Turning the corner

I don’t buy many foreign stocks. The story has to be compelling to draw me in. Coupang, Inc. (NYSE:CPNG) has elements aligning that remind me of Uber’s (UBER) turn to profitability

The SoftBank (OTCPK:SFTBY) backed startup IPO’d in 2021 and has declined massively after the risk on narrative waned post-FED rate hikes. Dubbed “The Amazon of South Korea” run by Harvard dropout CEO Bom Kim, is dominant in their own backyard and has now risen to become the #2 employer in the country. The question is, can they branch out and increase their TAM? We’ll explore, but they may not need to for quite some time. The e-commerce company is scaling warehouse automation at breakneck speed. Serving their own strapped for time consumer more and more efficiently is goal number 1, and they are executing.

Thesis

ir.aboutcoupang.com

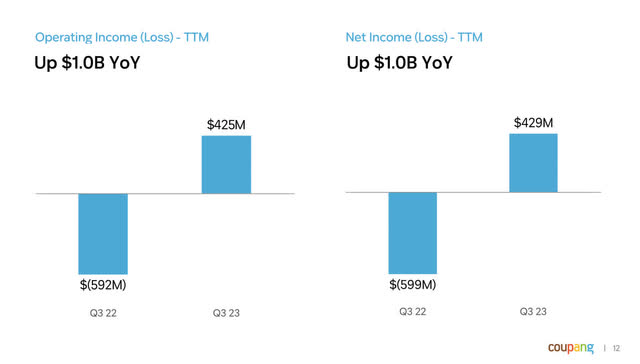

The thesis in this one is quite simple, it is lining up in a similar fashion to the turn in Uber, of the elements present, we find the following:

- Gross margins improving as revenue continues to grow

- Price to sales, trading at less than 1.5x P/S ratio

- Turning GAAP profitable after years of negative returns

While a low price to sales is less impressive in a commerce business than it is in a software business like Uber, it is a marker of value. Additionally, Coupang has turned GAAP profitable, while the pinpoint I put on Uber was a tad early at an adjusted EBITDA positive marker.

The stock is a buy based on these value elements aligning for the first time.

What they do and the company story

From the company 10-K:

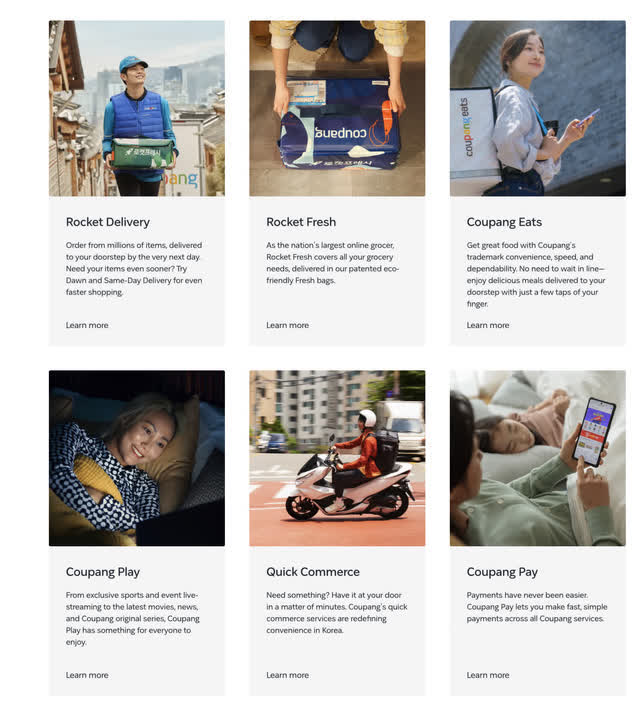

The company operates in the following segments:

Product Commerce, which primarily includes our core retail (owned inventory) and marketplace offerings (third-party merchants) and Rocket Fresh, our fresh grocery offering, as well as advertising products associated with these offerings

Developing Offerings, which primarily includes our more nascent offerings and services, including Coupang Eats, our restaurant ordering and delivery service, Coupang Play, our online content streaming service, fintech, certain international initiatives, as well as advertising products associated with these offerings.”

aboutcoupang.com

Revenue segments

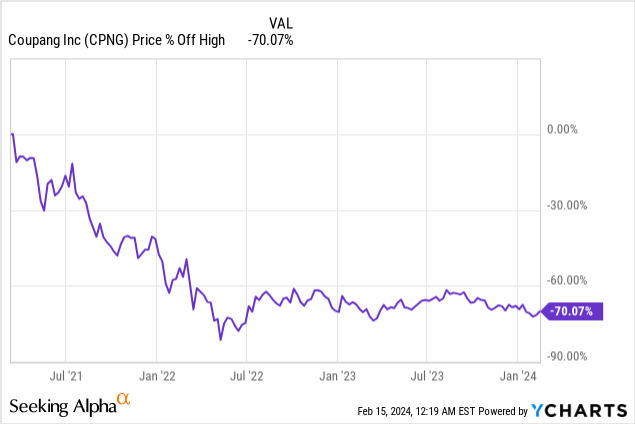

Coupang 10Q

Retail sales make up 87.8% of revenue sources, with 12.2% coming from the other offerings the company has. The company states on its website that they are working with teams in Seattle, Mountain View, Shanghai, Beijing, Singapore, and Seoul in tech development. Eventually, this company looks destined to operate worldwide.

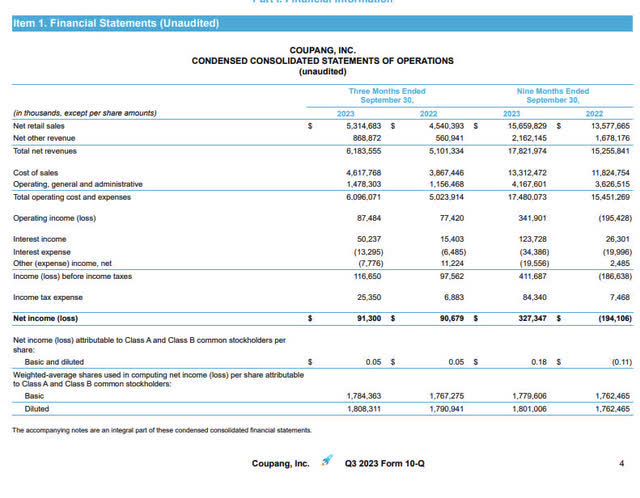

Percent off high

YCharts

This is my favorite type of bed to lie on. Head on the left, propped up with my feet on the ground. Much better than doing a headstand on a parabola from a risk perspective. Anything off this much from the all-time highs deserves a closer look, especially when revenue and earnings metrics are growing while the price is on the downtrend.

Price vs. revenue trends

YCharts

Here we can see YCharts tracking revenue before the company IPO, with revenue now skyrocketing to a new record $20+ billion USD in annual sales. The price, on the other hand, has dropped from nearly $50 a share down to a near-record low of $15/share. Again, elements I look for where price action is non-reactive to growth.

Price to sales ratio and more

YCharts

Price to sales

Here is a visualization of the buy thesis in a nutshell, when a company sells at a price-to-sales ratio below 1.5 X and finally turns the corner to positive adjusted EBITDA or non-GAAP positive earnings plus a great balance sheet, I’m in. This was the same thesis I used in my article on Block Inc. (SQ) and Uber.

This is also what I noted in both articles regarding James O’Shaughnessy and the price-to-sales ratio.

James O’Shaughnessy wrote a popular book on stock evaluation called ‘What works on Wall Street’. In it, he found the following:

“In the original edition of ‘What works on Wall Street’, O’Shaughnessy wrote that the single-best value factor was a company’s price-to-sales ratio (P/S).

O’Shaughnessy used to run O’Shaughnessy Asset Management, LLC, an asset management firm that Franklin Templeton later acquired. Through his writing and research, he reviewed which fundamental premise was most indicative of value and support levels for a stock. He found that price-to-sales was even more effective in predicting value than price-to-earnings or other ratios.”

Margin trends

ir.aboutcoupang.com Seeking Alpha

Gross margin trends look great for Coupang. From only 5% pre-IPO to 25% at current, the company is becoming ever more profitable with ever-increasing automation.

How did they get here?

Seeking Alpha

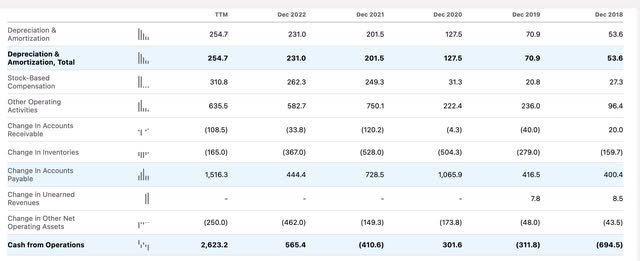

The company is now slightly GAAP profitable but also has a healthy free cash flow yield.

The largest item that stands out on the cash flow statement is the larger than normal increase in accounts payable and a positive starting net income of $429 million. So the increase in accounts payable, a proxy for short-term borrowing to increase inventory, could be viewed as a positive or negative. It increases the cash flow, which could be a phantom trickle down in the interim to free cash flow, or it could represent a large expected increase in demand that will continue to reflect in revenue growth. Either way, positive GAAP net income is a big turning point for the company.

Taking the free cash flow at face value looks great, but it will remain to be seen if this can be a consistent trend and grow from here.

Valuation

The company has grown revenue from 2019 until current at a nearly 30% compound annual growth rate. Even assuming we cut that growth rate in half as it pertains to free cash flow, down to a 15% assumption of growth, would get us to $2.09 per share 5 years from now with the current free cash flow per share starting at $1.04/share currently.

Using even a 6% discount rate, which seems will be quite a bit higher than the risk-free rate 5 years from now, would give us a future value of $34 a share.

For now, on the safer side, referring back to O’Shaughnessy, a company that is consistently growing revenue year over year would be a good value at 1.5 X sales.

With the company generating an expected $24.42 Billion to finish out the 2023 fiscal year, 1.5 X would be a $36.63 Billion market cap. 2024 full-year revenue is estimated at $27.23 Billion, which would be a $40.85 Billion market cap based on forward numbers. With 1.787 Billion shares outstanding, that would give us a fair price range of $20.5-$22.85 a share.

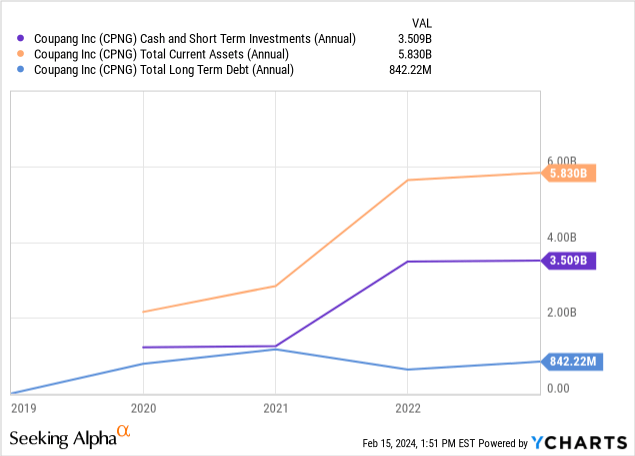

Balance sheet

YCharts

Another great-looking balance sheet that is relatively light on debt. The company has both current assets, cash and short-term equivalents well ahead of long-term debt.

Seeking Alpha

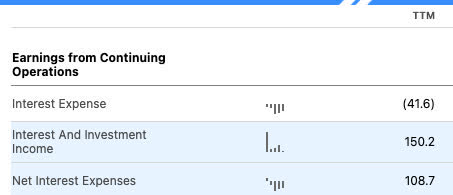

The company is generating $150 million in interest and investment income rather than having to worry about interest payments.

The levered free cash flow TTM of $1.487 Billion plus the $41.6 million of interest expense gets us to $1.528 Billion of total cash generation should the business be owned free and clear. Looking at the enterprise cash yield using free cash flow + interest expense / EV = $1,528/$24,890 million = 6.1% enterprise cash yield.

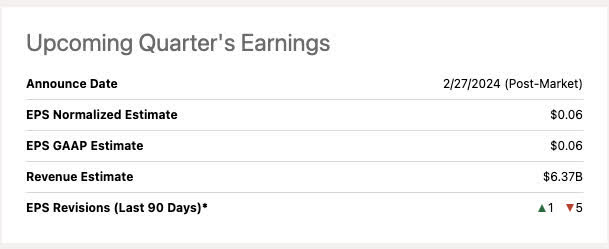

Upcoming earnings

Seeking Alpha

As a long-term “buy and hold” investor, I am less prone to the whims of earnings reports on a quarter-to-quarter basis. Nonetheless, we have 5 downward revisions and only one upward by analysts rolling into this report. Let’s also keep in mind that this quarter will encompass Christmas, and South Korea, being a largely Christian country, does celebrate the holiday with a day off and extra gift buying. The company missed slightly on the last report, but with the Christmas holiday at hand, this could be a beat quarter.

In the days ahead, monitoring the region’s GDP expectations would be a good angle. With Japan recently slipping into a recession and the South Korean government keeping central bank interest rates at a 3.5% level to fight inflation, consumers may not be in the best position to continue discretionary spending. As Coupang sells both discretionary and non-discretionary items, inflation may actually assist revenue growth in their consumer staples sales.

Growth prospects

ir.aboutcoupang.com

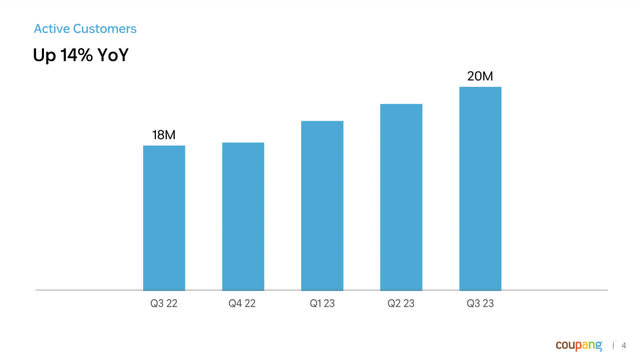

The customer base keeps increasing. Many people believe that South Korea is a soon-to-be over-saturated market, with a population of only 51 million citizens. CEO Bom Kim still maintains the company is laser-focused on their own domestic market, which he believes has a TAM of over $500 Billion itself.

The recent enhancement of the business with the acquisition of Farfetch will continue to grow its share of the upscale luxury consumer market, for which South Korea has one of the healthiest consumer discretionary consumer bases.

The company wants to sell everything from the ground up in South Korea and have it delivered in less than 24 hours. If they can continue to deliver on this proposition where South Korea is considered the world’s most overworked at 69 hours per week, then the consumer may be more willing to give up an in-person shopping experience than anywhere else in the world. Time is precious, and a commute to the store in heavy traffic can wipe out hours of an individual’s day.

Risks

I don’t live in South Korea and have no experience with their services. This is the only thing holding me back from a strong buy recommendation. One of the questions I ask myself when buying a stock is, how often do I interact with this product? In this case, zero. Every assumption is based on numbers, statistics, and my knowledge about Asia.

Furthermore, the company faces domestic pressures from AliExpress and Temu, who have both now established themselves in South Korea.

Summary

This is a new buy for me. The company seems to be mimicking all the positive portions of industry leaders in e-commerce, including food delivery services and streaming. The company has quickly become one of the largest employers in South Korea, a country with a few well-established behemoths. This is also a founder-run company by a Billionaire, for which studies would tell you that this is a positive omen. Buy.

Read the full article here