes. Blade also has a rapidly growing organ transport business that appears set to dominate revenue in coming years. While Blade has managed to drive rapid growth in recent years and is reducing its losses, gross profit margins are low, and the business doesn’t appear defensible. This is already reflected in the company’s valuation though, which is quite low, particularly given the company’s relatively large cash balance. Despite this, the stock is likely to remain under pressure for the time being, as the macro environment will continue to be a problem in the near-term and there has been a number of recent one-time boosts to revenue.

Market

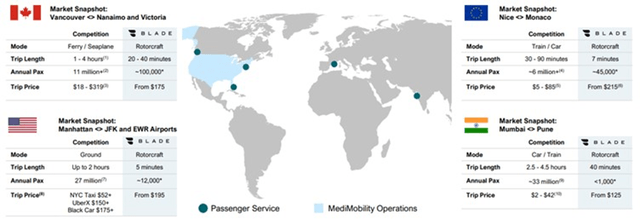

Blade is positioning its platform as a reasonably priced alternative transportation option that has the potentially to dramatically reduce commute times on congested routes. Target markets include NYC, Boston, Philadelphia, Washington DC, LA and San Francisco. Traffic congestion is a large and growing issue, costing the economies of the aforementioned cities an estimated 35 billion USD annually.

Blade has suggested that UAM could be part of the solution to this problem, but UAM will likely only ever be a drop in the ocean. More realistically, increased congestion problems will lead to greater demand for UAM by individuals who highly value their time.

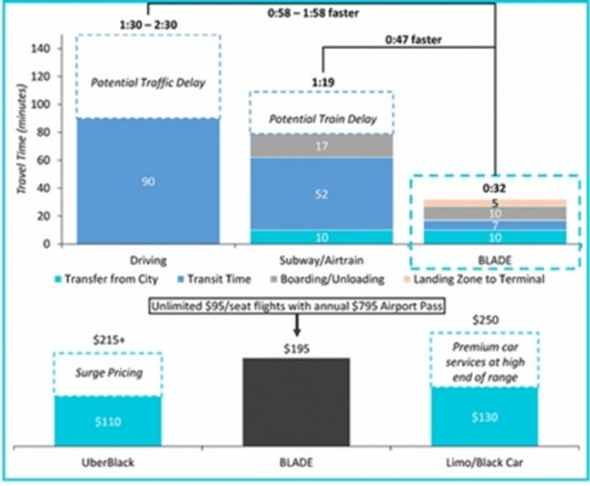

Figure 1: Manhattan (Hudson Yards) – JFK Travel Time and Price Comparison (source: Blade)

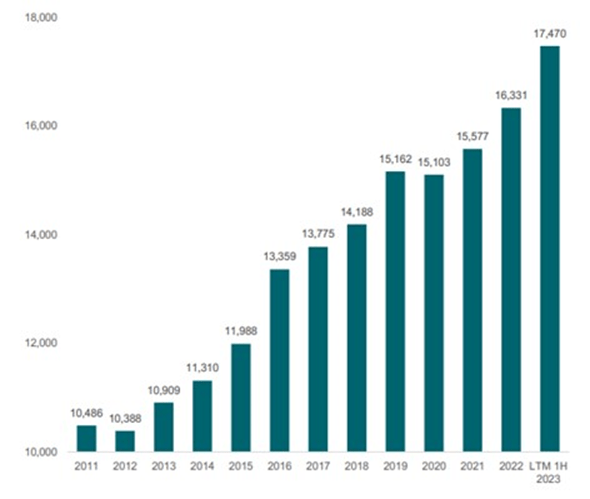

Blade estimates that there are 27 million passengers per year travelling between NYC airports and Manhattan. Based on surveys, the company believes that 3-5 million of these passengers would be willing to pay to use a helicopter. Using an average 195 USD revenue per trip, this results in a 1 billion USD SAM. Similar calculations across Blade’s target markets results in a total SAM of around 5-8 billion USD.

Table 1: Blade Estimated UAM SAM (source: Created by author using data from Blade)

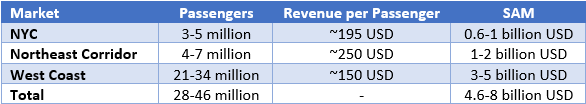

Blade’s MediMobility business primarily generates revenue from the transportation of hearts, livers and lungs, as these organs can only survive outside of the body for a short period of time. Blade believes there is also an opportunity in adjacent markets like kidney transport, medical radioisotopes and critical cargo and parts delivery.

Figure 2: Organ Transplants in the US (source: Blade)

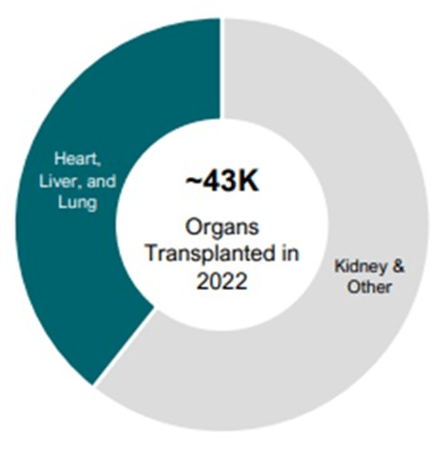

Based on UNOS data, the organ transport market grew 18% YoY in the second quarter of 2023, and Blade believes that there will be mid double-digit growth going forward. Some of this growth is being driven by perfusion devices, which enable longer trips. Taken to the extreme, perfusion devices could potentially reduce the demand for air transportation if effective preservation times become long enough.

Figure 3: National Heart, Liver, Lung Transplants by Year (source: Blade)

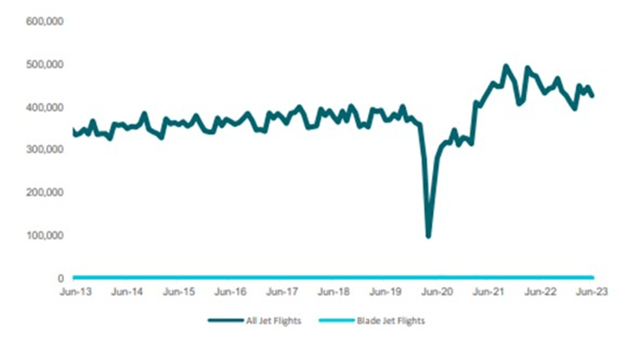

Blade’s Short Distance and Jet and Other product lines compete primarily with Part 135 operators or brokers of helicopters, seaplanes and jets. These companies generally only offer full aircraft charter, although some air carriers offer competing by-the-seat service. At a higher level, Blade also competes with other forms of transportation, like rail, ferry, bus, car, etc. While price points vary significantly, consumers must weigh the tradeoff between cost and time. Blade could also face competition from commercial airlines or companies like Uber Technologies (UBER). EVA manufacturers may also choose to develop vertically integrated businesses.

Blade’s MediMobility Organ Transport product line competes primarily with Part 135 jet operators and a limited number of asset-light logistics businesses.

Blade Urban Mobility

Blade provides a UAM platform that aims to lower the cost of air transportation alternatives on congested routes. The company has an asset-light business model that currently utilizes conventional aircraft but is also positioned to benefit from the introduction of electric aircraft.

Blade does not own aircraft, instead choosing to buy aircraft time by-the-hour. Blade pays a fixed, all-inclusive rate which covers all costs associated with flights. Operators stand to benefit from increased passenger volumes, a more predictable revenue stream and reduced fixed costs.

Passenger Segment

Blade breaks its Passenger business into two segments:

- Short Distance – Helicopter and amphibious seaplane flights that are generally between 10 and 100 miles long.

- Jet and Other – Non-medical jet charter and by-the-seat jet flights between New York and South Florida. This segment also includes revenue from brand partners and ground transportation services.

The passenger business is currently dominated by B2B but Blade believes there is a large opportunity to expand amongst consumers.

Blade Airport service provides passengers with the ability to book individual seats on five-minute flights between Manhattan and New York area airports. Blade’s airport route between the west side of Manhattan and JFK became profitable for the first time in the second quarter, which Blade believes is indicative of the underlying potential of its business.

Blade’s passenger business recently expanded into Europe through the acquisition of three businesses. Blade Europe has new terminals in Monaco, Nice and Cannes. Traffic has been normalizing from record levels in 2022 and Blade’s fleet availability has been lower due to aircraft maintenance delays. The integration of the three European businesses that Blade acquired is also progressing slower than planned.

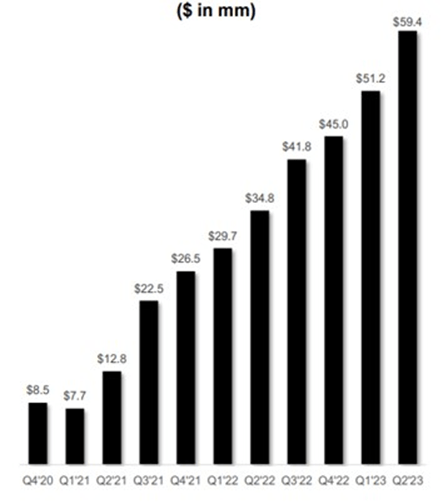

Figure 4: Blade Short Distance TTM Revenue (source: Blade)

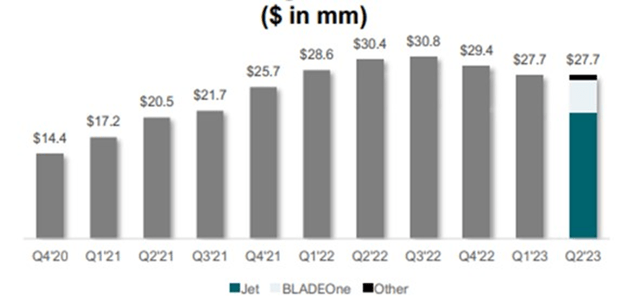

Figure 5: Jet and Other TTM Revenue (source: Blade)

Figure 6: FAA Monthly Business Jet Operations (source: Blade)

Blade’s infrastructure is an integral part of the passenger business. The company currently has 16 passenger terminals servicing traditional rotorcraft. This infrastructure should also provide Blade with a foothold when EVAs are commercialized. EVAs are likely to initially leverage existing infrastructure as it will take time to gain approval for and build new infrastructure.

Blade recently announced an agreement to operate and revitalize the Newport Helistop in Jersey City. As part of the agreement, Blade launched a pilot program for charter flights and is analyzing the viability of a service between the Newport Helistop and New York area airports and heliports.

Blade plans on investing in infrastructure in locations like:

- Los Angeles

- San Francisco

- Baltimore

- Washington DC

- Philadelphia

- Wilmington

- Vancouver

- Jakarta

- Tokyo

Figure 7: Blade Short Distance Footprint (source: Blade)

Blade believes that its private terminal / lounge network provides a strategic advantage, but its control of passenger terminal infrastructure is somewhat tenuous. Blade leases and licenses this infrastructure from airport and heliport operators, and they in turn lease the infrastructure from the municipality that owns the premises. Blade’s leases, licenses, and permits vary in length, ranging from month-to-month to multi-year. Control is undermined by the fact that some municipalities, including New York, retain the authority to terminate a heliport operator’s lease upon as short as 30 days’ notice.

Blade’s passenger business could also create value by aggregating UAM supply and demand, helping to create a more liquid marketplace. There are obviously network effects involved in this, but these network effects are localized. Given the number of operators on the supply side, these network effects are also likely to be weak.

Medical Segment

Blade’s MediMobility business operates as Trinity Medical Solutions and currently serves over 68 transport centers and Organ Procurement Organizations across the US. Trinity Medical Solutions transports human organs for transplant and/or the medical teams supporting these services.

There are over 20 aircraft dedicated to Blade and many more available through the company’s asset-light platform. Demand typically occurs at night, complementing consumer demand. Blade believes that it has the most reliable and cost-effective national network for organ transportation in the US.

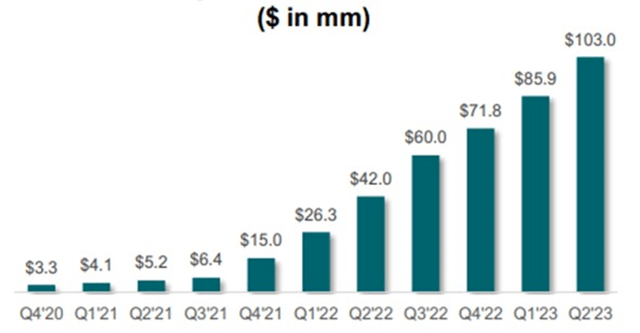

Figure 8: MediMobility Organ Transport TTM Revenue (source: Blade)

M&A

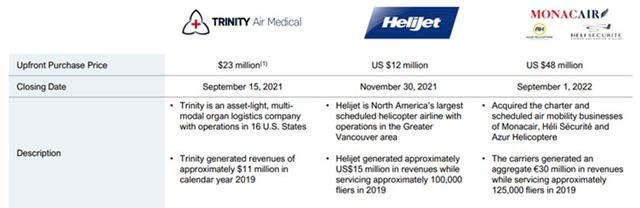

Blade’s strategy leans heavily on M&A to drive growth, with recent acquisitions including Trinity Air Medical, Helijet and Monacair. Blade believes that its platform and capabilities helps to scale companies post-acquisition. While this may be the case, the reliance on M&A to drive growth is a risk.

Figure 9: Recent Blade Acquisitions (source: Blade)

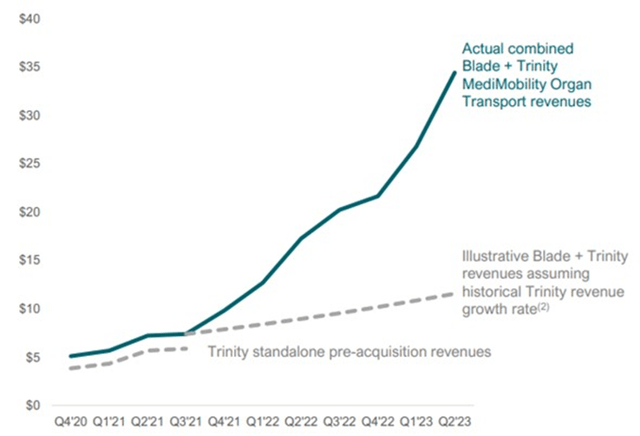

Trinity’s TTM revenue prior to the acquisition by Blade was 17.8 million USD, with a 29% annual growth rate since 2019. The business has since grown to 103 million USD revenue, which Blade believes is largely due to its aircraft operator network and technology platform.

Figure 10: Combined Blade + Trinity Quarterly Revenue – million USD (source: Blade)

EVAs

EVAs could prove to be a growth catalyst for the Urban Air Mobility market, given that they are less noisy, have zero emissions and are expected to reduce costs. EVAs are also expected to have cruising speeds that are nearly 20% faster than traditional rotorcraft.

In addition to potentially expanding the UAM market, EVAs could also lead to a modest improvement in unit economics for Blade’s business.

Figure 11: Traditional Rotorcraft and EVA Cost Comparison (source: Blade)

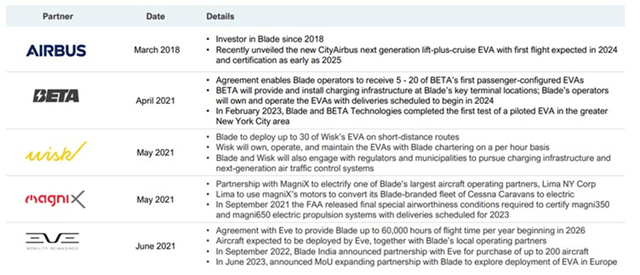

Some manufacturers expect to be certified and available for commercial service in 2024 (BETA Technologies, Wisk, Eve). Blade is already collaborating with EVA companies with the goal of integrating their aircraft into Blade’s network.

Figure 12: Blade EVA Manufacturer Partnerships (source: Blade)

Blade’s EVA partnerships and existing UAM business are unlikely to protect it from the increase in competition that will follow the commercialization of EVAs. For example, Eve Air Mobility and United Airlines (UAL) are partnering to bring EVAs to San Francisco. The companies are working together to identify origin and destination areas and ensure the appropriate infrastructure is in place. Eve’s electric eVTOL has a range of 60 miles using specialized rotors for vertical flight and fixed wings for cruising. It will be piloted at launch but evolve towards uncrewed operations in the future. United invested 15 million USD in Eve Air Mobility in 2022 and has a conditional purchase agreement for 200 eVTOLs, plus an option for 200 more. Eve’s eVTOL is scheduled to enter service in 2026.

Financial Analysis

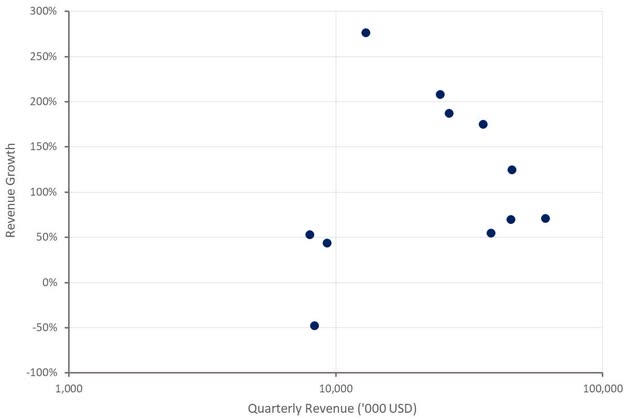

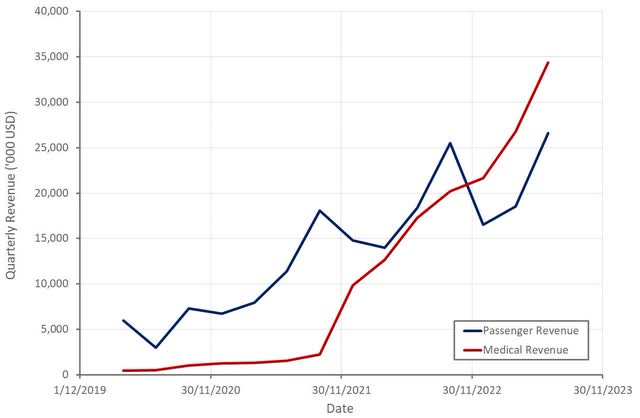

Blade’s recent growth has been solid, driven largely by the expansion of its organ transport business. Growth in the second quarter was approximately 71% YoY, despite recent weakness in the passenger business. Adjusting for temporary MediMobility revenue, growth was more like 60% YoY. Adjusting for non-organic growth, Blade’s headline growth rate in the second quarter was only around 38% YoY.

Figure 13: Blade Revenue Growth (source: Created by author using data from Blade)

MediMobility revenue grew by 99% YoY in the second quarter on the back of hospital wins, continued expansion with existing hospitals and solid end market growth. Blade’s acquisition of Trinity Air Medical was completed in September 2021, meaning that current growth is organic. Roughly half of second quarter growth was driven by new customers, with the remainder coming from existing customers.

Medical growth in the second quarter was boosted by revenue from one transplant center that Blade has been supporting on a temporary basis. As a result, medical revenue is expected to be flat sequentially in the third quarter, which equates to high-double-digit YoY growth. Medical revenue is expected to return to single-digit sequential growth in the fourth quarter. The Medical segment has long sales cycles and Blade often works with people on a non-contracted basis when demand is high.

Short Distance revenue was up 75% to 19.2 million USD in the second quarter of 2023. Growth was driven by Blade’s acquisition of Blade Europe, Blade Airport volume and pricing growth and strong growth across the US Short Distance portfolio. Organic Short Distance revenue growth was 5% YoY on a constant currency basis. European revenue was lower than expected in the second quarter due to a slight decline in industry-wide helicopter activity across key European destinations, along with new landing volume restrictions in St. Tropez. Blade believes that this restriction is more of a redistribution of traffic across landing sites rather than a fall in traffic and has stated that it isn’t particularly concerned.

Blade Airport revenue increased approximately 65% YoY and is the fastest growing product in Blade’s passenger portfolio. This growth was driven by both an increase in seats flown and higher average revenue per seat. This strength has carried over into the third quarter, with continued passenger growth and increased pricing.

Figure 14: Blade Revenue by Segment (source: Created by author using data from Blade)

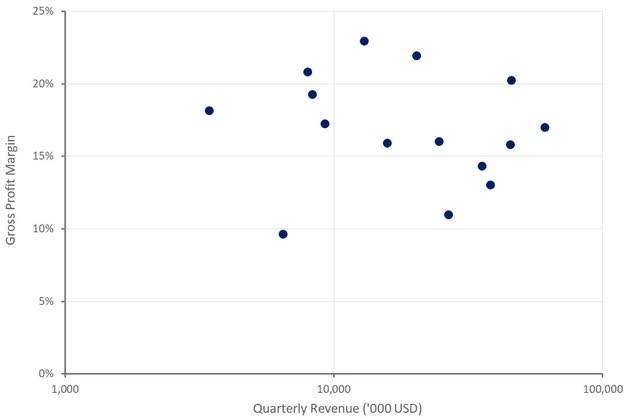

Blade’s gross profit margins are relatively low, although the company has suggested that higher utilization will lead margins higher. So far, the company has demonstrated no ability to do this, but stable margins could simply be the result of new businesses ramping and a shift in revenue mix. For example, Blade Airport is still ramping and is operating below breakeven. Excluding this, Blade estimates that flight margins would have been approximately 1% higher. Longer term, Blade is targeting flight margins of greater than 20%.

Figure 15: Blade Gross Profit Margins (source: Created by author using data from Blade)

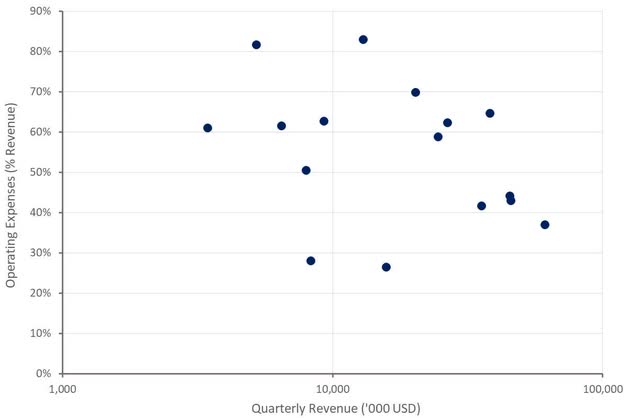

Recent improvements in adjusted EBITDA margins have been driven by operating leverage and cost efficiency programs. On the corporate expense front, adjusted unallocated corporate expenses and software development costs decreased 12% YoY in Q2 2023.

Passenger segment adjusted EBITDA was negative 2.1 million USD in the second quarter. Losses were attributed to the startup of Blade Europe, partially offset by improved US Short Distance profitability. Medical segment adjusted EBITDA was 3.0 million USD. The medical business appears to have better economics, which should be a margin tailwind if medical growth continues to outpace passenger growth.

Figure 16: Blade Operating Expenses (source: Created by author using data from Blade)

Valuation

Despite rapid growth and improving margins since going public in 2021, Blade’s stock has trended down and is around 90% off its peak. The company’s enterprise value is now approaching zero, indicating the extent to which the market doesn’t believe in Blade’s business.

Blade may now appear attractively priced given its relatively high growth rate but there are a number of considerations:

- Blade will likely consume most of its cash pile on the way to breakeven

- M&A has driven much of Blade’s recent growth

- Blade’s gross profit margins are structurally low, limiting potential cash flows

- Barriers to entry appear to be low

Based on a discounted cash flow analysis I estimate that Blade’s stock is worth approximately 2.5 USD per share. There is a large amount of uncertainty involved in any estimate at this point though, as Blade’s potential profit margins at scale are unclear.

At this stage investors are probably better off focusing on near-term developments. Growth will likely fall off rapidly over the next year, which will not be well received by the market. The relatively rapid growth of the organ transport business will provide a margin tailwind though. Sustained progress towards breakeven is probably the main factor that could halt the decline of Blade’s stock.

Figure 17: Blade P/S Ratio (source: Seeking Alpha)

Read the full article here