Will GE stock keep rising after Q4 report?

General Electric (NYSE:GE) just released its Q4 and 2023 full-year earnings report (“ER”) last week. Overall, GE’s Q4 2023 earnings report read quite positively to me, showing strong revenue and order growth, improving profitability, and progress on its deleveraging goals. All business segments, including Aerospace, Power, Renewable Energy, and Healthcare, saw healthy organic revenue growth. The company’s outlook for 2024 also is positive, suggesting continued momentum in its turnaround efforts.

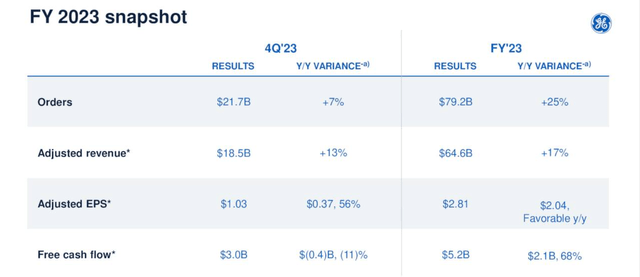

As you can see from the chart below, the company reported strong growth in both top and bottom lines. Total revenue reached $18.5 billion on an adjusted basis in Q4, up 13% year-over-year. For FY 2023, total revenue grew 17%. In terms of free cash flow, the growth is even more impressive. For FY 2023, GE generated a total of $5.2 billion, translating into a YoY growth of 68%.

Source: GE

Diving in a bit further, a few highlights are especially worth mentioning from the ER. First, its total orders for Q4 dialed in at $21.7 billion, up 7% year-over-year. On a full-year basis, its total order stands at $79.2B, representing a 25% YoY growth. Second, I’m especially impressed with its services growth. Services grew 24% organically year-over-year. A combination of health orders and service growth provides two key advantages in my mind. First, Services provide a more predictable and recurring revenue stream compared to product sales, which can be volatile and dependent on economic cycles. This stable income stream helps GE improve its financial predictability and facilitates long-term investment in research and development. Second, service revenue typically offers higher profit margins compared to product sales thanks to the recurring nature from maintenance, repairs, and upgrades.

Despite the above strong positives, my rating for the stock is a Hold. With GE’s stock prices hovering around a six-year high, I see limited upside potential. And in the remainder of this article, I will detail two key reservations I have on the stock. First, I will discuss the valuation risks. Second, I will discuss the uneven performance among its segments and the uncertainties of its ongoing breakup.

Valuation Risks

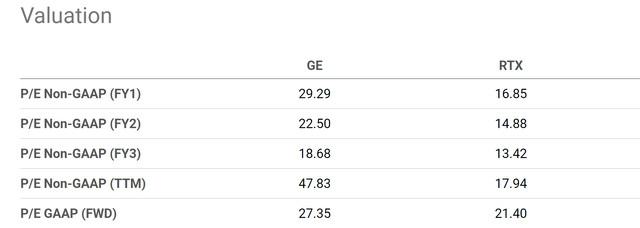

At a share price of ~$134.5 as of this writing, GE stock is trading near a six-year high (see the next chart below). If you recall from the earlier chart above, GE’s 2023 FY EPS was $2.81 per share on GAAP basis. Thus, the stock is trading at a TTM GAAP P/E ratio of ~47.8x, a very expensive multiple on both absolute and relative terms.

Seeking Alpha

On a non-GAAP basis, the stock is trading at 29x P/E on an FWD basis (see the next chart below). Such a multiple is also expensive when compared to either the overall market or its close peers. As an example, RTX is now trading at a P/E of only 16.8x (again, on an FWD basis). As such, I see considerable valuation risks baked in under current conditions.

Seeking Alpha

Uneven performances and breakup plan

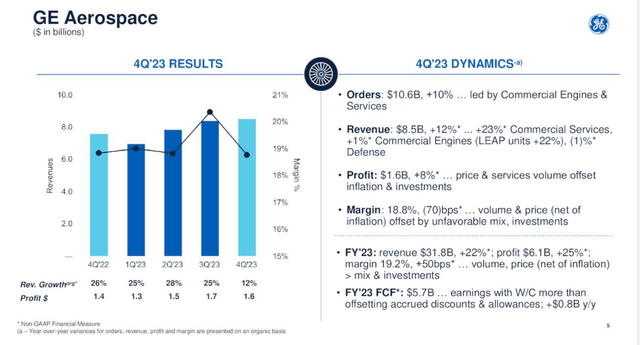

GE Aerospace and GE Vernova are currently in the pre-spin-off phase, with the official launch expected in early April 2024. Among these two main segments, I personally like the Aerospace segment better due to the technological superiority of GE’s jet engines. While both segments reported their individual results within GE’s Q4 2023 earnings, their financial statements and operations are still intertwined to some extent. However, based on the available information, here’s are my key thoughts on their performances.

If you recall from the first chart, overall, GE generated a total of $5.2 billion of free cash flow, up 68% YOY. However, the growth is very unevenly distributed among its main segments. As seen in the next chart below, GE Aerospace generated a total of $5.7 billion of free cash flow and GE Vernova reported a negative free cash flow. I think the potential factors contributing to their differing free cash flow performance are two-fold. First, I see a wider moat for GE Aerospace compared to Vernova. Especially with the recovery of commercial engines, I expect its LEAP engines to continue being a major revenue driver for GE Aerospace and drive robust growth in both sales and cash inflows. Second, I also see GE aerospace better positioned for services revenue growth. As mentioned earlier, service contracts typically have higher profit margins and generate recurring revenue. Based on the information provided in the ER, my assessment is that GE Aerospace is much better positioned on this front due to its leading engines, large installation base, and strong customer relationship. In the earnings call, CEO Larry Culp called GE Aerospace an “exceptional franchise” (see full quote below) and I totally agree.

GE Aerospace is an exceptional franchise, with our fleet of 44,000 commercial engines and 26,000 rotorcraft and combat engines plus extensive aftermarket services representing 70% of revenue.

As aforementioned, my first reservation is the high valuation risk baked into the stock under current conditions. Combined with the uneven performances discussed above, my judgement is that the valuation risks are even higher for the Vernova segment. As such, potential investors could wait till the spinoff is completed to only buy the segment they want.

Source: GE

Summary and Final Thoughts

To recap, I read GE’s Q4 and full year 2023 ER very positively. The company reported strong growth in all segments and I am especially impressed with the growth in its orders and service revenues. However, I have two key concerns and rate the stock as a Hold under current conditions. My concerns involve the valuation risks and the uneven performance across its main segments.

All told, I see limited upside potential under current price levels. My judgment is that the valuation risks are higher for the Vernova segment compared to the Aerospace segment due to the differences in the business fundamentals. As mentioned, I personally like the Aerospace segment better and would prefer to wait till the spinoff is completed so I can evaluate and invest in these segments independently.

Read the full article here