As Ring Energy (NYSE:REI) management notes in the current presentation, the value strategy has little to no importance in the calculations of Mr. Market. However, management is working to get the debt ratio to acceptable levels. The acquisitions are lowering the debt ratio and commodity prices are staying (so far) in a reasonably helpful range. As I noted before, management may need to pick up the acquisition pace. But a continuation of the current strategy of opportunistic acquisitions and repaying debt should allow the stock price to recover in the future.

Mr. Market wants to see free cash flow at a certain level using much more conservative prices than is the case right now. Mr. Market also wants to see a debt ratio of 1.0 with sufficient free cash flow. Ring Energy has made some acquisitions and is busy digesting those acquisitions. More free cash flow can come from a greater oil percentage of production which may result in a minimal amount of production growth. That cash flow could also come from the reworks because they appear to have promising initial results as well. This company does not appear to be solely dependent upon more acquisitions to improve the balance sheet.

The other thing in the company’s favor is that the market really does not approve of growth (with few notable exceptions). Therefore, industry production is unlikely to grow as fast as it did prior to 2015. As long as the market attitude is hostile to growth, the commodity prices will likely remain volatile in a comfortable range.

There may be a recession in the future (or not). But a recession has nothing close to the business disruption of a pandemic (and we have recovered from that pretty well) or a depression that could last for years. Therefore, companies like this one are likely to be given the time to continue to repair their balance sheets. However, the stock price itself may well remain in a holding pattern until that “magic” debt ratio of 1.0 is reached. The timing of that is uncertain.

As Vital Energy (VTLE) just demonstrated, the recent group of acquisitions resulted in new guidance of a debt ratio of 1.0 with more debt repayments to come. It really depends upon commodity prices in the future and what is available for an acquisition (under what deal conditions too). Even another quarter like the second quarter of fiscal year 2022 allows for material progress. So, timing is uncertain which does raise the risk somewhat of an industry downturn. But the overall progress to better times for the stock appears to be in place.

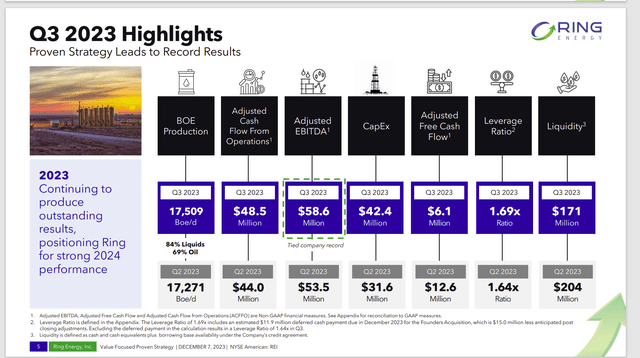

Third Quarter Improvement

As a result of the acquisitions made, the third quarter did show improvement in the form of a maintained debt ratio despite declining commodity prices that were materially weaker than in 2022.

Ring Energy Key Operating And Financial Results Compared To Second Quarter 2023 (Ring Energy Corporate Presentation December 2023)

This is yet another company where the debt ratio has improved. But the market wants a better debt ratio. The market also does not like when the free cash flow declines for a quarter no matter the reason. Hence, management needs a clearly communicated and delineated strategy to improve the situation going forward.

The issue with the market right now appears to be the focus solely on free cash flow and debt ratios. If either of those two does not meet current market requirements, then the stock goes nowhere fast.

Latest Acquisition

The Founders acquisition may be just the ticket and could provide a road map for further future improvements.

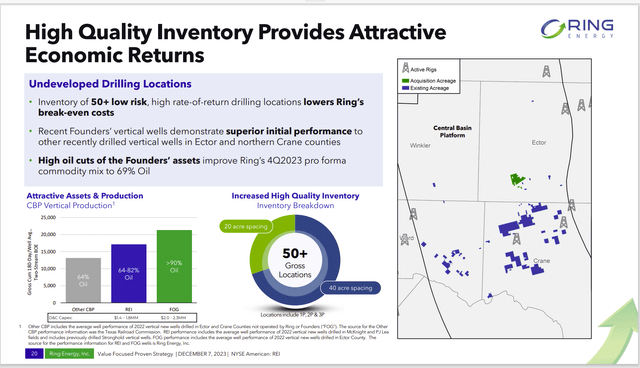

Ring Energy Comparison Of Oil Production Among Various Holdings And Industry Average (Ring Energy Corporate Presentation December 2023)

The Founders’ acreage has a superior percentage of oil production that results in greater profitability. Drilling on this acreage to replace declining production elsewhere could result in some free cash flow progress without additional acquisitions that should prove to be material. This is actually the same strategy that Vital Energy pursued although Vital Energy continued to make acquisitions as well to speed up the process.

A side benefit of the acquisitions could be that major selling shareholders of these private companies may accept stock and then make management aware of more accretive deals that could aid this process.

Advantages

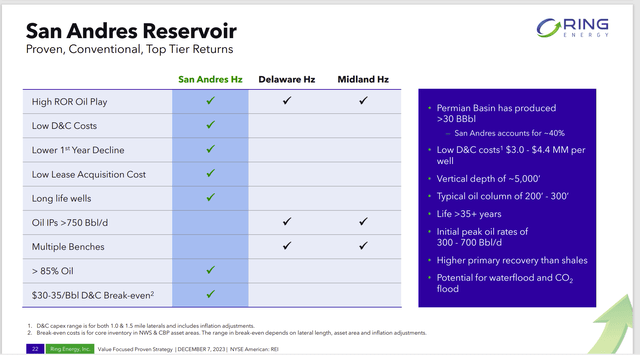

Ring Energy is a conventional operator. As such it faces less competition for acreage that has the interval it develops. Therefore, the acreage prices are low, and potentially the company’s profitability will be higher. The decline rates are likewise different than is the case with unconventional operators. That means more cash flow upfront because the initial decline is not as steep.

Ring Energy Comparison Of San Andreas To Other Unconventional Intervals (Ring Energy Corporate Presentation December 2023)

The biggest challenge remains that the company never quite became an operating company before the coronavirus challenges hit. When the oil price recovery began, the market gave no credit to the hedging that allowed this company to easily survive the oil price downturn in fiscal year 2020 while demanding a big change in lending practices.

Before fiscal year 2020, companies could lend money based on the value of the assets. Therefore, the first acquisition of the Northwest leases was considered a conservative deal at the time. That was no longer the case after fiscal year 2020 when the debt market demanded cash flow and sufficient production no matter what the case was before then.

That meant that a company like this has had to scramble to meet new conditions that management had no idea would even be on the horizon. The result has been some drilling and some acquisitions to improve cash flow while heading towards what would have been a “slam dunk” strategy to an ideal production level.

That has left the stock price waiting for the results rather than a recovery that would have normally been anticipated.

Conclusion

The wells drilled have some of the lowest breakeven points in the industry. Mr. Market does not care and the debt market is only a little more supportive. There is a “one size fits all” attitude towards companies like this.

That means management has to get to ideal production levels and cash flow levels through a combination of acquisitions and high-graded drilling prospects. So far, that strategy has yielded results. But the market appears to be waiting for minimum satisfactory levels of the debt ratio and cash flow.

I had often thought that things would return to a far more normal level. To a certain extent, things have loosened up. But even a company like HighPeak Energy (HPK) got caught up in this (though at much higher production levels) to the point where it now has its lending outside the usual banking lines. It has to work its way back into bank lending requirements.

Therefore, management needs to keep shopping for appropriate acquisitions while improving operations. The improving operations are showing a relative reduction in the capital budget as more high-quality acreage is acquired. In the past, the low well breakeven point would have been enough for the lending market. Now, the lending market only wants to know about acquisitions that improve cash flow.

At least there is still a pathway back to market acceptance. But it is frustrating how the lending market and the stock market adopted a “one size fits all” strategy.

As long as management continues to execute the strategy to meet market requirements, this stock has a lot of upside potential as a strong buy. It is far undervalued compared to its past and industry history. But patience is required for what has become a speculative situation when it began as a “slam dunk”. Therefore, only those with patience and those able to handle the risk should look at this issue. Dividends are not on the agenda for the foreseeable future.

Read the full article here