Tesla, Inc. (NASDAQ: NASDAQ:TSLA) just had the worst week of the year, as its share price fell by double-digits alongside its Q3 earnings release. Just before earnings, we recommended selling, expecting the company’s margins to drop substantially. As we’ll see throughout this article, the company’s weak margins and continued competition mean its overblown valuation will continue to decline.

Tesla Earning Highlights

The company’s earnings were impacted by its poor financial performance.

Tesla Press Release

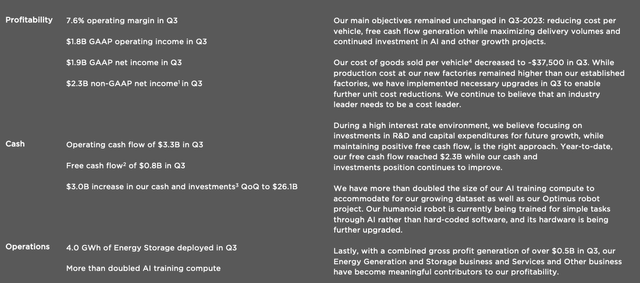

The company’s operating margin was a mere 7.6%. The company had $1.9 billion in GAAP net income versus an almost $700 billion market cap. That means the company is trading at an almost triple-digit P/E ratio. The company’s free cash flow (“FCF”) was dramatically lower at $0.8 billion. The company argues it’s continuing to invest, which is why its FCF is lower.

However, at the end of the day, the company only has 4% of its market capitalization in cash and investments. FCF is a fraction of 1% and the company will never be able to drive strong shareholder returns with that positioning. The company’s Energy Generation, Storage, and Services businesses have become a strong contribution to its profitability.

However, that’s not because the businesses deserve a valuation in the $100s of billions, it’s because the valuation of its core business is so high. The company did deploy 4.0 GWh in energy storage, and annualized profitability here is $2 billion.

Tesla’s Cybertruck Grave

Among Tesla’s numerous issues is the company’s recently announced grave with the Cybertruck.

The company has regularly missed estimates here. It’s now targeting 250k in annual production by 2025, however, we wouldn’t be surprised with its scaling challenges, if it misses that target as well. It’s a revolutionary design and we do expect the company to sell its production here, but it’s a number of years to get anywhere here.

At $100k per unit, that’s a potential of $25 billion a year in fresh revenue, and at a generous 15% margin, that’s just under $4 billion in fresh annual profit. However, the company is not first to the pick-up truck market. Rivian (RIVN) and Ford (F) already have popular electric pick-up trucks. There’s no guarantee that the company will get the market share it’s gotten elsewhere.

The delays here and the continued ramp schedules could hurt margins, and stop the company from achieving substantial profits in the extremely lucrative pick-up truck industry.

Tesla Financial Performance

Tesla’s financial performance has remained weak in relation to its valuation.

Tesla Press Release

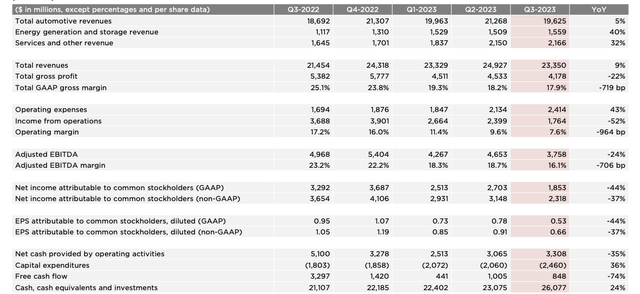

The company’s revenues for the quarter were $19.6 billion, up 5% YoY and down quarter-over-quarter. The company’s energy generation and storage revenue is up 40% and services is up 32%. However, these are much smaller businesses, where total revenue for the company is up a mere 9% YoY. That’s substantial weakness.

The company originally discussed the importance of growing production by 35-50% YoY. However, at the end of the day, money is what matters. If it’s forced to cut prices so much to sell those vehicles that revenue only goes up 9% YoY, the move towards a fair valuation isn’t possible. The company’s operating margin dropped off a cliff.

The company’s adjusted EBITDA dropped 24%, to $3.8 billion, and net income dropped almost 45% YoY to $1.8 billion. The company’s FCF dropped 74%. Cash and cash equivalents went up 24%, shows the company’s FCF, but still $5 billion in FCF for the year is a less than 1% yield. The company is profitable, but it’s nowhere near an almost $700 billion valuation.

Tesla Vehicle Capacity

Tesla’s vehicle capacity has continued to grow, but it’s still nowhere near where its valuation would dictate.

Tesla Press Release

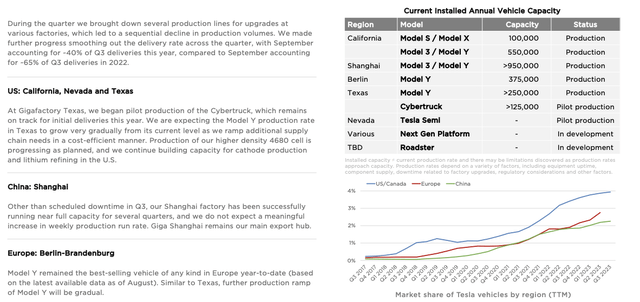

The company’s core U.S. production is in California, with 650 thousand vehicles / year in capacity. The company is also production >250 thousand vehicles / year in Texas, with a potential 50% increase with the Cybertruck in pilot production. The company is ramping in a cost-efficient manner, but demand for high vehicle production seems low.

The company’s Shanghai factory is its largest, and remains a major export hub. Production is at almost 1 million vehicles / year in the incredibly popular Shanghai market. Rumors are that the China market is in substantial oversupply from an EV perspective, and exports are thought to potentially put pricing pressure.

We don’t see the factory growing. In Berlin, the Model Y remains popular, with almost 400 thousand vehicles / year in production, but again the company sees only gradual ramp here. One of the things we see above is minimal long-term growth sources with lower demand.

Other Businesses

The company has started reporting Other Businesses as a segment that’s earning profits.

Tesla Press Release

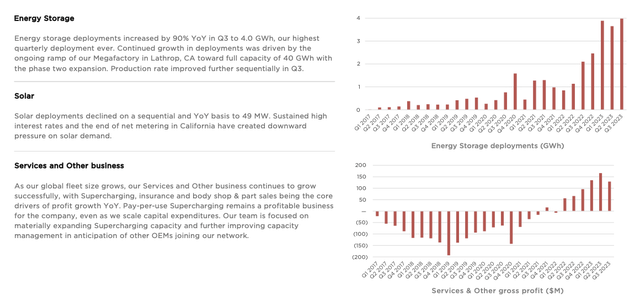

The company’s energy storage increased by 90% YoY to 4.0 GWh, however, it’s stagnated in recent quarters. The company is ramping its megafactory to hit 40 GWh in annual production. Solar deployments have declined substantially and we expect it to effectively disappear. The company has no competitive advantage here and it’s a tough industry.

The company’s services business continues to grow, supported by supercharging. It’s benefited by the company’s fleet and grows profits here are reaching $500 million annualized. It’s respectable and could increase in relation to fleet size, but we don’t see this business getting past several billion annually.

That’s not enough to justify the company’s valuation.

Thesis Risk

The largest risk to our thesis in our view is whether Tesla has a black swan discovery. For example, if the company can achieve full self-driving (“FSD”), which it has continuously delayed, it could dramatically increase its earnings per vehicle. In our view, the company isn’t the leader in this field. However, a breakthrough could change its market positioning.

Conclusion

Tesla’s financials remain weak in relation to its valuation. The company is worth several times Toyota (TM), which sells 10% of global vehicles. Tesla is struggling to sell 2%. The company has managed to achieve its production growth goals, but at the cost of dramatically lowering average selling prices and hurting its profits.

The company’s weaker profits give it a P/E of almost triple digits for a company that had single digit YoY revenue growth. We don’t see a path to the company justifying its valuation and expect its share price to drop dramatically as investors realize that, making Tesla, Inc. stock a poor long-term investment.

Read the full article here