Investment thesis

Our current investment thesis is:

- Kyndryl is experiencing a sustained decline in revenue, while having terrible margins and negative FCF. The company has various issues, with Management currently focused on optimization.

- Financial improvement is being delivered every quarter, but we are unconvinced about the end result. Upselling customers and cutting costs will only deliver margin improvement, it does not fix the inherent competitive weakness. Further, the company is burning cash to such a degree that attractive FCFs are very unlikely.

- Despite the various challenges and unclear future, Kyndryl is trading at a similar valuation to its peers, who are much more profitable and growing. We see no reason to suggest Kyndryl is close to being attractively priced.

Company description

Kyndryl Holdings, Inc. (NYSE:KD) is a global technology services company that specializes in providing infrastructure services, cloud management, and technology consulting. As a spin-off from IBM in 2021, Kyndryl is headquartered in New York and operates worldwide. The company serves a diverse clientele, ranging from enterprises to government organizations.

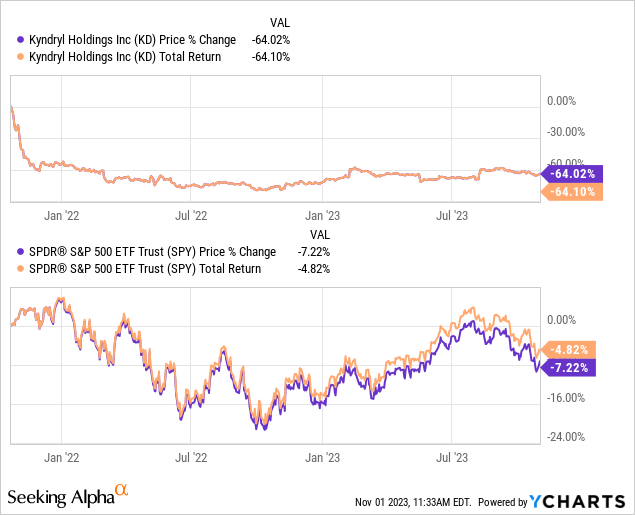

Share price

Following the spin-off from IBM, Kyndryl has experienced a monumental share price decline, losing over 60% of its value. This is driven by a change in investor sentiment following a deterioration in the company’s financial performance.

Financial analysis

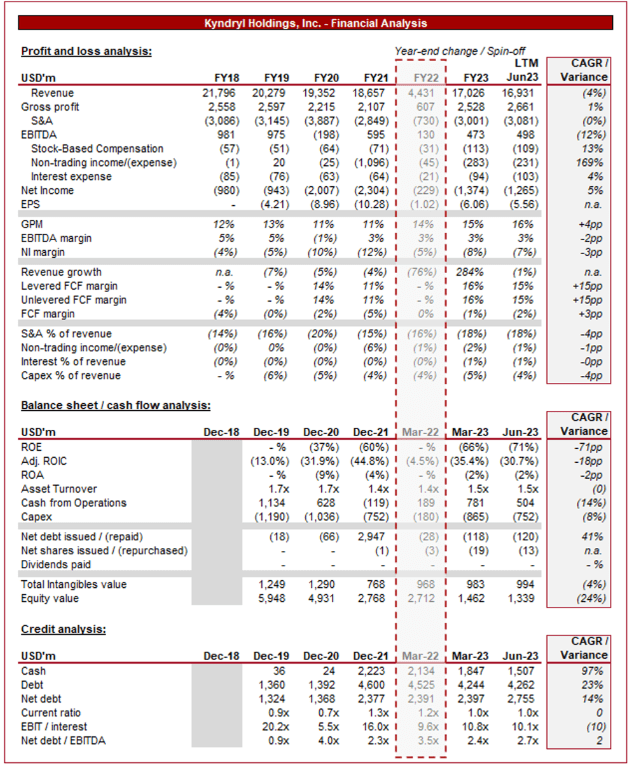

Kyndryl financials (Capital IQ)

Presented above are Kyndryl’s financial results.

Revenue & Commercial Factors

Kyndryl’s revenue has declined at a CAGR of (4)% during the short period under consideration, with a consistent downward trajectory since FY17.

Business Model

Kyndryl provides comprehensive managed infrastructure services, including data center management, cloud migration, and IT support. This allows businesses to focus on their core operations while Kyndryl manages their IT infrastructure. Kyndryl is the world’s largest IT infrastructure business, with a significant number of blue-chip companies as clients.

Recognizing the importance of hybrid cloud environments, Kyndryl has developed expertise in hybrid cloud architecture and management. This includes helping clients integrate on-premises infrastructure with cloud services seamlessly, enhancing (and protecting) its long-term relationships and business model.

Kyndryl places a strong emphasis on cybersecurity and compliance. It offers services to protect clients’ data and infrastructure from evolving cyber threats while ensuring adherence to industry-specific regulations. The value and frequency of data breaches are consistently increasing, supporting a strong growth trajectory for this segment.

Kyndryl provides consulting and advisory services to help clients strategize their IT infrastructure and digital transformation initiatives, fostering a “partnership” style relationship with its clients that develops as they grow. This includes identifying opportunities for automation, scalability, and cost reduction.

Finally, Kyndryl collaborates with leading technology providers, including IBM (IBM) and Microsoft (MSFT), to leverage cutting-edge technologies and offer clients innovative solutions. From Kyndryl’s position, this keeps the company’s services competitive, while it can attract these leading tech businesses with its access-to-market (given its substantial clientele list).

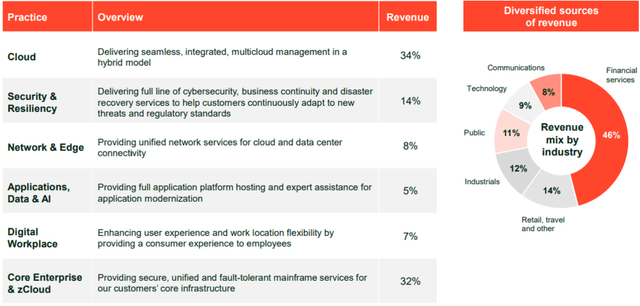

These services contribute the following to revenue, with a broadly diversified profile. This said, the company is clearly reliant on Core Enterprise and the related Cloud model. The source of Kyndryl’s revenue reiterates the global and universal application of its services.

Revenue profile (Kyndryl)

Despite the solid business model, Kyndryl has materially struggled with maintaining a consistent growth trajectory, reflecting a decline in competitive positioning, particularly due to pressures from other cloud services.

Beyond this, however, the company has operational issues. Declining revenue is one thing but there is no reason why it should be loss-making at a time when it is the leading player in its market.

Management has created a valuation creation plan, seeking to combine operational improvements with commercial development, leading to consistent growth and margin appreciation. This sounds great but the road ahead is difficult.

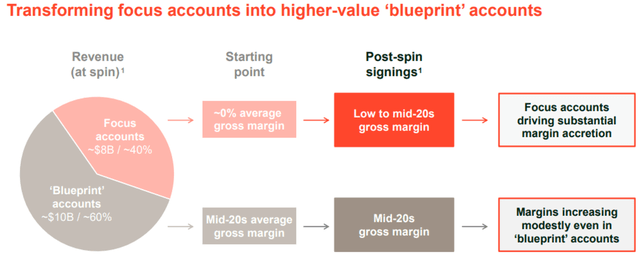

From a commercial perspective, the company is seeking to transition ~40% of its accounts to what it refers to as “Blueprint” clients, contributing to a c.20% uplift in GPM%. This is targeted at renewal and mid-contract, where possible. This sounds fantastic but we must ask ourselves if a client would be willing to do this, or if this encourages churn. Revenue growth from FY21 to LTM Jun-23 was (9.3)% while GPM% increased 5ppts, implying a net growth of +26% in Gross Profit ($). The strategy is working but not rapidly.

Accounts (Kyndryl)

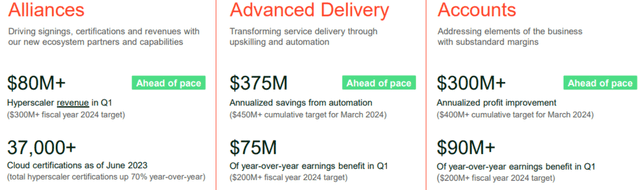

Next comes operational improvement, as despite the 26% GP growth, EBITDA has declined (16)% since FY21, unwinding all commercial gains. Management is estimating automation and upskilling can contribute to annualized savings of $375m, with the company ahead of schedule on delivering this. The entire EBITDA during the LTM is $498m, representing the significance of this improvement.

Kyndryl

Our concern with operational and GPM improvement is that although it will boost EBITDA, FCF still needs substantially more to reach an attractive level. Beyond this, the company will then need to reignite growth, in what is an incredibly competitive industry.

Realistically, the business needs a fundamental shift in its business model in our view, as declining revenues while upselling and operational improvements can only take the business so far.

Technology Infrastructure Industry

We consider the following as growth drivers going forward:

- Cloud Adoption – The ongoing shift to cloud computing for scalability, flexibility, and digital transformation is expected to continue globally purely from adoption, with growth in usage also expected.

- AI and Automation – Companies will be seeking ways to incorporate AI and automation into their operations to enhance business processes.

- Hybrid Cloud Adoption – The adoption of hybrid cloud models has become a prevailing trend, with interest in this service aligning with the broad cloud adoption wave.

- Cybersecurity Concerns – With the surge in cyber threats, cybersecurity has become a top priority for organizations. We expect continued growth from this segment, particularly, with integration into current infrastructure.

Q1

The key takeaways from the company’s Q1 results are:

- Revenue decline of (2)%. This is reasonably good, given the performance thus far, suggesting a gradual movement towards equilibrium.

- Adjusted EBITDA growth of +25%. This is a reflection of the company’s continued transformational improvement, with offsetting FX and Software cost increases. This is a good performance in our view and an illustration of progress.

- Adjusted FCF of $(106)m. This shows the concerns we have about Kyndryl’s fundamentals. Even with improvement, the company is positioned to continue to burn cash, a significant concern.

Balance sheet & Cash Flows

Kyndryl’s debt balance is sufficiently manageable, although the business has little scope for further raises. Cash flow generation has been negative as discussed previously, with no clear scope for immediate improvement. The company has sufficient cash to ensure there is not an immediate need for debt or equity raising.

For this reason, we believe it is extremely unlikely we will see any material distributions in the coming 3-5 years.

Outlook

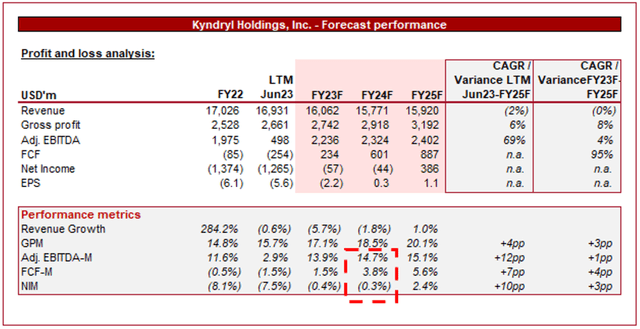

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a stagnation in the company’s revenue, with no growth from the lower FY23F results expected. This said, analysts do believe margins will bounce back, with incremental improvements (although small).

This is a disappointing indictment of the company, reflecting what is an incredibly competitive industry that Kyndryl is not positioned well to grow within. We consider both forecasts to be reasonable.

Industry analysis

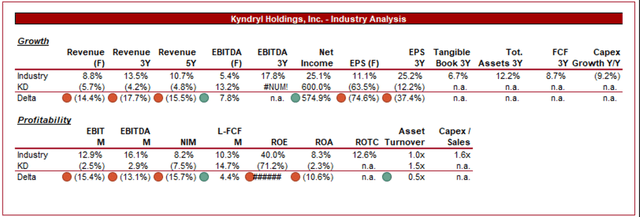

IT Consulting and Other Services Stocks (Seeking Alpha)

Presented above is a comparison of Kyndryl’s growth and profitability to the average of its industry, as defined by Seeking Alpha (19 companies).

Kyndryl is a clear underperformer within its industry. The company’s growth has been poor in recent years, suggesting the company has consistently lost market share, with forecasts suggesting this will continue. We struggle to see where future growth will come from, as the business sees its competitive position consistently deteriorate.

Further, Kyndryl’s margins are equally disappointing, with a significant delta to the industry average. Even if improvements are realized, we struggle to see the company reach the average or exceed it. This is an illustration of Kyndryl’s weak business model and relative uncompetitiveness.

Valuation

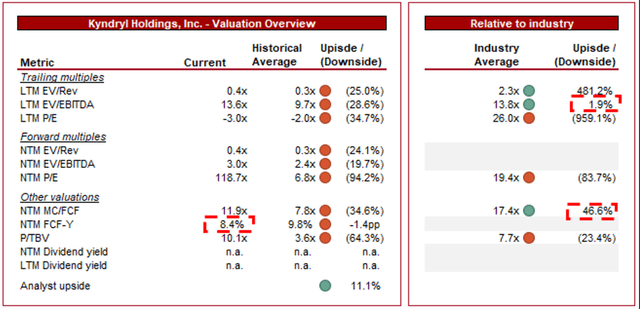

Valuation (Capital IQ)

Kyndryl is currently trading at 14x LTM EBITDA. This is in line with its peer group on an LTM EBITDA basis, although is a discount on a NTM FCF basis but a premium on a NTM P/E basis. This unclear directional valuation is a reflection of the company’s messy financial performance.

Broadly, we believe a deep discount is required, reflecting its poor financial performance, lack of visible upside potential, and importantly, its commercial unattractiveness. Our preferred metric is EBITDA, as this is the most stable metric in recent years. Based on this, the company is only at a discount of 1.9%, far too high in our view.

The downside risk is somewhat limited by the potential of a takeover, although we struggle to see what price this would be at. An acquirer is not interested in the “business” itself, its profitability is far too unattractive. This said, its infrastructure and clientele are highly attractive and monetizable, potentially by transitioning them to the acquirer’s services.

Final thoughts

Kyndryl is not a great business currently. It is struggling with growth, has poor profitability, is uncompetitive, and is burning cash. We do believe Management is taking the correct steps to improve the business but all efforts are inherently optimization-related. Once this occurs, we will have a business that is slightly more profitable but still has a poor revenue trajectory and is likely barely making cash.

The company needs a transformation exercise, be it an acquisition, merger, or new service line. We do not believe anyone should own this company otherwise, even with improvements ahead.

Read the full article here