When we last covered, Armour Residential REIT Preferred C (NYSE:ARR.PR.C) in October 2024, I, like many other market participants, spoke confidently in knowing the near term direction of interest rates. The Federal Reserve had begun what was then anticipated to be a long series of interest rate cuts. Not only did we know that rates were declining, but we also extrapolated that the decline would soon push ARR.PR.C share prices toward par.

If time doesn’t make you wiser, it at least shows you how little you know. Not only did the Fed stop cutting rates after the December 18, 2024 meeting, Jerome Powell recently described that the framework for rate decisions was being updated and that very low rates were no longer a sure thing. 10Y Treasury yields hovered around 3.50% when the Fed started cutting rates last September. Premarket on May 22nd, following the House’s passage of a new Tax and Spending bill, 10Y Treasury yields briefly exceeded 4.65%. An honest investor should admit that predicting the direction of interest rates is not a certain proposition.

Still Trying to Outperform

About a year ago, we developed and launched a fixed-income focused strategy we have alternately called Crazy 8s or Baseline +. Basically, the bulk of returns comes from the dividend stream produced by a diversified pool of discounted preferred equities (the Baseline). Further, additional return might be realized if interest rates decline and normalized markets push the discounted share price toward par (the +). The premise was that declining interest rates would deliver outperformance. The prior paragraph acknowledged that the lower rate premise has, thus far, proven illusory, but a recent comparative examination of historic fixed-income investment performance shows that the strategy may still have merit. ARR.PR.C has the characteristics that match the strategy, so we will use it as our example today.

The Issue and the Issuer

Armour Residential REIT (ARR) is an agency mREIT with a current common stock market capitalization of approximately $1.3B. They lever that equity up approximately 8.5x to manage a carefully hedged $14.7B portfolio of U.S. Government-sponsored mortgage-backed securities.

ARR 05/16/2025

Source: ARR

That common equity and the income the portfolio generates provide a sufficient capital cushion for us to feel confident in the preferred shares as a hybrid, fixed-income investment, and we’ve been varying degrees of long ARR.PR.C for almost six years now.

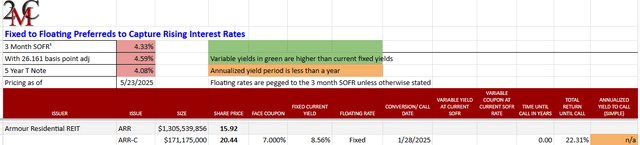

The $171MM face value of the preferred issuance is senior to the common and carries a fixed 7.0% coupon. The issue became callable after 01/28/2025, but the present interest rate environment and management’s expressed satisfaction with the preferred’s fixed coupon structure make us believe the issue won’t be called any time soon. At current market prices, new purchases capture an 8.56% yield, which is approximately 400bp above the current 10Y Treasury yield.

Source: Portfolio Income Solutions

Portfolio Income Solutions

Wrong Direction, Still a Superior Choice

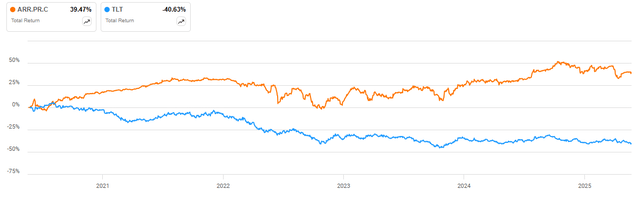

Trying to generate alpha, we routinely substitute carefully vetted preferred equities for long-term corporate or government bonds. We try to capture both a yield and pricing advantage. ARR.PR.C’s share price has fallen about $2 (~9%) since the 10/24 article, so we wanted to take some measure of how it has performed relative to the long-term, fixed-income alternatives historically.

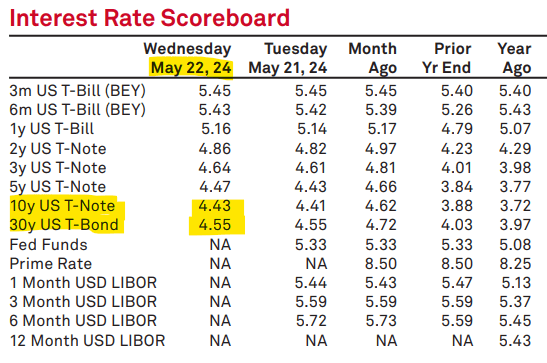

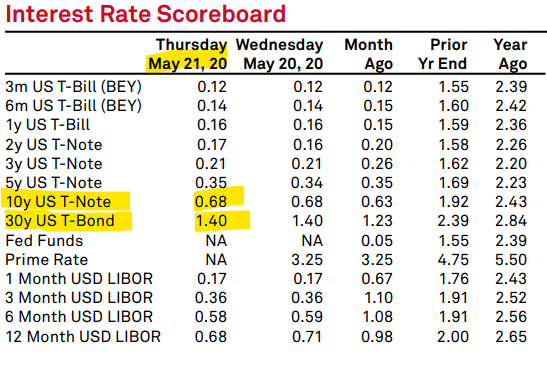

A year ago, long-term Treasuries were priced to yield about 4.5%.

S&P Global IQ

Source: S&P Global IQ

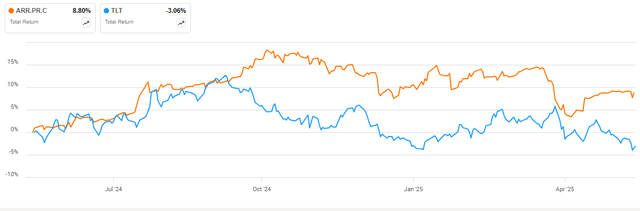

To measure returns against investment in credit-worthy alternatives, we used the iShares 20+ Year Treasury Bond ETF. Here is how they compare over the last year.

SA Charting

Source: SA Charting

The last 3 years.

SA Charting

Source: SA Charting

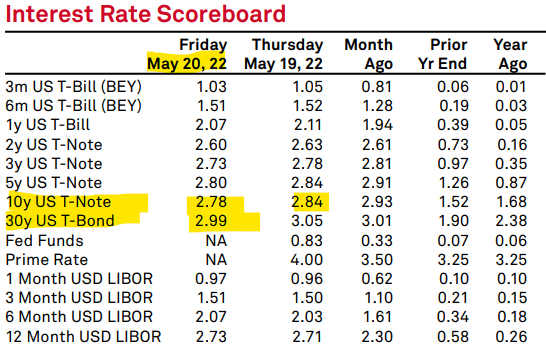

Three years ago, long-term Treasuries could be purchased for yields of ~2.9%.

S&P Global IQ

Source: S&P Global IQ

And the last 5 years.

SA Charting

Source: SA Charting

Five years ago, early in the Pandemic, long-term Treasuries were yielding only about 1%.

S&P Global IQ

Source: S&P Global IQ

We recognize that contrasting a non-rated, preferred REIT equity to long bonds, backed by the full faith and credit of the US government, is an apples to oranges comparison. The REIT credit risk is substantial and changing; the T-bond, held to maturity, is riskless.

We did, however, run the comparison over the same time frames in which each issue responded to the changing interest rate environments. Treasury pricing tracks changes in interest rates precisely and continuously. Preferred equities trade relative to rates but are substantially affected by their thin trading markets and top-end pricing is governed by their par value and call date calendars.

Through low-to-rising, low-to-falling, and medium-to-rising interest rate environments of the last five years, ARR.PR.C tended to price loosely in line with yield scarcity, but its returns were buoyed by always offering a yield coupon hundreds of basis points above Treasuries. We have seen similar results across a whole spectrum of REIT preferred equities.

What We Think We Know Now in a Time of Uncertainty

Jerome Powell does not know the near and intermediate term direction of interest rates. Nor do we.

Accepting credit risks, a significantly higher yield, purchased at discounted prices, can perform well against riskless alternatives.

Read the full article here