Uber Technologies (NYSE:UBER) is finally putting weight on the company’s profitability as the latest quarter was already profitable on a GAAP basis. The company is at an interesting point – how wide of a margin can Uber achieve, and how much growth will investors see as the company’s cutting costs? For the time being, I am watching on the sidelines with a hold-rating.

The Company & Stock

As most people know, Uber operates a platform of drivers and people looking for a ride. The company also own Uber Eats, a restaurant delivery service. The platform has seen a large growth in its userbase, as the company has expanded its operations internationally into the global brand that Uber is.

Uber’s stock price has rallied by 55% in the past year as the company has great growth and a shrinking loss:

1-Year Stock Chart (Seeking Alpha)

After the rally, it’s worthy to ask whether the price is worth paying.

Lyft’s on the other lane

As the first ride-sharing platform, Uber has achieved a good market share globally. The company isn’t without competition, though – Lyft has achieved a good share of the market in North America. The companies have had a fierce competition for the largest market share, but I believe that Uber has passed Lyft in quite a permanent manner with a more recognizable brand – with trailing twelve months’ revenues, Lyft is only 12% of Uber’s revenues. The latter has also had a greater growth along with a better current profitability. In addition, Uber has certain KPIs in which the company performs well above Lyft – in Steven Porrello’s article on the ascent, the author writes that Uber drivers earn more on average.

For the Uber Eats segment, the company has multiple well-known competitors such as DoorDash, Grubhub, Postmates, and Deliveroo – the food delivery segment is competing at a highly competed market. I believe that Uber’s brand recognition is mostly in the ride-sharing platform instead of deliveries, and that the company can maintain a dominant position in the prior segment.

Financials

Foot on the gas

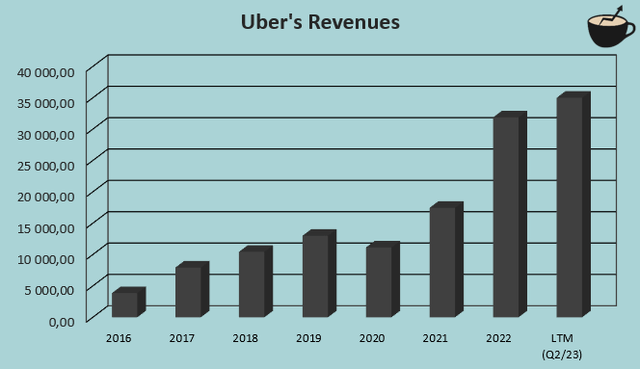

In the company’s history, Uber has had its foot on the gas – to gain a dominant market position, the company has churned through a large amount of capital. The company’s strategy seems to have succeeded when looking at revenues; from 2016 to 2022, Uber’s compounded annual growth rate is 42.3%:

Author’s Calculation Using TIKR Data

The growth seems to have slowed down, though. In Q2, Uber only had a growth of 14.3%, massively below the historical growth. Uber has turned its focus on improving the company’s bottom line, which seems to be a critical reason in the slowdown.

Steering the bottom line

In the past, Uber’s strategy has revolved around growing the company’s top line with extensive investments at the expense of profitability. The company is finally putting breaks on the strategy, though – in Q2 the company has improved its operating income by over a billion dollars, resulting in an EBIT of $326 million in the quarter. The improved income is a result of an increase in gross margin of 4.6 percentage points, as well as an SG&A expense decrease of $360 million. Uber’s CFO Nelson Chai expects further operating leverage in the upcoming quarters, according to the company’s prepared Q2 remarks.

More than just on the income statement, Uber has streamlined its capital expenditure needs – in the last twelve months, Uber has had CapEx of $240 million, down significantly from 2016’s CapEx level of $1629 million, resulting in significantly improved free cash flow. The company does also have very high stock-based compensation levels, but as these cost investors with dilution, the costs can’t be written off.

The profitability efforts seem to have worked well for the company. As efforts in the advertisement segment continue, and as Uber achieves further benefits from a growing scale of operations, the company’s net income margin should have great room to grow. The company hasn’t communicated a long-term margin target, though – investors are left questioning as to how wide of a margin Uber can achieve.

Baggage in the trunk

Uber’s balance sheet seems relatively healthy. The company has almost $5 billion of cash as well as $538 million in short-term investments. On the other side, though, the company does have a good amount of long-term debt – at the moment, Uber has long-term debts totalling around $9.4 billion, of which $153 million is in the current portion. I believe Uber can easily manage the held debt, though, as the company’s cash flows are improving into a good level.

Valuation

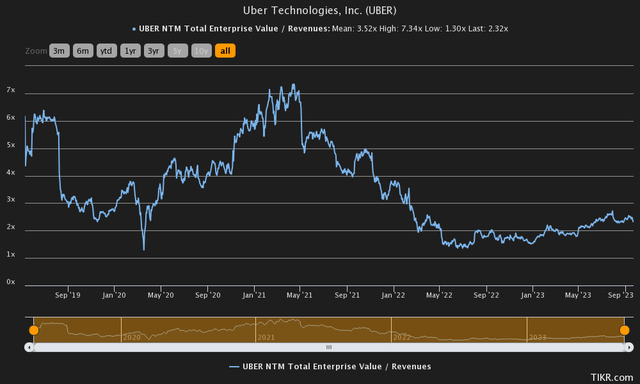

As Uber hasn’t been profitable in its past, I look at the past valuation through a sales multiple – in the company’s history as a public company, Uber has had an average forward EV/S ratio of 3.5:

Historical EV/S (TIKR)

Currently, the forward ratio stands at 2.3, significantly below the historical average. The lower ratio seems justifiable as the company’s growth seems to be slowing down. On the other hand, though, the company’s finally focusing on improving cash flows.

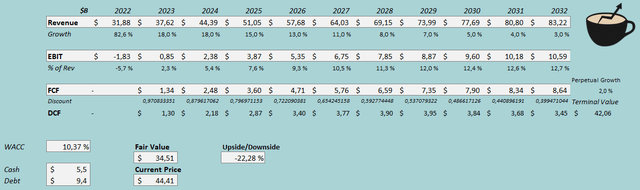

To further analyse the valuation, I constructed a discounted cash flow model as usual. In the model, I estimate Uber’s revenue growth to be 18% for 2023 and 2024 – significantly below the company’s historical rate, but roughly in line with the first half of 2023. Beyond the mentioned years, I estimate the growth to slow down in steps into a perpetual growth rate of 2% in 2033 and forward – my growth estimates correspond to a CAGR of 10.1% from 2022 to 2032.

As for Uber’s margin, I estimate the company’s EBIT margin to scale significantly in the coming years due to previously mentioned factors. For the current year, I have a positive but thin margin of 2.3%, pricing in a Q3 and Q4 along the lines of the latest quarter. Going forward, I price in a very good amount of operating leverage – the company’s EBIT margin scales into a figure of 12.7% as the company grows. I believe that the company can manage to achieve this margin, but there are risks involved with expecting such growth.

The company converts earnings into cash flows really well, as on most years Uber has had negative working capital changes, combined with a currently low amount of capital expenditures. The company also has very heavy stock-based compensation, but I have SBC as a cash expense in the cash flows – SBC is a very real cost, as it causes significant dilution in the long term.

The mentioned estimates along with a cost of capital of 10.37% craft the following DCF model with an estimated fair value of $34.51, around 22% below the current price:

DCF Model (Author’s Calculation)

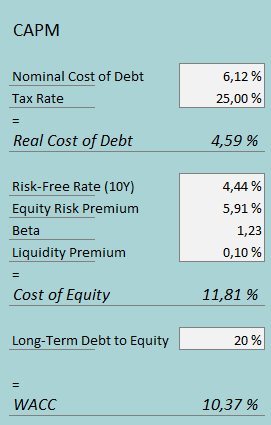

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Uber had $144 million in interest expenses. With the company’s current amount of interest-bearing debt, the company’s interest rate comes up to 6.12%. As the company achieves better cash flows, I believe Uber can safely leverage more debt on its balance sheet – I estimate a long-term debt-to-equity ratio of 20%, slightly above the current level.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.44% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the US. Yahoo Finance estimates Uber’s beta to be 1.23. Finally, I add a very small liquidity premium of 0.1% into the cost of equity, crafting the figure at 11.81% and the WACC at 10.37%, used in the DCF model.

Takeaway

Although the DCF model has a moderate downside for the stock, I don’t see a sell-rating for Uber as reasonable for the time being. The company still has international expansion and segment initiatives that could result in growth that’s well above my estimates. As the company’s margins improve, I suggest to keep a keen eye on Uber’s operating leverage – the investment case relies largely on the margin that Uber can achieve. As I don’t see a clear reason for the stock to either rise or fall, I have a hold-rating for the time being.

Read the full article here