This stock brought value to its shareholders increasing its market capitalization, and the strong revenue momentum continued this year. Today I would like to analyze APi Group (NYSE:APG). While both Quant Rating and Analysts are “screaming” to “Buy”, I doubt those perspectives and prefer to “Hold’. As the company`s returns are still lower than required, it makes it challenging to value it. I will go through the peer analysis and the recent company results together with industry perspectives to end up using an alternative valuation and target price.

Company overview

APi Group is a global company that operates in 2 segments: safety services and specialty services. Safety services design, install, inspect, and service integrated occupancy systems, such as fire protection, HVAC, and entry systems. The second segment is based on the maintenance and repair of critical infrastructure. The company has multiple customers and sources of revenue, making it less dependent on a single customer. Most of the revenues come from the safety services.

APi Group entered the organized market via SPAC acquisition and started trading in 2020 on the NYSE. There was a price drop after the approval of the acquisition (which is statistically frequent) but soon the company proved its value, continuing to gain momentum. 1-Year Total return was an astonishing 57.85%, leaving it among the best in its sector.

APG 1-Year Total Return (SeekingAlpha)

In January 2022 the company completed the purchase of the Chubb fire and security business, affecting the last year`s profitability and increasing the company`s debt. The result of the synergy must be closely monitored.

Peer analysis and sector performance

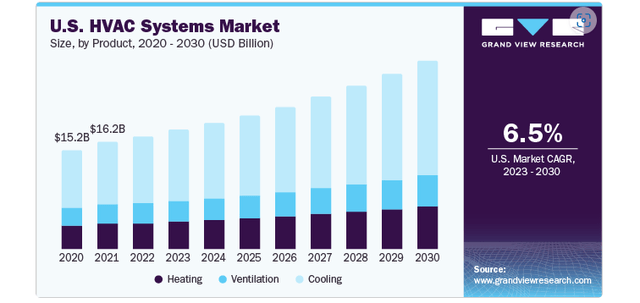

According to Grand View Research, only the US HVAC systems market will grow by 6.5% CAGR from 2023 to 2030. The growing real estate market together with global warming and demand for more energy-efficient equipment will be the main drivers of the segment. Stricter safety requirements will drive fire protection systems.

US HVAC Systems Market (Grand View Research)

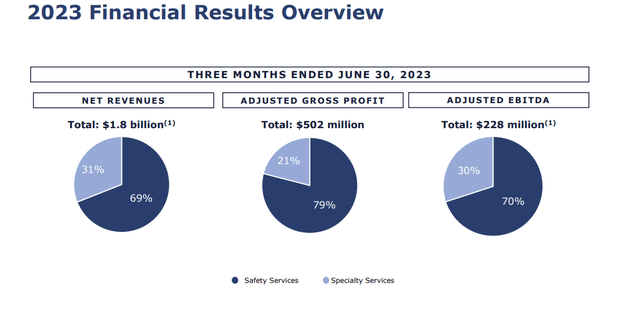

The vast majority of the company`s revenue comes from safety services and allows further expansion.

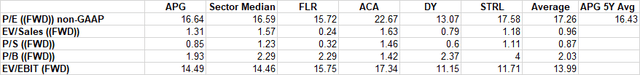

2023 Financial Results Overview (the company`s presentation) Multiple analysis (Author, with data from Seeking Alpha)

As can be seen, the APG multiples are very close to the sector`s median and average numbers. Forward P/E is even higher than the median and 5Y average of the company, all indicating that APG is reasonably priced, compared to competitors and its average. The company has a Current ratio of 1.53 and a Quick Ratio of 1.02. This suggests that while the long-term debt is well covered, short-term liquidity is adequate but raises some concerns.

Latest quarterly results

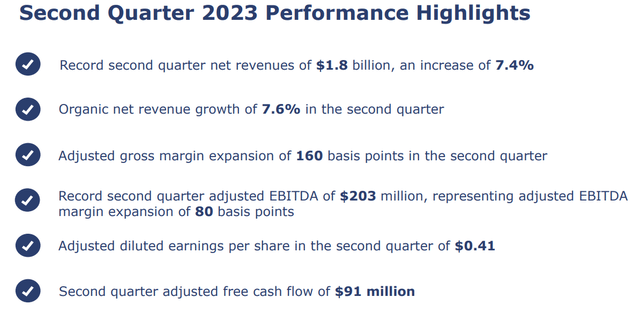

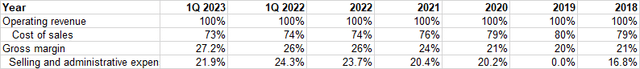

Second Quarter 2023 Performance Highlights (the company`s presentation) Cost of sales, Gross margin and Operating expenses composition (Author, with data from the company’s statements)

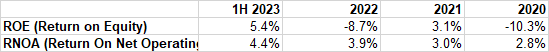

The company consecutively third-time beat its earnings results, thus upgrading its yearly guidance. Even though statistically the company usually has its worst quarters (2 first quarters, according to the statements) in the first half of the year, it posted strong revenue growth together with increasing margins and decreasing cost of sales and operating expenses resulting in positive comprehensive income. This gives a very good signal for further increase in return on equity and return on net operating assets, but at the moment those numbers are still low, not matching the required return, making it difficult for a proper valuation.

ROE and RNOA 2020-2023 (Author, with data from the company’s statements)

Risks

Around 38% of the company`s revenues come from outside of the US making its results highly dependent on foreign exchange rates. Increasing contract assets and unbilled receivables may negatively affect future revenue performance as they’ve been recorded in advance of billing. Creditworthiness of the customers for unfinished contracts may cause lower revenues.

Supply chain issues may affect the costs of components used in operations decreasing the earnings.

The rising interest rate makes it difficult to finance and refinance debt, especially affecting the highly indebted companies.

Finally, the benefits from the recent acquisition may not bring the expected benefits due to integration and transition difficulties.

Valuation methodology

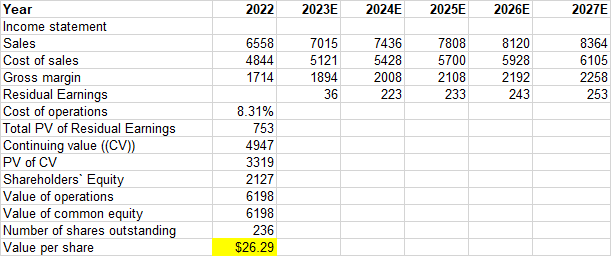

I cannot use the valuation technique from my previous articles, as the company is still not bringing the results required. As the difference between the return on net operating assets and the required return is negative, it doesn’t bring a value-added, which is not the case. As the ROE tends to be positive, I will use it instead, to calculate residual earnings and discount it. For this reason, the future statements will be simulated according to the revenues forecasted (from the company guidance and past performance). The required return is outsourced and WACC-calculated.

Valuation inputs and results

AGP shares target (Author`s calculations)

In millions of US Dollar, except per share amounts

For the revenue projection, the lower-bound forecast was used, long-term growth rate equals the average US GDP. The sales growth rate equals the company`s average number. The required return is equal to 8.31% with a beta of 1.37 and after-tax borrowing rate provided in the statements. For the income tax federal statutory rate of 21% (provided from the annual statements) was used.

Valuation risks

If the growth rate continues to rise this year, it will result in a higher price target. Due to accounting principles, some of the figures I used in my reformulation might be slightly off, but I tried to minimize their influence. The latest quarter statements are Non-GAAP which may result in some future changes in the numbers. The ROE is not the best indicator for calculations, but it is the only one that catches the value added at the moment. Continuing negative comprehensive income (due to exchange rates) may result in a significant valuation downgrade. WACC calculations are outsourced, but reasonably match my own.

Conclusion

With the current market price of around $25 and my price target of $26.3, the shares can bring some profits, but I assign a “Hold” rating, further watching its operating income. Despite the rising revenue, the company still doesn’t perform compared to its required return. APG has to justify its momentum and prove that it may deliver the proper operating results. Moreover, I will watch to their deleveraging path before recalculating.

Read the full article here