Background

Several events since 2020 altered Blackbaud’s (NASDAQ:BLKB) future, including a security breach, a significant acquisition of EVERFI in 2021, and a monumental business change in 2023, all discussed in detail below. The security breach’s temporary costs are winding down while the business is inflecting positively due to pricing initiatives. These factors culminated in an impressive 46% stock price appreciation in 2023. While Blackbaud is improving, its valuation is marginally too high for a buy recommendation. However, I would be interested if it pulled back into the high $60s; until then, I recommend a neutral stance.

Business Description

Blackbaud is a cloud software company in the social good space, serving nonprofits, higher education, K-12 schools, and other foundations. The portfolio of software and services has grown to support fundraising and CRM (customer relationship management), marketing, advocacy, peer-to-peer fundraising, CSR (corporate social responsibility), payment processing, analytics, and much more. They have over 40,000 customers with contractual billing arrangements and nearly 100,000 who paid Blackbaud through transactional fees.

Recurring revenue stems from 1 to 3-year contracts for access to their subscription-based software, including cloud solutions, hosting services, payment services, and other software-based platforms. Most offerings are off-the-shelf products with little associated costs; only their largest customers receive customized solutions. Blackbaud Raiser’s Edge NXT, the flagship product, offers fundraising and relationship management solutions. Raiser’s Edge NXT is the first and only cloud fundraising and relationship management solution that is all-inclusive and fully integrated with data health, analytics, email marketing, donation forms, event management, payment processing, and process automation to create tailored user-specific experiences. Blackbaud aids nonprofits in targeting potential donors combined with the correct donation amount.

Blackbaud Merchant Services operates as their credit card processing business, where customers pay a fee for each transaction. Like credit card companies charge merchants, Blackbaud takes a percentage of each donation plus a transaction fee. A significant portion of the processing fee goes to the credit card companies. On average, Blackbaud charges 2.79% plus $0.30 per transaction for donations made using Visa and Mastercard. This rate varies depending on the annual number of transactions processed and the card used to donate. For instance, from a $25 donation I made, the charity received $24. Blackbaud is also considering options for donors to cover processing fees; for example, on a $100 donation, the donor would pay the $2.80 + $0.30 processing fee.

Donations via a credit card are becoming more popular due to ease of use. They also provide K-12 private school customers with student tuition payment processing services. The greater the volume and number of transactions via a credit card, the more merchant services grow. On an accounting note, while BLKB charges 2.79%, much of this covers the merchant service fees charged by Visa, Mastercard, Amex, and others. Thus, they record the revenue on a net basis. If Visa charges 2.5% merchant fees, Blackbaud records revenues net of the fee, or 0.29% of the donation (2.79%-2.5%).

In addition to the offerings mentioned above, they provide Data Intelligence (becoming more powerful with the advancement of AI), Financial Management through the Financial Edge NXT – a cloud account solution, Grant and Award management, and more.

They generate revenue from the following sources: 1. License/contracts for Software solutions in cloud and hosted environments. 2. Payment for transactional services 3. Impact-as-a-Service digital educational content. 4. Software maintenance and support services. 5. Ancillary professional services, including implementation, consulting, training, analytics, and other services.

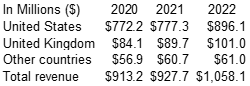

Blackbaud generates the bulk of revenue (97%) from a “recurring” revenue stream, including subscription-based software solutions providing access to cloud solutions, hosting services, payment services, online training programs, and subscription-based analytics services. Management’s commentary suggests ~55% is truly recurring, while the remaining 45% is transactional-based (though heavily reoccurring). Since this revenue stream is not contractually guaranteed, it’s best to differentiate it. One-time services comprise the remaining 3%. In 2022, 85% of revenue was generated in the US, 10% in the UK, and the rest in other countries (shown below).

Revenue by Geography (BLKB 10-K)

Market Overview

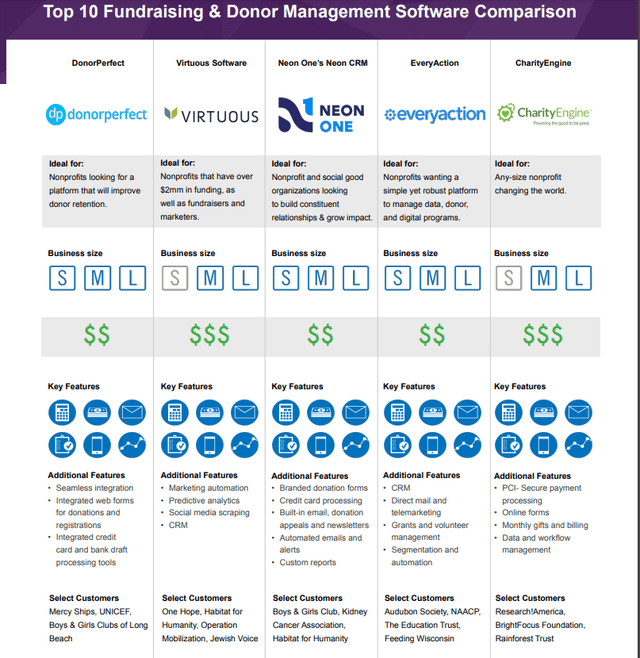

Although around 1.6m nonprofits are registered in the US, Blackbaud specifically targets organizations that generate over $1m in revenue. Since the solutions cost between $15,000 and $25,000, these organizations must be sufficiently large to afford this expense. Smaller organizations typically run their data sets in Microsoft Excel, Microsoft Access, or small-scale platforms (shown below).

$500B is donated annually in the US, and over $100B of funds flow through Blackbaud, some for fundraising, some for tuition management, and some for payables. The top 50 nonprofit organizations generate a substantial portion of funds raised; these include the University of Michigan, the American Cancer Society, and the Red Cross.

The chart below displays the top 10 fundraising and donor platforms, with Blackbaud being the most expensive.

Top 10 donor platforms (Donor Perfect)

Top 10 donor platforms (Donor Perfect)

Business Events in 2020-2023

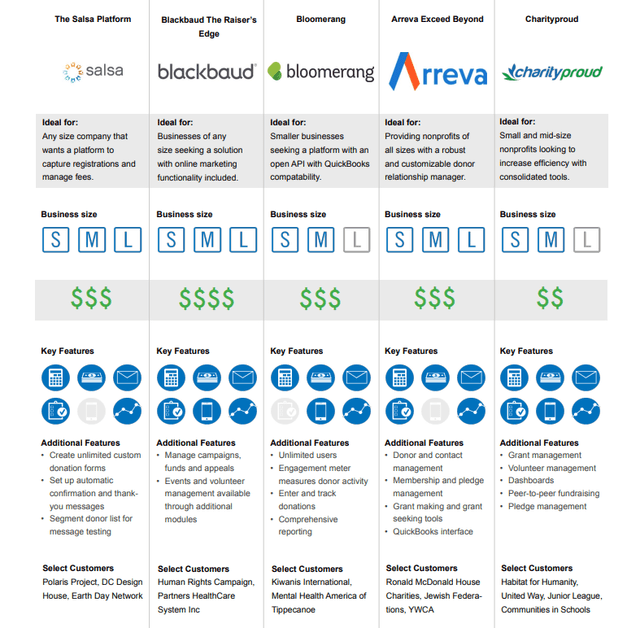

In May 2020, a cybercriminal removed data from Blackbaud’s servers, resulting in legal cases, claims, and investigations. To limit their exposure to claims-related losses, they maintain $50m of insurance. As shown in the chart below, as of the end of Q3 2023, they had $156m in gross legal exposure, offset by $50m insurance proceeds, for $106m in net exposure. In Q4 2023, they expect to pay $49.5m for a settlement with 49 state Attorney Generals and the District of Columbia. Over the past 3.5 years, costs associated with legal fees flowed through the company’s general and administrative expenses. Beyond legal fees, they’ve spent additional capital to improve their cybersecurity infrastructure. These incidents distracted management from focusing solely on the business.

Security Breach Exposure (BLKB Q3 2023 10-Q)

During Q3 and the 9 months of 2023, they incurred net pre-tax expenses of $4.1m and $48.6m, respectively, related to the Security Incident. These figures include $4.1m and $18.6m for ongoing legal fees and additional accruals for loss contingencies of $0 and $30m, respectively. For FY23, they expect net pre-tax expenses of approximately $20m to $30m and net cash outlays of $25m to $35m for ongoing legal fees related to the Security Incident. To put context around the legal expenses incurred from this incident, in 2022, they spent Q1 – $7.2m, Q2 – $8.4m, Q3 – $13.7m, and Q4 – $26.5m. In Q1 23, they incurred $17.8m in expenses, followed by $26.8m in Q2 and $4.1m in Q3. As the costly legal fees diminish and settlements get paid, margins should improve, allowing management to shift its focus from legal issues to business operations.

On January 2, 2022, Blackbaud announced the acquisition of EVERFI for US$753.6m in cash and stock ($450m in cash and 3.84m shares of BLKB). The acquisition enhanced Blackbaud’s positioning in the ESG and Corporate responsibility spaces, doubling their TAM to $20B. The acquisition represented a 6x 2022e revenue of $120m and was margin dilutive. Management’s pitch for the acquisition stems from corporate involvement in giving, including employer matching and donations to charities of employee choice.

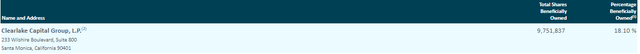

In March 2023, Clearlake Capital Group submitted a proposal to acquire the remaining 94.5% not already owned for $3.8B in cash, implying a $4.1B value or $71/share, representing a 23% premium to the prior day’s close. On March 27, 2023, the board rejected the offer, claiming it undervalued the company. They’ve proved right thus far, given the rise in stock price in 2023. Today, Clearlake owns ~18 % of s/o. It’s not unreasonable to think they make an offer for BLKB in the future.

Clearlake ownership (2023 BLKB Proxy)

Thesis

Modernized Approach to Pricing and Multi-Year Contracts

During COVID, they pulled back on price increases for their software platform and, throughout 2022, began modernizing their contracts. Historically, customers signed 1-3-year contracts and one-year renewals once the initial contract ended. Historically, contracts did not have price escalators in years 2 and 3; thus, what the customer paid in year one was the same as in years 2 and 3. In November 2022, they began notifying customers with March 2023 renewals of significant contract changes. First, they would almost exclusively offer 3-year renewal terms instead of one-year renewals. Second, should a customer only want to renew for one year, the rate increase would be far more than if they chose a three-year contract. Third, the 3-year renewal option now has annual rate increases. June, July, and December are the most significant renewal months. (The Q1 2023 earnings call provides insight into the new structure)

I spoke with a Blackbaud customer at length regarding the pricing updates. They recently renewed their contract at the end of 2023 and noted the dramatic increase in year one and subsequent increases in years two and three. The price hikes did not deter them from moving platforms as they would lose functionality, data, and certain capabilities in the transition, which they did not view to be worth it. One striking comment was, “Blackbaud is sophisticated in its donor software – and at one time was considered the “Cadillac” of fundraising software. In my opinion- they are still a good donor database but have overpromised in their capabilities as they move to their web-based platform. They have promised functionality that would be helpful to development and foundation operations and transfer all functionality of the Database to the Web version. There hasn’t been much movement in several years.” In addition, the customer created spreadsheets and databases to use data captured by Blackbaud. Blackbaud’s platforms are tier-based. Moving up tiers increases the price and applications users access. Instead of paying the higher tier prices, they opt to do it internally.

Management stated rate increases are in the mid to high teens; I estimate it to be 16%. While this may seem high, it also works as a catch-up when they had little to no rate increases in 2020-2022. Annual escalators are in the mid to high single digits, which I estimate to be 7%. A customer paying $10,000 at the end of 2023 would pay ~$13,280 in 2025 (+32.8%). This is a game changer as price increases have almost no associated costs, dramatically increasing earnings and margins. Q3 2023 margins were up 240bps y/y.

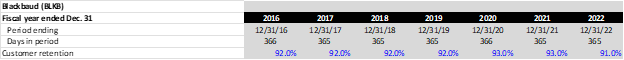

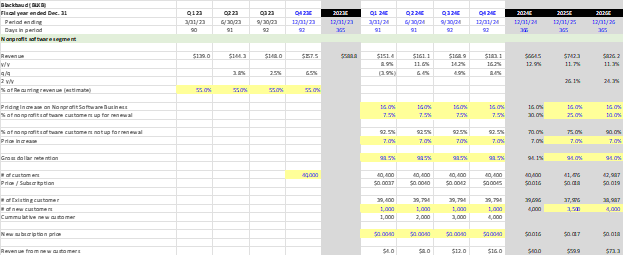

~55% of revenue is related to software contract initiatives. “When you think about our total revenue base, what I just described applies to just over half of it, or you can think of it as about 55%. It excludes the transactional revenue and the approximately 15% of revenues tied to our corporate business. So, what this pricing initiative is touching is our nonprofit software business. So of that 55% that’s impacted by this program.” 35% of customers were up for renewal in 2023, 30% in 2024, 25% in 2025, and the remainder in 2026. Revenue and margins have a tailwind from these initiatives. These initiatives should also dramatically improve retention, which was 90% in 2022 and 91% in 2021. Through October 2023, 90% of 2023 contracts were renewed. These initiatives add predictability and visibility, resulting in a higher-quality business. When these new contracts renew in 2026, I expect a continuation of mid-single-digit price increases. The compounding effect of this will drive earnings growth.

Gross Retention (BLKB 10-Ks)

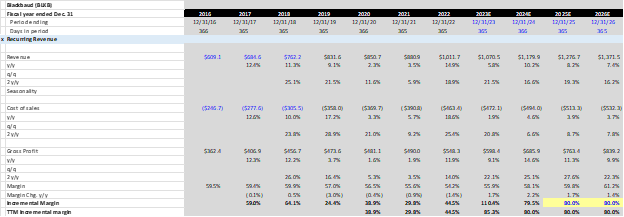

The chart below details the history of the recurring revenue segment, which has grown from $831m in 2019 to an estimated $1.07B in 2023. Guidance for the year was $1.1B at the midpoint, including one-time services, which is on pace to do $33m.

Blackbaud recurring revenue (BLKB Filings & Management Commentary)

Based on management’s statement at the Southwest Ideas conference, 55% of recurring revenue sales are a part of the new pricing initiative. One can disaggregate the revenue streams and the pricing impact of these initiatives. In 2024, management stated that 30% of customers are up for renewal, 25% in 2025, and 10% in 2026. Using the mid to high teens’ pricing increase on new contracts and high single digits for renewals, I can estimate revenue from these figures. In addition, contracts do not have a termination for convenience clause, which means the organization/charity cannot cancel the contract at will or by paying a cancellation penalty. Gross retention should dramatically improve due to this clause. I estimate Blackbaud will increase revenues associated with the new pricing initiatives by 13.3% in 2024, 7.2% in 2025, and 6.4% in 2026. Customer retention and clients choosing three-year contracts over one-year options will influence the results. Clients who opt for one-year contracts will likely face pricing increases of over 20%.

Blackbaud Nonprofit Software Revenue (Management Commentary)

Expense Management

In 2022, they closed four co-location data centers and a few more in 2023. They renegotiated key vendor contracts, including Microsoft Azure and AWS, and reduced staff levels in Q1 23. Since Q3 22, headcount is down ~14%, and they plan on managing the business at the current level in the future, another margin tailwind.

As noted above, the security breach was a costly event. These costs will wind down as major lawsuits settle. These legal costs had no revenue benefit; as they fall off, margins will expand. As discussed earlier, they spent almost $50m from Q1-Q3 2023 on legal costs. Note how large this percentage is on the total G&A expense base, which totaled $154.6m through Q3. Roughly 1/3 of the expense base should come out over the next few years, which will flow directly to the bottom line!

Finally, they expect to resume stock repurchases during the fourth quarter of 2023 under the existing $500m program, which increased from $250m on January 22.

The business model is improving, revenue growth has a significant pricing tailwind behind it for the next few years, expenses are coming down, and they began repurchasing shares in Q4.

While these changes are very bullish, the company’s valuation remains on the higher end, though not by a significant amount, enough to make the risk-reward neutral. Additionally, the negative commentary surrounding the lack of technological improvements allowed competition to improve their offerings, potentially impacting retention.

Valuation

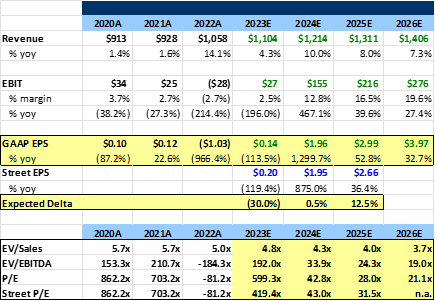

Valuation is the primary issue with the investment. Additionally, I am roughly in line with consensus estimates over the next two years, limiting the potential for positive earnings revisions. Due to the high use of stock-based compensation, I value the company on a GAAP EPS basis while factoring in the decline in legal costs mentioned above. As shown in the chart below, I estimate BLKB will generate EPS of $1.96 in 2024 vs. consensus of $1.95 and 2025 $2.99 vs. $2.66. While I am higher than the street, delays in legal costs decline, retention worse than expected, and transactional revenue coming in lower than I estimate are the key risks to my estimates.

Estimates vs Consensus and Valuation (BLKB Filings & Dominick D’Angelo Estimates)

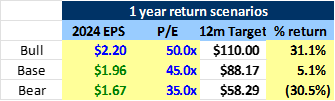

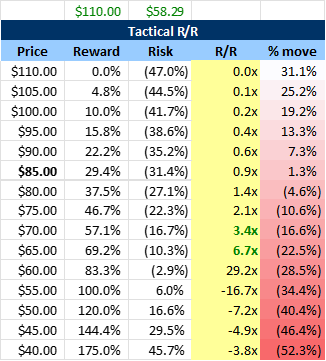

While the stock appears very expensive on a historical basis, pricing was not contributing to revenue growth; legal costs were a drag on margins, and 2022 retention was the lowest in several years. The stock is not as expensive looking forward. Trading at an estimated 28x 2025e EPS and 31x the streets. The likelihood of significant multiple expansion should the business perform better than expectations is unlikely. The return profile would be more attractive if the stock traded down to a market multiple on 2026 EPS or ~$68, last seen in November 2023. In my 1-year return scenario, shown in the table below, the risk-reward is relatively balanced with a bull case return of 31.1% and a bear case of -30.5%. The second table shows the risk-reward based on different stock prices. At $70, I estimate the stock has a 3.7x r/r, where I would begin building a position.

One-Year Return Analysis (Dominick D’Angelo estimates)

Risk/Reward at Different Price Levels (Dominick D’Angelo estimates)

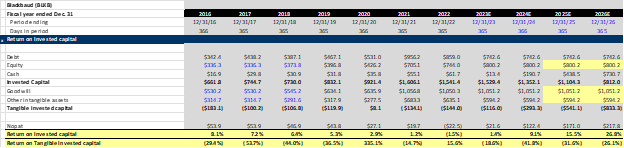

I am willing to pay an above-average price/valuation for BLKB due to the impressive ROIC. Unsurprisingly, a software business requires almost no tangible capital invested in the company. Instead, most “capex” is spent on software development costs. Over 100% of the invested capital stems from intangible assets, primarily goodwill associated with completed acquisitions. The tangible capital required is negative due to the capital-light nature of the business. With little need to reinvest earnings into the business, they can afford to use the bulk of cash flows on share repurchases, as management stated they would.

Return On Capital (BLKB Filings & Author Estimates)

Balance Sheet

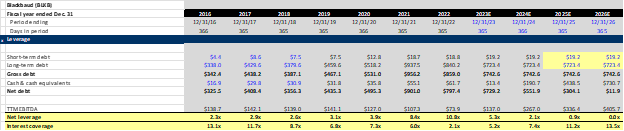

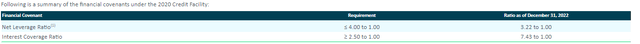

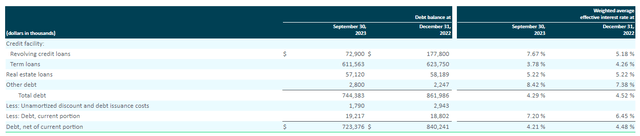

Blackbaud issued variable-rate debt to fund the EVERFI acquisition in Q4 2021, though subsequently entered into rate swaps. The average rate for the $611m term loan due in 2025 is 3.78%. The excess legal costs and subsequent drag on free cash flow have only allowed them to pay down $200m. Since the rate is so low, they’re unlikely to repay much until maturity. Management’s target leverage is 2x, which they should be at, excluding stock-based comp and legal expenses. I estimate they will end 2024 at 2x leverage on a GAAP basis. The leverage profile and cash generation will allow management to repurchase shares or make additional acquisitions. The term loan has two covenants: net leverage must be below 4x, and interest coverage must be greater than 2.5x. They comply with both, and I expect both metrics to improve moving forward due to the improving profitability trends.

BLKB Leverage Profile (BLKB Filings & Author Estimates) BLKB Term Loan Covenants (BLKB 10-K) BLKB Debt Profile (BLKB Q3 2023 10-Q)

As noted above, intangible assets comprise the bulk of BLKB’s balance sheet, with $1.05B in Goodwill and ~$600m in software content development costs. Blackbaud capitalizes on certain R&D expenses, depreciating it over three to seven years.

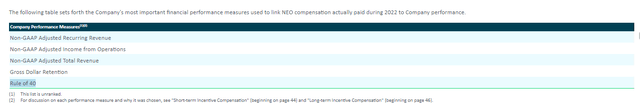

Management

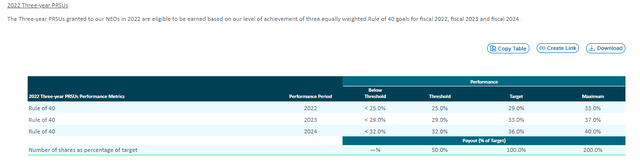

President and CEO Michael Gianoni joined in 2014. Management heavily focuses on achieving the ‘Rule of 40,’ a benchmark where the sum of Adjusted EBITDA margin and organic revenue growth exceeds 40%. During fiscal 2022, margins + revenue growth was 28.9%, a 2% increase y/y. For the year, management’s target was 29%, which resulted in a bonus payout of 99.6% of the target. During the 4th quarter 2022 call, management guided FY 2023 organic revenue + EBITDA margins to 34%; however, in Q3, organic revenue growth was 5.9%, and adj. EBITDA margin of 34.8% for a combined 40.7%, far surpassing original expectations. The company bases its management’s Performance Share Units (PSUs) on achieving the Rule of 40 for the year. With this figure’s early achievement, management stands to receive 200% of the target payout.

Rule of 40 PSU Payouts (2023 Proxy)

In addition to the Rule of 40, metrics including Non-GAAP Recurring Revenue, Non-GAAP EBIT, Non-GAAP Revenue, and Gross Dollar Retention contribute to management bonuses. While these are the primary drivers of the business, these measures all include adjustments that management can influence. Furthermore, due to the recent pricing initiatives, I suggest they include a margin performance measure, specifically Gross Margin. Higher/lower retention would directly impact this figure as well.

Management Bonus Metrics (2023 Proxy)

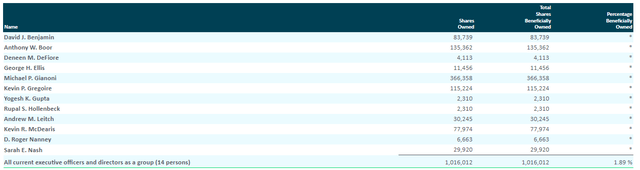

Another risk is the lack of insider ownership. As shown in the table below, management and the board own less than 2% of the outstanding shares. This lack of ownership could result in a conflict of interest with minority shareholders.

Insider Ownership (2023 Proxy)

On January 11, Kristian Talvitie was appointed to the board of directors, expanding it to nine. He served as Executive Vice President and Chief Financial Officer of PTC, Inc., a global industrial and manufacturing software company, and has experience with software as a service company.

Risks

The risks associated with the investment are as follows. 1. Blackbaud has outstanding litigation against them stemming from the cybersecurity breach. They are open to additional legal costs if additional class action lawsuits occur. The security breach could deter new customers from signing due to security/privacy concerns. 2. The substantial price increases may discourage customers from renewing contracts, opting for cheaper alternatives. This scenario is unlikely due to a few factors. The platform costs an average of $20,000, a 20% increase of $4,000. The time and effort required to transfer data is more costly than the price increase. Reinforced by my customer conversations, “Blackbaud is one of the most trusted platforms and offers the most comprehensive suite of products.” Gross retention trends will provide insight into this crucial risk. That said, the lack of product improvements (discussed above), which I expect stems from the security breach, presents the opportunity for competition to catch up. 3. Lack of management alignment with minority shareholders may deter them from acting in the shareholder’s best interest. As noted above, they received an offer for $71 early in 2023, which they declined. While this was the right decision, I believe BLKB could be an acquisition target. Once they stabilize/normalize the business, I could see private equity interested in the company. 4. Using adjusted figures in management’s compensation package is concerning. They could use additional stock-based comp as an add-back or take liberties with non-recurring expenses to meet targets and bonus payouts. 5. Given the premium price for Blackbaud services and the top-heavy nature of the nonprofit industry, the top 50 garner the most donations. Should one of the large foundations using Blackbaud shift to a different platform, it would negatively impact the company’s revenues. One last side note: I’ve reached out to Investor Relations several times over the previous three weeks and have not heard back. This is a bit odd and could be a red flag.

Summary

Blackbaud is a great business, with headwinds fading while pricing initiatives provide a tailwind to revenue growth and margin expansion. In Q4, management will present its capital allocation roadmap, likely focusing on buybacks. As legal costs wind down, margins should continue expanding, further improving the business economics. While they have several tailwinds, the valuation, management, and customer discussions keep me on the sidelines. Should the stock decline to the low $70s, I would begin building a position.

Go Forward KPIs

1. Gross retention should improve due to longer contracts. 2. Margin expands as costs decline, and the high incremental margin business benefits from higher revenue. 3. Management capital allocation priority. 4. Revenue growth – should be in the mid to high single digits over the next few years, declining thereafter as price increases decelerate to mid-single digit renewals.

Read the full article here